🧠Quote(s) of the week:

"Events in 2024 with probability %:

- Spot Bitcoin ETF 10th of Jan (90%)

- Rate cuts in March (75%)

- Bitcoin Halving in April (100%)

- QE by the Fed second half of 2024 (90%)" -BTCforFreedom

"Wall Street thinks it will change Bitcoin but it will be Bitcoin that will change Wall Street." - BitVolt

🧡Bitcoin news🧡

➡️ I quote Daniel Batten: "Another first: a well-respected sustainability magazine just published an article with the headline

"In an unexpected twist,

Bitcoin mining could help wind and solar development"

It takes some time to get it. But when you commit to taking the time, you will finally realize that Bitcoin functions as an "economic battery" and Bitcoin mining will improve the economics of renewables. Take the time. Gradually, then suddenly!

read the article here:

"A new analysis demonstrates how Bitcoin mining could ease financial stresses in the early phases of renewable energy deployment."

https://www.anthropocenemagazine.org/2023/12/wind-and-solar-projects-struggle-financially-in-their-early-phases-could-bitcoin-mining-change-that/

➡️ Another example of how the narrative has quickly shifted.

The author of the following article mentioned to Daniel Batten that this was the most popular post on Coinpost Global last year.

https://medium.com/@coinpost.gb/bitcoin-is-crucial-climate-tech-btp-ep-1-recap-854d3ebbe573…

And this was the most watched talk from Plan₿

https://planb.lugano.ch/why-bitcoin-is-the-worlds-best-esg-asset/…

Now let's connect that with the Bitcoin ETF...are you ready?

➡️ Bitcoin ETF: 63 million boomer brokerage accounts with 2X margin are about to gain easy access to spot Bitcoin price exposure.

➡️ According to PwC, 30% of the $23 Trillion in ESG Funds ($ 6.9 trillion) is struggling to find a home.

This French ruling against fossil fuels in ESG funds will make that harder. Bitcoin has never looked so ripe to fill the gap for sophisticated ESG investors.

Implication: Bitcoin & ESG is often the most popular Bitcoin topic for pre-coiners

Today we learned that Blackrock was cutting their ESG division, but staffing their Bitcoin division.

Remember:

ESG = force behavior

Bitcoin = incentive behavior

Bitcoin will be the trend, it is inevitable.

Regarding the Bitcoin ETF, I can be very clear.

1. If you understand Bitcoin a bit and have a low time preference you hope the SEC rejects the ETF this week so you can stack more sats. People with high time preferences hope they approve it. Know the difference!

2. I really don't care what will happen. I’m not looking forward to buying Bitcoin at all-time highs this year but, that’s exactly what’s going to happen. "I’ll be buying at the top forever”

3. If you own a spot Bitcoin ETF, you don't hold Bitcoin.

extra info regarding point 2:

But Felipe I don't want to buy the top...

If you bought the top of 2013 you would have 3840% profit.

If you bought the top of 2017 you would have 140% profit.

Soon the 2022 top purchases will still be in good profit.

If you want to trade your Bitcoin, fine, just know that HODLing Bitcoin isn't a bad thing. It's all about perspective.

https://twitter.com/VailshireCap/status/1742239078043541944

extra info on point 3:

"Bitcoin vs Bitcoin ETF:

Bitcoin:

- Decentralized

- Secure

- Permissionless

- Money

Bitcoin ETF

- Decentralized

- Secure

- Permissionless

- Money

Choose wisely."

Now for the people who want to know more information on the Bitcoin ETF, read the following bit:

➡️ Let's start with a survey conducted by BitWise:

source: https://bitwiseinvestments.com/crypto-market-insights/the-bitwise-vettafi-2024-benchmark-survey

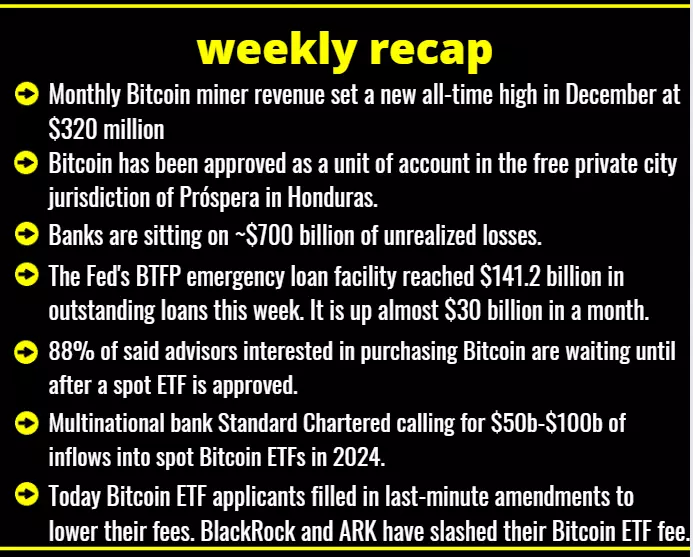

- Only 39% of financial advisors believe a spot bitcoin ETF will be approved in 2024.

- 88% of said advisors interested in purchasing Bitcoin are waiting until after a spot ETF is approved.

- Only 19% said they are able to currently buy in client accounts.

- 71% of advisors favor #bitcoin over Ethereum. 29% should not be giving out advice.

The above makes me wonder that we are still early and it is still early to get into Bitcoin. Just stating the obvious, the approval itself won't change that face.

➡️ BlackRock sources say the SEC will take until the end of this week to approve Bitcoin ETFs - Fox Business

➡️ https://twitter.com/BitcoinNewsCom/status/1742998017454555438

If I am right Fidelity is the only ETF applicant in which you can self custody of your Bitcoin.

➡️The fight for customers has started...

Today Bitcoin ETF applicants filled in last-minute amendments to lower their fees

BlackRock and ARK have slashed their Bitcoin ETF fees.

ARK

- down from 0.80% to 0.25%

BlackRock

- 0.20% for the first 12 months, or first $5 billion AUM.

https://twitter.com/CaitlinLong_/status/1744336024845578539

Please do yourself a favor and read Caitlin's tweets, all of them. And do understand this all smells like rehypothecation baby. Remember Celsius? Remember FTX?

➡️Now what will happen with Bitcoin price when a wall of money hits a scarce and illiquid asset like Bitcoin?

https://twitter.com/Capital15C/status/1743899674841378862

Today multinational bank Standard Chartered calling for $50b-$100b of inflows into spot Bitcoin ETFs in 2024. To give you some context that is like the equivalent of 10 more MicroStrategy's / Michael Saylor's entering the market.

We know the Bitcoin ETF is inevitable. When even the SEC is releasing statements & warning investors not to "FOMO" into digital assets, you know this thing can't be stopped. By the way, the SEC are just freaking morons by warning people not to FOMO into digital assets...by doing that the opposite will happen. People will FOMO with a vengeance into the Bitcoin ETFs (unfortunately).

I fully subscribe to the following statement made by BitPaine:

https://twitter.com/BitPaine/status/1743250516417851864

Funny how the narrative is shifting on Bitcoin mining, Bitcoin ESG, etc.

The puppets of the mainstream media are doing their part:

On the 6th of January the Financial Times, perhaps the most 'authoritative' financial news publication in the UK, published a bullish article on Bitcoin. https://www.ft.com/content/59bb430b-a5b1-4469-b05a-482b951109a2

"There is no bigger investment story right now. Google searches for “bitcoin ETF” have tripled over the past week."

"I would be mad to miss out."

This is the Number 1 European financial news source giving readers the green light to buy into the ETF. Which will start trading this week.

The author pushes back on a lot of the FUD in giving his reasons for buying into the Bitcoin ETF when it is eventually launched:

- volatility

- risk

- no income

- hard to value

- speculative

- intangible

Imagine how far we have come that FT is orange-pilled.

➡️ Bitcoin has been approved as a unit of account in the free private city jurisdiction of Próspera in Honduras. This essentially validates Bitcoin’s legitimacy and its acceptance in commercial, tax, and financial dealings in the zone

https://twitter.com/duczko/status/1743848879932805510

➡️Monthly Bitcoin miner revenue set a new all-time high in December at $320 million

➡️Marathon sets a record Bitcoin duction of 1,853 Bitcoin in December, taking the total 2023 production to 12,852. Marathon holds currently over 15K Bitcoin.

Talking about Miners:

➡️ Because of Bitcoin mining, 1800 homes in this (read the article) African village Bondo have electricity:

- Food can be stored in fridges, so villagers do not have to make the 12-mile trek to batch purchase

- Cooking the evening meal is 3x quicker

“Yet the big surprise in Bondo is not simply the supply of energy to such an isolated community, in a country where only one in eight citizens has access to grid electricity and on a continent where almost half the 1.2 billion population still lack this life-changing supply. The real eye-opener is the stack of 32 computers inside the concrete pump shed. This innovative mini-grid — located more than two hours from Malawi’s second city of Blantyre along bumpy roads and tracks that can become impassable in a torrential downpour — is mining Bitcoin to fund its operation.”

“Bitcoin has also become a helpful tool for activists and journalists in dictatorships since it makes it far harder to track funds.”

Bitcoin is financial inclusion, Bitcoin is financial empowerment!

Full article: https://unherd.com/2024/01/the-african-village-mining-bitcoin/

➡️ https://twitter.com/olvelez007/status/1741998751697289588

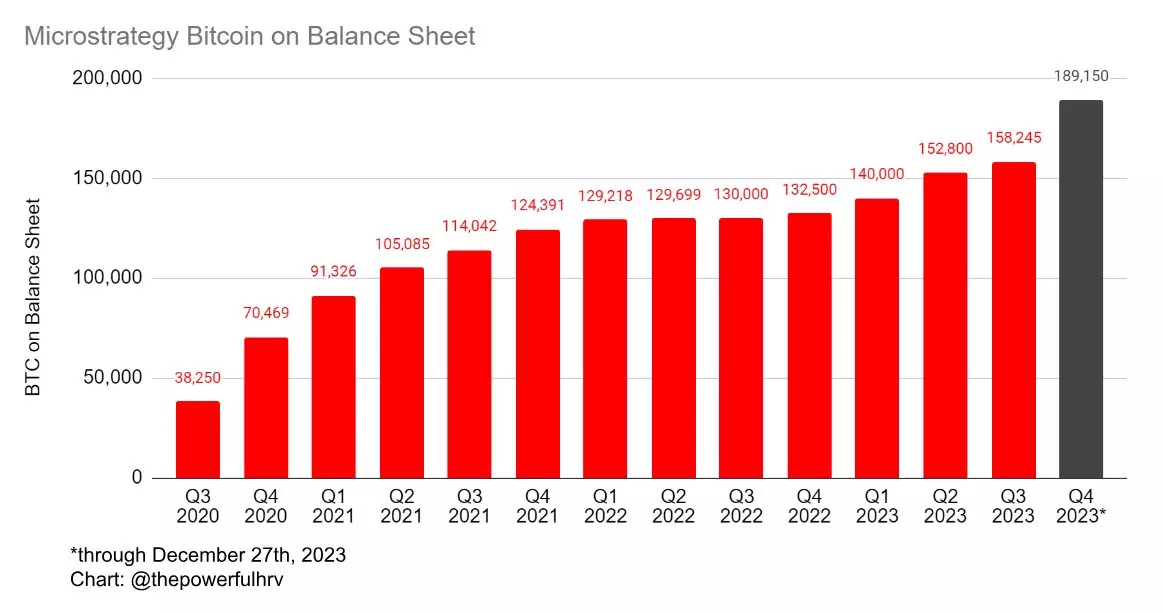

➡️The #17 largest Bitcoin holder bought 1,500 Bitcoin on the fourth of January for $65 million.

➡️ https://twitter.com/thepowerfulHRV/status/1743008302231875874/photo/1

It’s only a matter of time until most companies adopt this strategy. For now...MicroStrategy is sitting on some $4B in profits. Talk about C O N V I C T I O N

(picture 3)

➡️ 76% of Bitcoin supply is held by Long-Term HODLers - ARK Invest

➡️ "In countries where those in power weaponize the financial system, Bitcoin offers a way out to retain control over one's financial destiny" - Forbes

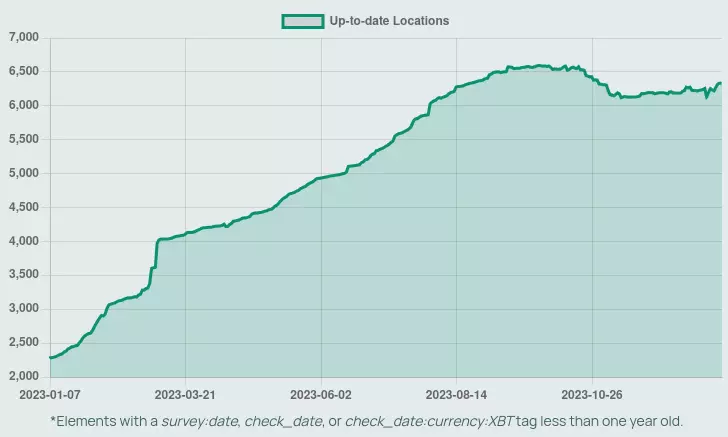

➡️The number of up-to-date merchants accepting BTC cataloged by @btcmap increased 174% in 2023. (picture 4)

➡️ Japanese e-commerce giant Mercari to accept Bitcoin payments. It has +20m monthly customers...

➡️On the 3rd of January, 15 years ago Bitcoin went online!

Bitcoin Genesis Block Day! This block is unspendable. Satoshi also waited 6 days before mining block #2 so others had time to join the network.

Now that Bitcoin has existed for 15 years! Lindy effect says that Bitcoin would at least exist for another 15 years.

January 3, 2009. Satoshi undermines block 0 on a difficulty 1 CPU and incorporates into the Genesis Block hexadecimal code base the headline of that day's Times "The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks". The bank bailout plan ‘cause of the subprime mortgage crisis in the TGFC.

The Bitcoin close on its 15th anniversary was its second-highest birthday close in history.

➡️ Last item on the Bitcoin segment. Please do not forget that Bitcoin is the 9th most valuable asset in the world. In less than 15 years, it surpassed 7,963 other assets to accomplish this. By the end of 2025, I suspect it to be in the top five.

💸Traditional Finance / Macro:

Wealth concentration. Just simple, raw data:

https://twitter.com/LynAldenContact/status/1741960890134475090

While Wall Street celebrates, Main Street mourns.

To make it even worse I will quote Aaron Layman:

"The part Lyn left out is that the top 1% accounted for 53.9% of this wealth coming out of the pandemic, a record high. The gap between the middle class and the top 1% has grown wider over the past decade.

This is the essence of the Cantillon Effect in the Fed's trickle-down wealth inequality machine. It's also why you see several Fed apologists among the Fintwit ecosphere.

To put things in context, the Federal Reserve is still in cover-up mode when it comes to the self-dealing and trading by some of its former members who are part of that 1% (or 0.1%) club.

Congress continues to ignore the self-dealing by many of its members as they front-run legislation and line their own pockets."

bingo!

🏦Banks:

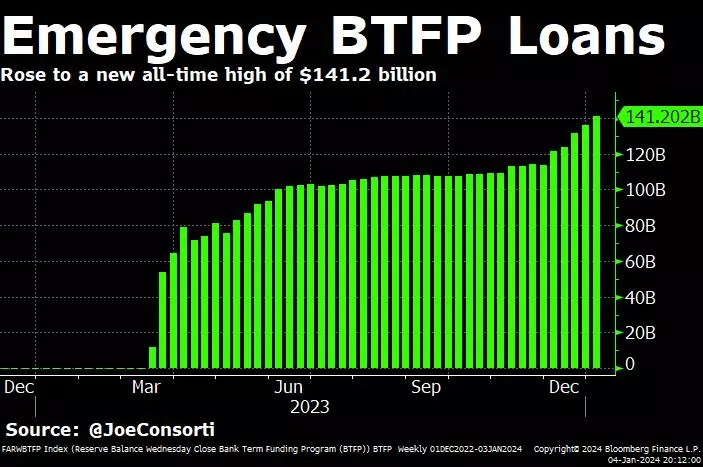

👉🏽"The Fed's BTFP emergency loan facility reached $141.2 billion in outstanding loans this week. It is up almost $30 billion in a month.

Borrowing from BTFP is accelerating as banks look to secure a sweetheart loan before the facility restricts itself or shuts off on March 11th."

As mentioned in one of my previous Weekly Recaps:

"Regulatory Arbitrage. Arbitraging the Fed itself. No risk. Absolute clown show. Classic bank mindset - making money at the expense of the public.

source: https://archive.ph/xhUg5";

(picture 5)

🌎Macro/Geopolitics:

👉🏽"10 of the last 11 months have seen downward revisions in their jobs number, according to Zerohedge.

The November 2023 jobs number was revised lower, from 199,000 to 173,000.

This means that the November jobs report actually missed expectations of 180,000.

The October jobs report was also revised lower from 150,000 to 105,000.

This means that the October jobs report was an even bigger miss than expected.

For September, the jobs number was revised lower by 74,000 jobs." - TKL

Either they don't fully understand/comprehend their own data (by they I mean the government). That itself is concerning but not surprising OR the establishment is trying to bury the data so it doesn’t destroy their narrative that the economy is strong.

👉🏽 https://twitter.com/jameslavish/status/1742982672492974376

The perfect analogy by James Lavish.

👉🏽 https://twitter.com/KobeissiLetter/status/1744058890029813829

"4 years ago, banks were sitting on ~$100 billion of unrealized gains.

Now, they are sitting on ~$700 billion of unrealized losses.

The question becomes, what happens when the BTFP expires in just a few months?"- TKL

👉🏽https://twitter.com/jsblokland/status/1741906043720868090

This means that not only Germany should be worried, but also Europe.

Who knew that shutting down your nuclear reactors and trying to run the green agenda to run your economy on intermittent wind and solar would be a bad idea?

One word: Deindustrialization

The following bit is from the Weekly Recap on the 4th of December 2023:

"Deutsche Bundesbank cuts German 2024 GDP forecast by a whopping 0.5ppts to -0.2% due to the budget crisis following the Constitutional Court hearing.

"The state pension is looking increasingly shaky. The federal govt now has to contribute more than €100bn a year. And the fact that the introduction of the so-called equity pension, i.e. the funded pension, has now also been postponed does not make things any easier."

"There was a statement last year by the president of the Confederation of German Employers’ Associations: “Germany’s pension system is “on the verge of collapse. It won’t be financially viable in five years without reform. The costs will explode” Labor shortages, an aging population, and lower productivity - are all material factors for the viability of this system"

Germany is the sick man of Europe. This is going to be a massive issue in so many countries, not only in Germany."

👉🏽https://twitter.com/NickTimiraos/status/1743667579011371388

Slowing QT means slowly switching to QE, which means more liquidity, which means markets go up. Liquidity is important.

🎁If you have made it this far I would like to give you a little gift:

Lyn Alden's January newsletter is out now and focuses on the push-and-pull effects that fiscal and monetary policy are currently having.

Lyn's monthly writings are always a must-read for me, but the recent one is particularly good! What I like the most about this newsletter is that she used information from her previous write-ups and connected them to the economic changes over the last few years.

https://lynalden.com/january-2024-newsletter/

Today / this week I feel extra special, as I started a new chapter in my life, so I will share an additional 'gift':

"The release of the 2023 Q4 Advisory Board Call: Broken Money – And How to Fix It, featuring the remarkable Lyn Alden"

https://www.incrementum.li/en/journal/advisory-board-call-q4-2023/

Free knowledge!

And please order her book 'Broken Money':

https://www.amazon.com/-/de/dp/B0CG8985FR?crid=3U31JD0RX7P7T&keywords=lyn+alden+broken+money&qid=1693853281&sprefix=Lyn+Alden,aps,553&sr=8-1&linkCode=sl1&tag=felipehubertu-20&linkId=549c11e6bc118853bc6c5593866e6336&language=de_DE&ref_=as_li_ss_tl

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption