Bitcoin is the:

Math class you never had.

History class you never had.

Finance class you never had.

Physics class you never had.

Economics class you never had.

Philosophy class you never had.

― The Bitcoin Therapist

🧡Bitcoin news🧡

➡️Last week I showed you guys with data and charts how the US, the world reserve currency, our current system, is leading our society to 'death'.

This is not something new. The Dutch eventually lost their reserve currency status and after that the British (Empire). Why? Too much debt.

Our current system needs to consume to pay off our debt. It's that simple...

If you look at last week's Government Debt chart you will notice that this doesn't include the debt of households & businesses, the nature of the money multiplier & fractional reserve banking means the total outstanding debt in the world is much higher.

Again, high-time preference culture and borrowing from our future will lead to the death of society. As we have seen in the past...

Unless we have something that will rise out of the ashes...

Bitcoin.

➡️Tether has added another 8,888.88888888 Bitcoin to their reserves, bringing their total treasury to 75,354 BTC. This is consistent with Tether's Treasury Reserve Strategy of saving 15% of profits in Bitcoin.

➡️Bitmain has unveiled the Antminer S21 Pro, the newest iteration of its flagship Bitcoin mining ASIC.

Boasting a hash rate of 234 TH/s and an energy efficiency ratio of 15.0 J/TH, the Antminer S21 Pro “has the ability to deal with more challenging environments.”

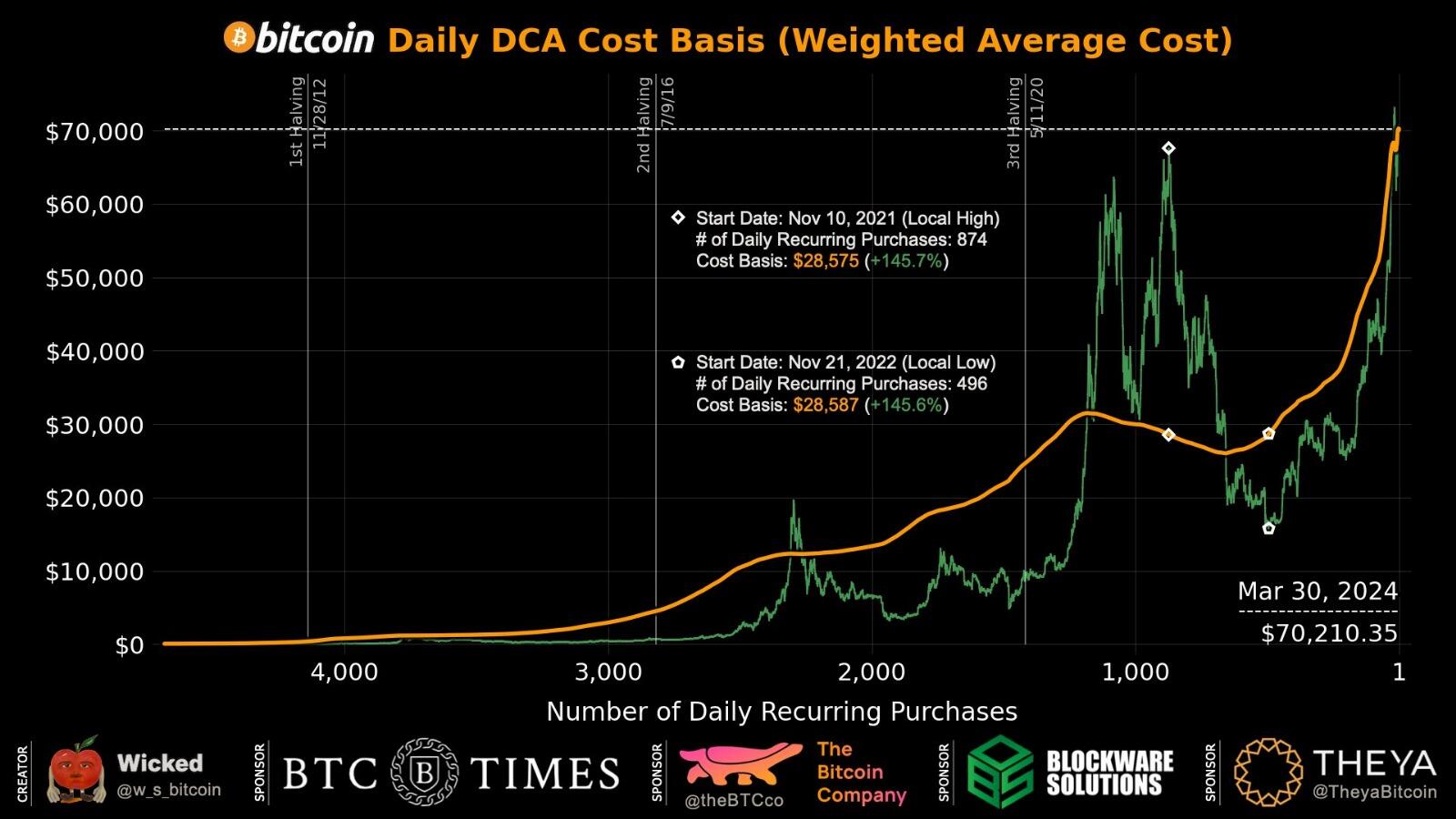

➡️"The daily DCAers who started stacking Bitcoin at the all-time high in late 2021 now have a lower cost basis than the daily DCAers who started stacking at the bear market low in late 2022.

Proving once again that with Bitcoin, time in the market beats timing the market." - Wicked (picture 2)

Ergo: get off zero. The biggest mistake you can make is being on the sidelines as Bitcoin is the greatest savings technology ever devised.

➡️On the 30th of March someone bought or transferred $1.1 Billion worth of Bitcoin at $70K.

https://www.blockchain.com/explorer/transactions/btc/fe60e8baae112517b6e1708c6e7414386ff3ceaeb10f51091adb806ed8d068a5

1.1 Billion...I wish I had cash like that available. Oh by the way the fee was only 17 dollars. Classic!

➡️Bitcoin closed its 7th straight green month for the first time in history.

➡️Coinbase Bitcoin reserves hit a 9-year low on the 26th of March.

➡️Cryptocurrency exchange Kucoin and two of its founders criminally charged with bank secrecy act violations and unlicensed money transmission offenses.

➡️On the 28th of March it was exactly 27 years ago, Adam Back invented Proof-of-Work, the bedrock of Bitcoin. It's how Satoshi harnessed time and energy to create the best money in human history.

Bitcoin ETF news:

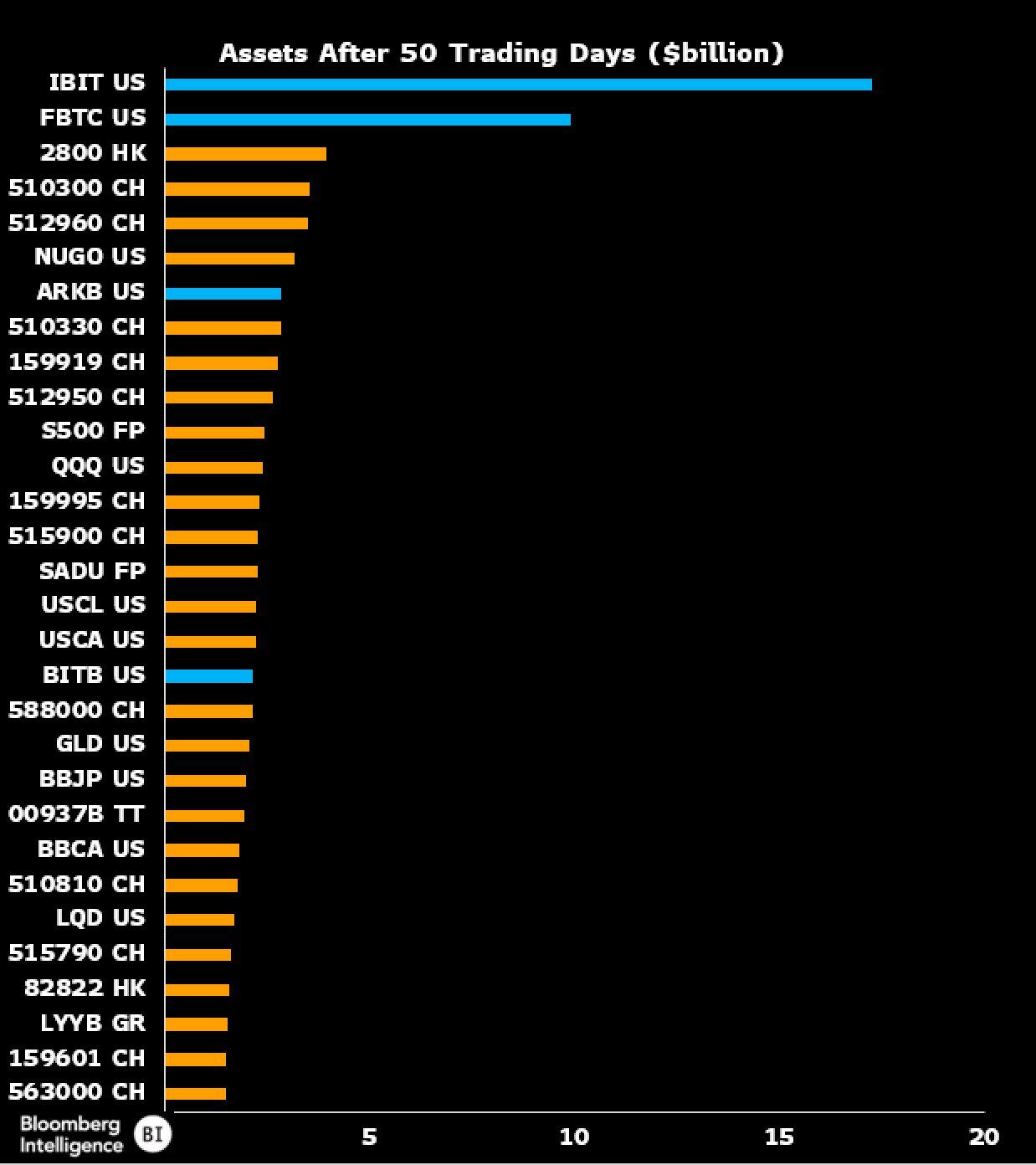

➡️Two months in, Bitcoin ETFs have ~$60B AUM

Gold ETFs had $60B AUM after 15 years.

However, you can't really compare both assets with each other as the USD had a completely different value back then. Still an impressive growth for the Bitcoin ETFs. The move from analog to digital is always exponential.

➡️Here's a look at the Top 30 ranked by assets in the first 50 days on the market. Went global for this so this is out of 11,338 funds. Four BTC ETFs made the list.

Out of 11,338 global funds, the two with the largest AUM in history after 50 trading days are both Bitcoin ETFs, and it isn’t particularly close. (Picture 3)

One thing to consider this is not adjusted for inflation.

At this rate, BlackRock could overtake Grayscale's Bitcoin stack by this month's halving.

Blackrock's spot Bitcoin ETF IBIT holdings have now surpassed 252,011 BTC ($18B)

"I’m pleasantly surprised and I’d never have predicted it before we filed it that we were going to see this type of retail demand," says Blackrock CEO Larry Fink.

➡️WisdomTree gained approval to purchase spot Bitcoin ETFs for its $206 million and $117 million funds.

➡️Bitwise CIO Matt Hougan: 3% is the new 1%

He reports professional investors' potential Bitcoin allocation has shifted from 1% to 3%+ since 2018, primarily due to ETFs mitigating "going to zero" risk.

For wealth investors, 3%+ is the new norm.

➡️ Rumours that Morgan Stanley will approve Bitcoin ETFs on their platform in the next 2 weeks are getting stronger.

Early this month Morgan Stanley filed with the SEC that 12 of their funds may buy Bitcoin ETFs, and last week they sent Bitcoin compliance & education materials out to all advisors.

Morgan Stanley has $1.5 Trillion in assets under management.

➡️Hong Kong Bitcoin ETFs are expected to be approved in Q2

Including the ability to withdraw Bitcoin (No paper bitcoins!). (source: https://finance.yahoo.com/news/hong-kong-likely-allow-kind-162521543.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr&guccounter=1&guce_referrer=aHR0cHM6Ly90LmNvLw&guce_referrer_sig=AQAAADQ9lwMOgCrUeYU0wXFR-I3VLIKK-KPVw7jOrmT28h7AkgQov2AuXnkaTT2jaFgNCEnYB4HKsdsctI_6_qKwmpCImH9bSY7Urg2Jc31A2ESgCz8C3zt7ijbuasbFwUFkEscFEHe_VrX4FeEzOtzzvr61eM2d_A9C4_TQql_qEu0l)

➡️SBF sentenced to 25 years in jail.

Judge Kaplan: you are sentenced… for a total of 300 months [25 years]."

This is blasphemy as SBF stole billions of customers' money, and lied in court.

Ross Ulbricht created a website and is still serving 2 life sentences in prison.

Injustice at its finest.

A double life sentence + 40 years with no chance of parole.

Ross was sentenced at the age of 29.

On the 28th of March, he turned 40.

His “crime” was building a website where people could trade freely without government permission.

In the process, he introduced the world to Bitcoin.

http://FreeRoss.org

If you want to know more about Ross read this excellent thread by Pete Rizzo:

https://threadreaderapp.com/thread/1774052843562889450.html?utm_campaign=topunroll

Just to make one thing clear. He's definitely a legend. Ross Ulbricht's story is remarkable and complex, highlighting the early days of Bitcoin and the challenges faced by its pioneers. But making a black market is not something good, he got what he deserved. But the sentence is way too harsh.

➡️Since 2022, someone has consistently bought 100 Bitcoin at any price.

They now hold 53,733 Bitcoin worth $4 billion, making them the 13th largest Bitcoin holder.

➡️The latest Bitcoin difficulty adjustment came in on the morning of the 28th of March at -0.98%

There is only one more difficulty adjustment before the halving.

Everything is lining up perfectly for the halving to occur on 4/20.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have ISM, payroll reports, and communication from key Fed officials. In Europe, we have PMI, inflation, and unemployment data. In Asia we start the week with a central bank meeting in India, the Bank of Japan Tankan survey, and PMI and inflation releases across the region.

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

👉🏽"If US government debt averages 4% across the weighted duration spectrum, that would be about $1.4 trillion in annual interest expense.

At $50 trillion in debt (which will get us there quickly), it’ll be $2 trillion in annual interest expense." -Lyn Alden

The US Government currently makes about $12.2B while spending $17.7B per day. That's overspending by $5.5B per day, which will add up to a total of $2T of overspending for the year.

Drowning in debt. Totally normal phenomenon and sound finance, right? This is why US interest rates can't rise much more and also why they should. More on this topic the great thread by Bob Elliott

https://twitter.com/BobEUnlimited/status/1772229788737913036

Remember we are not in a pandemic, we’re not in a World War, and the US is in an allegedly healthy economy. When any of those changes, debt will skyrocket.

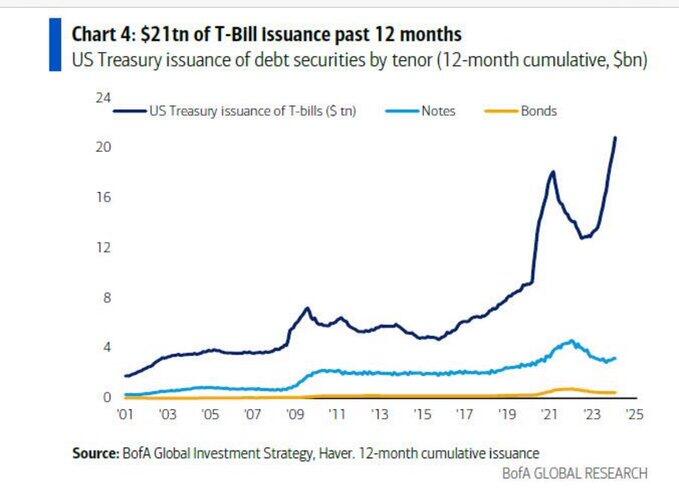

With US national debt up $10 trillion since the pandemic, and roughly sixfold the 2008 crisis. The Treasury issued $7 trillion of debt in just 3 months. (Picture 4)

That matches the worst of Covid -- no pandemic needed. And it's double the previous record that had stood for 231 years.

Again I don't want to be doom and gloom, but these are just the facts. Issuing more t-bills at an accelerating pace is a precondition to becoming a banana republic. This is the type of thing you see emerging markets do, not the issuer of the world's reserve currency and neutral reserve asset.

Just to make it even worse, the US Bond Market has now been in a drawdown for 44 months, by far the longest bond bear market in history.

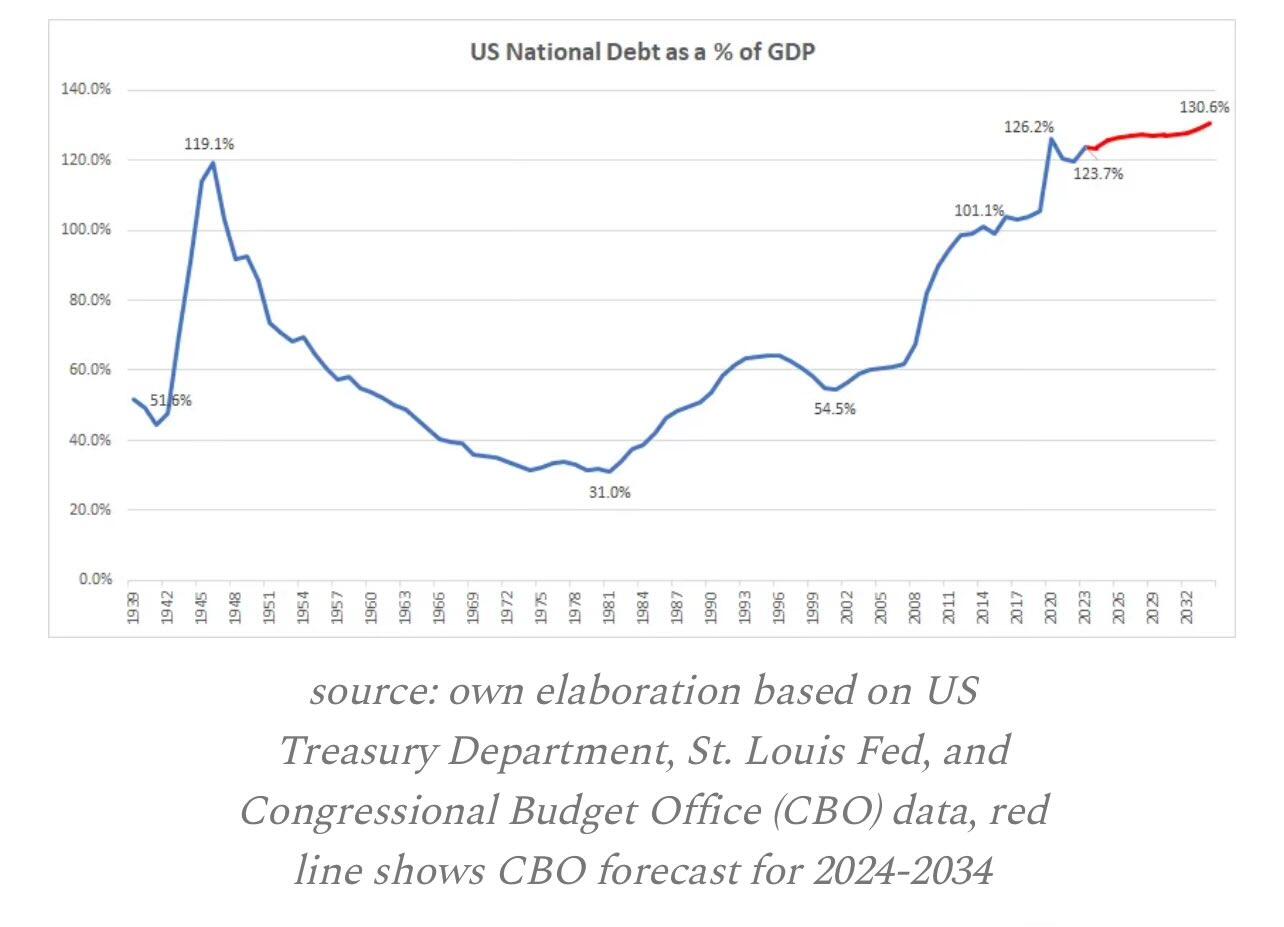

👉🏽"Since 1800, 51 out of 52 countries who have reached a 130% Debt-to-GDP ratio have defaulted.

According to the US CBO itself, debt-to-GDP in the US is on track to hit 130% for the first time by 2033.

In 2007, debt-to-GDP in the US was just 60% and it has quickly doubled since then.

Currently, debt-to-GDP is at ~124% which is HIGHER than the peak of World War 2, at 119%.

Since 2020, debt-to-GDP is up a whopping 20% after the government's massive borrowing spree.

Simply put, this is unsustainable." -TKL (picture 5)

As you can see in the picture the red line is based on the 'optimist' forecast by the CBO.

As mentioned at the start of this week's 'Weekly Recap' the world is changing that hasn't happened before in our lifetimes but has many times in history.

Please watch the following video by Ray Dalio in which he explains the 500 years of economic rise and downturns of nations brilliantly.

https://www.youtube.com/watch?si=de7o5anFfpSmqVno&v=xguam0TKMw8&feature=youtu.be👉🏽The Federal Reserve’s expenses exceeded its earnings in 2023 by $114.3 billion — its largest operating loss ever. Source: https://archive.ph/7rcCv

"In plain English: The Fed printed $114B (net) out of thin air & handed it to banks, essentially to bribe them not to lend excess reserves into the economy."- Luke Gromen

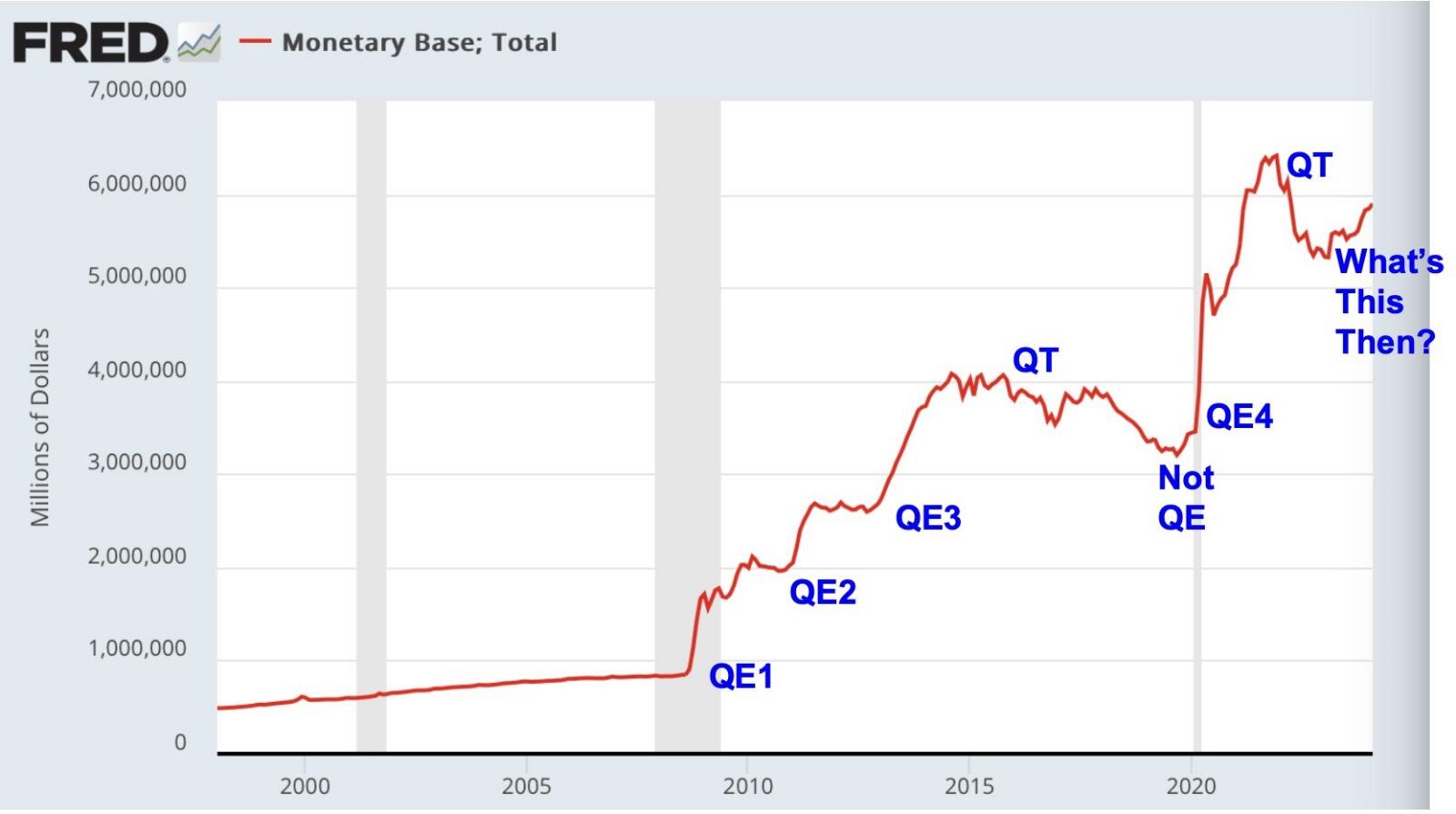

👉🏽"Since 2008 the monetary base expanded during times of Fed intervention and shrunk during times of QT.

Markets bottomed in October 2022 as the shrinking of the monetary base ended.

It has expanded since then. Hence the question:

What's this then?" - Sven Henrich (picture 6)

Answer: Fiscal dominance.

👉🏽 SWIFT is planning the launch of a new central bank digital currency platform in 12-24 months. (source: Reuters)

Kinda funny innit? The world banks are on the brink of collapse (DEBT) and switch everyone over to their new CBDC in 2024-2025 and stop printing physical cash. According to the central bank's white papers (BoE, ECB), they are planning to release CBDCs in 2025. It's not like they are hiding it. It's just that nobody is bothering at the moment.

I don't know about you but I stick with my 12-24 words!

CBDC is financial slavery.

👉🏽Now let's put another phrase in the mix. Financial Colonialism...

"Over the next two years, low-income countries need to refinance about $60 billion of external debt each year, about three times the average in the decade through 2020. More in this blog:"

https://www.imf.org/en/Blogs/Articles/2024/01/24/how-to-ease-rising-external-debt-service-pressures-in-low-income-countries

Low-income countries never seem to be able to pay back their debts. This might be the reason why they got to be low-income in the first place, innit?

Anyway, low-income countries need to mine Bitcoin (Africa, South America, etc) and escape the debt slavery by the central bankers / IMF / World Bank.

👉🏽"Core PCE inflation, the inflation measure the Federal Reserve looks at most, declined to 2.78% in February. This marks the slowest pace of core inflation in nearly two years. Given that the Fed needs little to start cutting rates from levels that should be highly restrictive, assuming a neutral rate of 2.50%, markets price a 70% chance of the first rate cut in June. Hence, equities up, gold up, yields down." - Jeroen Blokland

👉🏽Commodity prices across the board seem to be permanently elevated.

Cocoa prices have skyrocketed to nearly $10,000, a fresh all-time high.

In 2024 alone, Cocoa prices are up 130% and outperforming most assets.

To put this in perspective, Nvidia, one of the hottest stocks in the world, is up ~30% LESS than Cocoa in 2024.

Cocoa prices are at record highs due to the:

* Weather damage in West Africa

* Supply constraints

* Increased demand

* Poor farmer returns

* EU rules impacting supply

First, it was Orange Juice and Olive Oil, now it's Cocoa prices exploding.

Commodity prices are outperforming many hedge funds.

The days of low oil prices are gone and consumers are feeling the pain.

The purchasing power of the US Dollar is down over 20% in just 4 years.

👉🏽France's public sector deficit for 2023 climbed to 5.5% of GDP, or €154bn, statistics agency INSEE said, undermining President Macron’s credibility as an econ reformer capable of resolving the country’s fiscal challenges. The earlier official govt deficit est was 4.9% of GDP.

The last time France didn't have a budget deficit: 1974

👉🏽Palestinian banks could be cut off from the Israeli banking system starting next week following.

The decision made by Israel's finance minister to isolate Palestinian Authority banks would paralyze the Palestinian economy. Anyway, Bitcoin fixed this! (source: https://www.middleeasteye.net/news/israel-may-cut-off-palestinian-banks-global-banking-system-next-week?utm_source=twitter&utm_medium=social&utm_campaign=Social_Traffic&utm_content=ap_6ej2zdsxqj

👉🏽65 million AT&T customers have had their personal data leaked on the dark web. Yikes! That's a lot of social security numbers on the dark web.

👉🏽"Warren Buffett, the billionaire head of Berkshire Hathaway, will probably go down as the greatest investor in history... Berkshire shares have seen an average annual return of 20.0%..."

Meanwhile: https://twitter.com/Snowden/status/1774577333820629449

Just some members of Congress outperforming the greatest investor in history. we are surely fortunate to be represented by such extraordinary talents." - Edward Snowden (picture 7)

🎁If you have made it this far I would like to give you a little gift:

Lyn is one of my favorite macroeconomists. The interview below is her most recent interview about U.S. fiscal dominance, China, energy, tech, and Broken Money.

https://www.youtube.com/watch?v=jVFkv7fezxE

Anyway, that's it for today.

Only invest in Bitcoin what you can’t afford to have gradually stolen from you by the government.

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption