๐๐ฏ ๐ฆ๐น๐ค๐ฆ๐ณ๐ฑ๐ต ๐ง๐ณ๐ฐ๐ฎ ๐ต๐ฉ๐ฆ ๐ด๐ช๐น๐ต๐ฆ๐ฆ๐ฏ๐ต๐ฉ ๐ค๐ฉ๐ข๐ฑ๐ต๐ฆ๐ณ ๐ฐ๐ง โ๐ฎ๐ญ ๐ค๐๐ฒ๐๐๐ถ๐ผ๐ป๐โ, ๐ต๐ฉ๐ฆ ๐ธ๐ฐ๐ณ๐ญ๐ฅโ๐ด ๐ง๐ช๐ณ๐ด๐ต #Ai-๐ฆ๐ฏ๐ฉ๐ข๐ฏ๐ค๐ฆ๐ฅ #Bitcoin ๐ฃ๐ฐ๐ฐ๐ฌ.

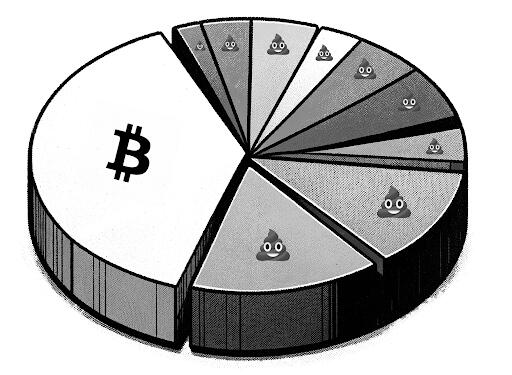

Itโs common for those new to bitcoin to refer to it and altcoins together as โcrypto.โ They often bring their preconceptions with them, such as the importance of diversifying their investments, in case one falls while another rises. In this chapter, bradmillscan (npub1zjxโฆpvrl), TheGuySwann (npub1h8nโฆrpev), and Svetski (npub1dtgโฆup6m) shine a light on what bitcoin ๐ณ๐ฆ๐ข๐ญ๐ญ๐บ is, how it differs from crypto, and why it should not be considered an investment, but simply the best form of money.

Below is Aleksandar Svetskiโs answer, as written in โ๐ฎ๐ญ ๐ค๐๐ฒ๐๐๐ถ๐ผ๐ป๐โ:

๐๐น๐ฒ๐ธ๐๐ฎ๐ป๐ฑ๐ฎ๐ฟ ๐ฆ๐๐ฒ๐๐๐ธ๐ถโ๐ ๐ฎ๐ป๐๐๐ฒ๐ฟ:

This common question has a very simple answer.

Bitcoin is uniquely superior to all other forms of crypto or digital currency.

Why?

Because Bitcoin solved a very specific problem: The issuance of money.

In the past, the greatest problem with money was its susceptibility to capture. He who controls (or issues) the money controls everything else. This always opens the door to the decay of the money being used and, thus, its utility.

This is not the case with Bitcoin. While all other money can be captured, Bitcoin cannot. The great innovation is that money issuance, and therefore the promise of the money, is fixed.

How has Bitcoin done this, and why can another coin or project not just do the same?

๐๐ฌ๐ค ๐ฌ๐ค๐ง๐๐จ: ๐๐๐ฉ๐ ๐๐๐ฅ๐๐ฃ๐๐๐ฃ๐๐ฎ.

Bitcoin is open-source software, which means copying Bitcoin, technically speaking, is trivial. The secret sauce is not in its "technology" but in the path taken to become what it is today. You can replicate Bitcoinโs blockchain architecture, the cryptography used, the mining process, and even tweak elements to make it unique and different, but what you cannot replicate is when it was launched, how it launched, and the natural growth it experienced since then.

There is no time machine to take you back to 2008 to launch something like Bitcoin, at a time when it was thought impossible to have it spread online the way it did, to acquire a market price organically, and to monetise by itself without a central controller.

Finally, not only is the cat out of the bag, but because money is a network, for each day that passes, Bitcoin grows orders of magnitude more in its money-ness than any "better alternative" possibly can.

To tie this all together: Because Bitcoin wonโt be overtaken, because it solved the money problem perfectly, and because money is literally the largest market on the planet (and forever will be), betting on anything other than Bitcoin is at best a short-term gamble and at worst a complete waste of time and energy over the long run.

Aleksandar Svetski is an author and entrepreneur with 15 years in the startup scene. He is the author of the best-selling ๐๐ฏ๐๐ฐ๐ฎ๐ฎ๐ถ๐ฏ๐ช๐ด๐ต ๐๐ข๐ฏ๐ช๐ง๐ฆ๐ด๐ต๐ฐ and the upcoming ๐๐ฉ๐ฆ ๐๐ถ๐ด๐ฉ๐ช๐ฅ๐ฐ ๐ฐ๐ง ๐๐ช๐ต๐ค๐ฐ๐ช๐ฏ. He also founded the worldโs first Bitcoin-only savings app: Amber. Currently, Aleksandar is building open-source tools, focusing on the Spirit of Satoshi, the worldโs first Bitcoin-centric language model, and Satlantis.

Preorder your copy of โ๐ฎ๐ญ ๐ค๐๐ฒ๐๐๐ถ๐ผ๐ป๐โ, and ๐๐ฎ๐๐ฒ ๐๐ฝ ๐๐ผ ๐ฒ๐ฌ%, by contributing to our geyser (npub1kmwโฆxqk9) initiative:

https://geyser.fund/project/spiritofsatoshi