If you rather want to read the long format outside of Nostr, click here:

https://habla.news/a/naddr1qvzqqqr4gupzq2jazfrlt2gdkxx2lwc7qn47j3ewlv34dhpj6qqx38w4agpe3tgpqqxnzdejxscnsdeexgerzdejv488jr

On Nostr:

🧠Quote(s) of the week:

‘Bitcoin is for everyone.

It’s for Democrats

It’s for Republicans

It’s for conservatives

It’s for progressives It’s for every single person on this planet who wants to participate regardless of where they came from or what they believe.’ - Dennis Porter

“It doesn’t matter if the existing system prints \(2 trillion, \)8 trillion, $50 trillion. It’s just different pieces of paper. And Bitcoin measured against a piece of paper will look like it’s going up. But all prices relative to Bitcoin are actually going down and will forever.”

-Jeff Booth

🧡Bitcoin news🧡

But the unlikely thing happened in late 2008: Bitcoin

On the 13th of August:

➡️ Bitcoin is the 6th ranked monetary asset in the world.

➡️Although the following statement is from the 3rd of July nonetheless I want to share it with you.

All 3,070 Four-year HODL periods of Bitcoin have been positive. The worst four-year HODL period was:

December 16th, 2017 to December 15th, 2021 a 155% return, representing a 22.2% CAGR

99.7 percentile* CAGR of 26.4%. *periods above

What does that tell you? Think of Bitcoin from a long-term perspective, at least holding Bitcoin for four years. ‘It’s like watching a super-long movie where the plot thickens and the suspense builds!’

➡️Bitcoin Miner Reserves Drop to 3-Year Low. The miner sell-off appears complete.

➡️Bitcoin exchange reserves have hit a five-year low.

➡️’Bitcoin’s sustainable energy mix is 6% for the year (faster than any industry) Over the same period, Bitcoin price 128% I guess the rising Bitcoin price isn’t boiling the oceans.’ - Daniel Batten

➡️Metaplanet buys another ¥500 million worth of Bitcoin

On the 14th of August:

➡️Norges Bank, the Central Bank of Norway, owns over 1.1 MILLION shares of MicroStrategy stock.

➡️Goldman Sachs bought $418m Bitcoin ETFs in the last quarter. Goldman Sach’s latest 13F filing discloses owning:

- $238.6 million iShares Bitcoin Trust

- $79.5 million Fidelity Bitcoin ETF

- $35.1 million Grayscale BTC

- $56.1 million Invesco Galaxy Bitcoin

- $8.3 million Bitwise Bitcoin ETF

- $749,469 WisdomTree Bitcoin

- \(299,900 ARK 21Shares Bitcoin ETF For a total of \)418 million in Bitcoin ETFs

➡️The Swiss Central Bank owns 514 Bitcoin through buying 466.000 MSTR shares.

➡️Marathon bought 4,144 BTC for $249M and now HODLs over 25,000 Bitcoin.

➡️ ‘State of Wisconsin Investment Board bought another $14m Bitcoin through BlackRock’s ETF.’ -Bitcoin Archive

On the 15th of August:

➡️94% of the 21 million Bitcoin has now been mined. Only 6% left to be mined over the next 116 years!

foto credit: Wicked

So global Bitcoin adoption is at ~0.10% and 94.00% of all coins have already been mined and you still think diminishing returns are likely? What happens when 99.9% of the world tries to buy the last 6.00% of Bitcoin?

➡️ Great rebuttal and excellent analysis by Daniel Batten:

Rebuttal of New IMF report on Bitcoin mining emissions IMF report says “Carbon Emissions from AI and Crypto are surging” then goes on to a detailed report on how regulators should impose a “crypto carbon” tax.

Rebuttal: Firstly, Bitcoin advocates everywhere should pause to reflect on the significance of this moment. With the scientific consensus (9 of the last 10 peer-reviewed articles) and mainstream journalism now concluding that Bitcoin mining has significant environmental benefits, those who stand to lose most from mainstream adoption of Bitcoin (IMF, Central Banks) need to resort to direct attack pieces.

Here’s a breakdown of why the IMF report is at best poorly researched, and at worst propaganda.

https://x.com/DSBatten/status/1824129351371096516

It’s helpful to have, the facts beyond the ‘journalism’ they offer. Please read the rebuttal.

➡️You can’t make this up. The German Federal Office for Information Security shared a post on Linkedin calling hardware wallets the most secure way to store crypto-assets like Bitcoin. They also recommend creating backups and keeping them safe in multiple locations.

“Schon gewusst? Der Bitcoin-Wert geht dieses Jahr über 100.000 Euro!” - Okay, someone is bullish!

Didn’t see this one coming. And why on earth did they, even though it’s a different German government agency, sell 50.000 BTC below €100k/BTC, great logic! WAHNSINN!

➡️Apple opens iPhone Payment Chip to Third Parties for the first time making Bitcoin “Tap to Pay” possible!

➡️The world’s 3rd-largest public pension fund, South Korea’s NPS, has bought $34M in MicroStrategy shares.

➡️’65% of Bitcoin has not moved in over a year. This metric peaked at nearly 71% last November.’ -Bitcoin News

On the 17th of August:

➡️Billionaire Peter Thiel tells Joe Rogan that Bitcoin is such a big deal that society does not know how to process and recognize it immediately, and it is on the same scale as the internet.

➡️I have said it before and I will say it again:

For all the people on Twitter or other platforms, stop bootlicking politicians, stop larping. You can’t say “Don’t trust, verify” AND trust politicians or go full fangirl.

RFKjr.: ‘Join me for a fireside chat with Charles Hoskinson’.

Ask yourself…why he gave that speech in Nashville at the Bitcoin Conference and now endorses this (Cardano). One answer: votes!

➡️’Bitcoin wallet dormant since 2014 moves nearly 175 BTC for the first time in over a decade. The funds, which were valued at \(151,970 in 2014, are now worth \)10.2 million.’ - Bitcoin News

➡️’Marathon a leading publicly traded Bitcoin mining company, recently expanded its Bitcoin holdings with a \(249 million purchase, bringing the total to over 25,000 Bitcoins, valued at approximately \)1.5 billion.

On August 12th, the company announced a \(250 million convertible note offering, which was increased to \)300 million due to strong demand.

Marathon used \(249 million of the proceeds to acquire 4,144 additional Bitcoin at an average price of \)59,500 per coin.’ -BTCTimes

On the 18th of August:

➡️75% Of Bitcoin Hasn’t Moved In Over 6 Months, Signaling Strong HODLing Trend

➡️ El Salvador mined 474 Bitcoin worth $29 million using volcano-fueled geothermal power.

➡️Welcome to the Lightning Network Bisq as Bisq v2.1 has been released! Highlights include:

- Option to settle trades over the Lightning Network

- Refined chat experience including emoji reactions

- Know who’s online with peer liveness indicators

💸Traditional Finance / Macro:

On the 15th of August:

👉🏽No news

🏦Banks:

👉🏽No news

🌎Macro/Geopolitics:

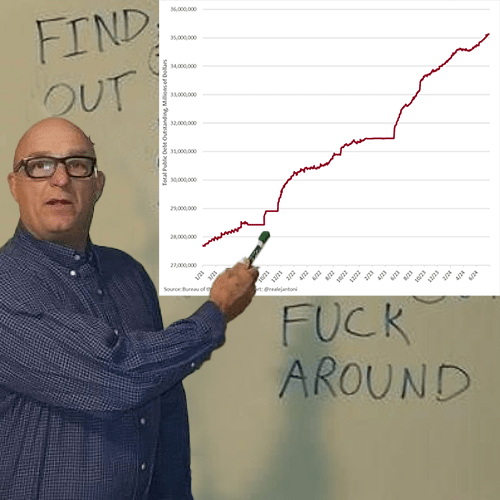

I want to start with this segment with the following quote and picture by James Lavish: ‘With US Federal Debt powering right through $35 trillion and heading exponentially higher, we are at this phase of the fiat debt cycle.’

Now please connect the above quote with the following statement by Argentina President Javier Milei:

“If printing money would end poverty, printing diplomas would end stupidity.” That is the best sentence I’ve heard lately!

On the 13th of August:

👉🏽Walker Amerika:

‘Trump just said “We would have no inflation” if not for Biden. This is false. I think it’s important to clarify that there was massive inflation during Trump’s administration.

From January 2017 to January 2021, the M2 money supply increased from ~\(13.3 trillion to ~\)19.4 trillion by January 2021. That’s an INFLATION of ~$6.1 trillion, or ~45%.

There is a LAG between monetary inflation and general price increases throughout the economy, and price increases do not happen uniformly (look up the Cantillon Effect). To clarify for the partisans out there: this is NOT an attempt to make excuses for Biden or to say that the monetary and fiscal policies under Biden are good; they are not good. The point is that it is false to say “there was no inflation” under Trump. Monetary inflation is inflation.’

Spot on! It doesn’t matter who is President inflation will run wild. Every President will have to spend more than the one before him, because of 30 to 50 years of bad policy. You better own Bitcoin.

👉🏽’The US government deficit hit a massive $1.5 trillion in the first 10 months of FY 2024, according to the Treasury Department.

In July alone, the US deficit spending reached a whopping \(244 billion. Total outlays came in at \)5.6 trillion and total receipts were $5.6 trillion over the last 10 months.

Social Security was the largest expenditure amounting to $1.2 trillion. Net interest was the second largest cost, exceeding health, Medicare, and national defense expenses.

Government spending remains at crisis levels.’ -TKL UNSUSTAINABLE

👉🏽 In the last couple of weeks I have been reading for the second time the book: ‘The Sovereign Individual’

The concept of the ‘Rule of Law’ is impossible nowadays. Globalization makes the ‘Rule of Law’ impossible. A study demonstrates that.

‘36% of multinational profits are shifted to tax havens every year. This reduces corporate tax revenue by >$200 billion (10% of global corporate tax receipts). Reallocation would increase domestic profits by 20% in high-tax EU countries, 10% in the US, and 5% in developing countries.’ -Phillip Heimberger Source: https://gabriel-zucman.eu/files/TWZ2022Restud.pdf What is interesting about the article is that it is co-authored by a Danish minister of Finance and a UC Berkeley professor.

Anyway, read the book ‘The Sovereign Individual.’

👉🏽The 3 years’ lowest excess of cash in the financial system. Remember what happened in 2018⁄2019? This is likely a good setup for increased liquidity.

‘The Fed’s Reverse Repo (RRP) facility has dropped below \(300 billion for the first time since 2021. The RRP is one of the financial system's excess liquidity metrics and is widely watched by investors. Large banks, government-sponsored enterprises, and money-market funds put their extra cash into the facility to earn interest on it. RRP usage has plummeted by \)2.3 TRILLION since December 2022. Over the last several months, however, the decline has stabilized and the facility usage has been oscillating around \(300-\)400 billion.’ -TKL

👉🏽The UK sees the worst 1 month job losses since the COVID crash UK unemployment is at 135K (forecast 14.5K, previous 32.3K) over 10x higher than expected.

You don’t say?

Let’s see what are the effects of unemployment. “We find a strong relationship between increases in unemployment and voting for nonmainstream parties, especially populist ones. Moreover, unemployment increases in tandem with declining trust toward national and European political institutions.”

Who would have ever thought?

Unemployment / left populism

Inmigration / Right populism

Now look at what is happening in Europe. Even the authors explore causality and find ‘that crisis-driven economic insecurity is a substantial determine of populism and political distrust.’.

ERGO: Economic stress leads to political extremism

On the 14th of August:

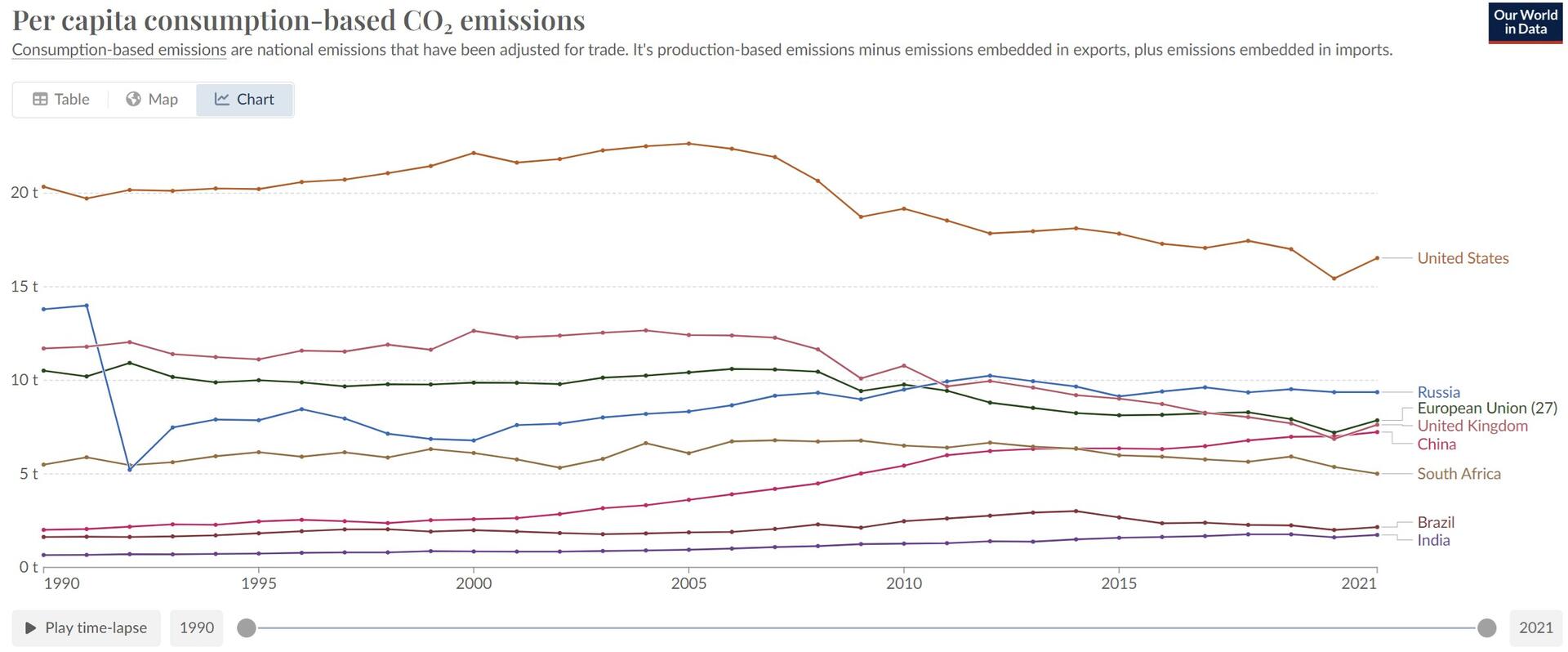

As long as you remember China’s emissions are for a large part due to the stuff we buy, the industry we outsourced there.

The EU and UK would rather manufacture climate hysteria and green policies that restrict growth and drive up energy prices than create an attractive capital market and innovation for techno solutions.

A lot of the manufacturing capacity needed to feed the EU consumers is located in China. I’d say Europeans are net importers regarding China, so if we measure by consumption, the proportions would likely be different. Territorial-based, China has slightly worse emissions than the EU. However, consumption-based, it’s marginally better than the EU.

Now don’t get me wrong. I do care about our climate & nature, but the truth without context is useless in discussing climate change and what we, the civilized people of the West (lmao), should do about it.

For example, deindustrializing Europe, especially Germany as the engine of Europe, for climate change is like throwing tomato soup at the Mona Lisa or gluing yourself on a highway –pointless!

Humanity always evolved forward by upgrading to more energy-dense, stable energy sources. It is the first time in history we actually regressed on that front, and maybe (personal opinion) it caused our climate issues.

Tackling climate change is nearly impossible within a debt-driven, inflationary economy. It promotes consumption over saving, and short-term profit over sustainability, and hinders so-called ‘green’ investments.

Fix the money, fix the world: Bitcoin.

👉🏽So last week I spoke about Thierry Breton (EU) and his terror on freedom of speech. Look what we have this week…

EU Commissioner brags about having AI regulation when they don’t have a SINGLE MAJOR AI COMPANY.

Only a career bureaucrat could think of regulation as an achievement…

It’s like celebrating a traffic law in a town with no cars. Who elected people like Thierry…NOBODY!

Yes, you could argue that it’s home (the EU) to ASML, the main supplier of NVDA. Without it, NVDA would not exist. So OK, maybe will have a few AI companies despite the regulation. But we won’t be a leading sector.

👉🏽 Hackers have reportedly stolen the Social Security numbers of every American from National Public Data, according to the LA Times.

Records for nearly 2.9 billion people were reportedly stolen. Most of the data was posted on an online marketplace. The group reportedly offered to sell the data on an online forum. The breach is expected to “power a raft of identity theft, fraud and other crimes.” -TKL

👉🏽’Chinese Bank Loans fall for the first time in almost 20 years.’ -Radar

‘What This Means:

- Bank Loans Decrease: When bank loans fall, it means businesses and individuals are borrowing less money from banks. This could be due to various reasons, like reduced demand for borrowing, tighter lending standards, or economic uncertainty. -Economic Implications: A decline in loans can signal a slowdown in economic activity. Loans are often used to fund business expansion, investments, and consumer spending. If these activities decline, it can slow down economic growth.

This event could signal a potential slowdown in the Chinese economy, which might impact global markets, depending on how the situation evolves. Investors and market participants will closely watch this development to gauge its broader implications.’ -Chat GPT

👉🏽”The S&P index is pretty much going up 7% per year for 100 years, and the U.S. dollar currency supply is going up 7% per year for 100 years.

What you have is a basket of assets that are holding their value in real terms while they trend up in nominal terms..” —Michael Saylor

Remember, inflation is caused by central bank money printing and the relentless expansion of the money supply, not ‘greedy corporations and price gouging’.

Reagan: “We don’t have inflation because the people are living too well. We have inflation because the government is living too well”

👉🏽 Just a rounding error: ‘US job numbers have been revised lower by 778,000 jobs since February 2022, according to BlackRock.

This year alone, non-farm payrolls were revised down by 279,000 from January to June. Furthermore, the US economy LOST 192,000 jobs in Q3 2023 and added 344,000 jobs in Q4 2023, according to the BED survey released by BLS.

On the other hand, nonfarm payroll data showed that the US labor market added 663,000 and 577,000 new jobs in Q3 and Q4 2023.

This is a jaw-dropping 1,088,000 difference in job count over just two quarters. The labor market is weaker than the headlines make it seem.’ -TKL

Now ask yourself how are they allowed to do this so blatantly. Why isn’t the Media reporting on this? And they can’t even get this straight why on earth do you believe that they have control & tell the truth on other topics….

Ask yourself. If overall inflation is up 6% and many things you buy way higher, what has gone down in price to bring the overall number down?

Fake Jobs Fake Inflation Fake GDP; Oh well, just a thought.

On the 16th of August:

👉🏽The cooling towers of the last nuclear power plant in Germany were demolished today.

This is what economic self-destruction looks like. They shut that clean energy down to turn up brown coal. That’s why Germany’s emissions are 7X more than France’s per KW/hr. I have the feeling that this will go down in history as one of the most insane, self-destructive, and stupid energy decisions made in the Western world.

👉🏽Gold hits 2500 for the first time in history ahead of Kamala’s central planning unveil that will usher in even more runaway inflation. Fueled by lower Dollar and lower US Treasury yields year-to-date, Gold is up 20.7%, setting the stage for its strongest annual performance since 2020 when it gained 25.1%.

👉🏽Again the ECB is absolutely getting drilled on Twitter by Dr. Jan Wüstenfeld and obviously he gets the silent treatment.

ECB: ‘We’ve improved our environmental performance: Better carbon footprint reporting Increased biodiversity on our premises Enhanced emissions calculations Find out more, including how we’re reducing our operational footprint.’

Dr. Jan Wüstenfeld’s reaction:

You can’t effectively fight climate change in a debt-based, inflationary monetary system. The incentives are not aligned. You are part of the problem.

- Inflation favours consumption over saving: As money loses value over time, people are encouraged to spend or invest rather than save.

- Debt in an inflationary monetary system: Borrowing is attractive because future payments are easier, leading to more consumption, sometimes of unnecessary or unsustainable items.

- Short-term focus: Continuous economic growth is needed at all costs, often pushing aside long-term sustainability. -> Companies prioritize short-term profits, leading to resource overuse and little focus on sustainability.

- Climate impact: The push for growth leads to excessive resource use, worsening environmental damage, and climate change. -> Overconsumption Immediate profit focus often delays investment in sustainable technologies. -> Delayed green investment Fix the money, fix the world! Bitcoin!

Please dear EBC you still only have one job. ‘Inflationary money fuels wasteful behavior, wasteful behavior harms the environment.’

On the 18th of August:

👉🏽How bad is the US Federal debt situation?

‘Net interest costs on US Federal debt as a % of GDP are set to reach almost 3 TIMES the share of defense spending in 2054.

Net interest is estimated to hit 6.3% of GDP while defense spending will be 2.3% of GDP by 2054. By comparison, since 1973 net interest costs have averaged just 2.1% of GDP, just one-third the 2054 amount.

Meanwhile, nominal interest payments are projected to reach a MASSIVE \(1.7 trillion in 2034, 2.6 times higher than the \)658 billion recorded in 2024. The debt crisis is an understatement.’ -TKL

Milton Friedman said it best:

“Keep your eye on how much the Government is spending, because that is the true tax. There is no such thing as an unbalanced budget. You PAY FOR IT either in the form of taxes or indirectly in the form of inflation or debt.”

🎁If you have made it this far I would like to give you a little gift:

Great podcast, What Bitcoin Did, on Protecting Your Bitcoin with Jameson Lopp. They discuss:

- Comprehensive Bitcoin security theory

- Physical attacks & threat defense

- Security implications of privacy vs obscurity

- The future of Bitcoin security

Credit: I have used multiple sources! My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (Please only use it till the 31st of October - after that full KYC)

Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀ ⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple.⠀ ⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.

Enjoy you week and see you next time!

Felipe - Bitcoin Friday

🧡