"If the China mining ban and FTX selling billions of dollars of fake Bitcoin in 2021 did suppress the price, then it's likely that the real previous all-time high should have been > $100,000.

That would potentially explain how we're so close to new "highs" already.

If the price was suppressed in 2021, which it undoubtedly was to some extent, then maybe we’re just making normal progress back to the “would have been” all-time high of over $100,000.

It might be possible that bitcoin outperforms the muted returns seen last cycle. At the end of the day, bitcoin is objectively the world’s best money due to its superior monetary properties. 93% of all coins have already been mined and less than 1% of the world has a serious allocation. So get ready, this could get out of control quickly." - Joe Burnett

Very well put and succinct. I think Joe is right, I have been saying that last year also.

🧡Bitcoin news🧡

➡️Let's start the Weekly Recap with the tweet that made me spit out my coffee:

"Let's be honest

A lot of people did not expect Bitcoin to get back to ATH territory with Fed Funds at 5.33% and the average mortgage rate at 7.27%

It was a speculative, zero-interest rate, easy money phenomenon, they said.

Boy, do we have news for you!" - Alex Gladstein

Just imagine what will happen if they (the FED) will lower rates...just imagine.

➡️11 days ago, the European Central Bank said Bitcoin's fair value is zero.

Yesterday, BTC reached an all-time high vs the Euro.

Bitcoin is up 285% since the European Central Bank said Bitcoin was on "the road to irrelevance".

It was literally the bottom of the bear market.

➡️UK authorities push for regulation to seize your Bitcoin.

„Authorities will be able to retrieve crypto assets directly from exchanges and custodian wallet providers.“ https://www.legislation.gov.uk/uksi/2024/269/made/data.pdf

Get your Bitcoin off exchanges and into cold storage, now!

➡️ Australian bank, Commonwealth Bank, limits users’ ability to buy cryptocurrency as Bitcoin hits new ATH in the country.

"If they can control how you spend your money, it’s not your money."

➡️Balance of Bitcoin on OTC desks hits lowest levels since Q4 2018.

More on that topic...

➡️All in all last week Friday, just over $2.3B worth of Bitcoin left on exchanges. One of the biggest withdrawals in over 5 years. (Roughly $200M of this was sent to Coinbase Prime) so let’s call it $2B.

Binance saw about $400M and has seen fairly big outflows for the past few days. Coinbase saw the rest.

Binance outflows are the interesting ones because they have nothing to do with the ETF.

Talking about Coinbase...

➡️Coinbase crashed again during the Bitcoin rally that hit $67,000, showing zero for customer balances.

Coinbase also crashed last week in the middle of a rally.

➡️Bitcoin Inflows to accumulation addresses (never spend) reach an all-time high.

➡️The price of a house has gone from 20 Bitcoin to under 7 Bitcoin IN LESS THAN A YEAR.

➡️This was not on my Bitcoin 24' Bingo card and I still find it hard to believe, but the WEF finally shared something positive about Bitcoin. I guess that is the power of Larry Fink (BlackRock).

"Just remember, their change in tone didn't happen by accident.

CEO of BlackRock, Larry Fink, is on the WEF Board of Trustees.

BlackRock is the largest spot Bitcoin ETF provider in the world and they are adding billions of dollars in Bitcoin every week to their fund.

Make no mistake: the narrative is changing." - The Bitcoin Therapist

In the video, the WEF shows how one of Africa’s largest natural parks uses hydroelectricity to mine Bitcoin generating $150,000 a month. It also uses the heat generated by Bitcoin mining ASICS to make chocolate.

https://twitter.com/gladstein/status/1763944314437009451

"I am not mentally prepared to deal with videos from the World Economic Forum that promote the positive social and sustainability benefits of Bitcoin mining. The cognitive dissonance is too much.

Is this the turn of the tide?" - Freddie New

Anyway, the truth will always prevail.

More on the mining bit...

➡️1.5 GIGAWATTS of Bitcoin mining have officially reported their grid balancing activity to the ‘Curtailment Survey’.

That is enough power to heat 1.5 million small homes or energize 300 large hospitals.

It is critical now, more than ever that we help paint a clear picture for lawmakers and regulators on the value of Bitcoin mining as a large flexible consumer of power.

➡️El Salvador’s congress passes a tax code amendment, changing the threshold for requesting buyer documents from $200 to $25,000. This helps maintain privacy for those who are using Bitcoin in the country. Great move by El Salvador. By implementing this tax code amendment BTC is treated more like a normal currency. If you exchange 25k USD worth you have to record the transaction and the bank needs to know who the customer is. Before it was a threshold of $200.

➡️Texas Blockchain Council's lawsuit successfully stops the Biden administration from government data collection on Bitcoin miners.

The Government agrees to destroy the data collected.

➡️Jack Mallers at Bitcoin Atlantis in Madeira says Strike will be available in Europe within a matter of weeks.

➡️Feb 2024 printed a $19.84k Bitcoin candle, the largest monthly USD increase in history.

This added $390B to the Bitcoin market cap...

Up a remarkable 47%.

➡️Bitcoin officially enters Bull market territory on Plan B's model with the first since 2021.

This usually marks the start of a parabolic move.

Although it is just a model, most of PlanB's forecasts were inaccurate. It tells you something... bull market is on. And it is already on for a couple of months.

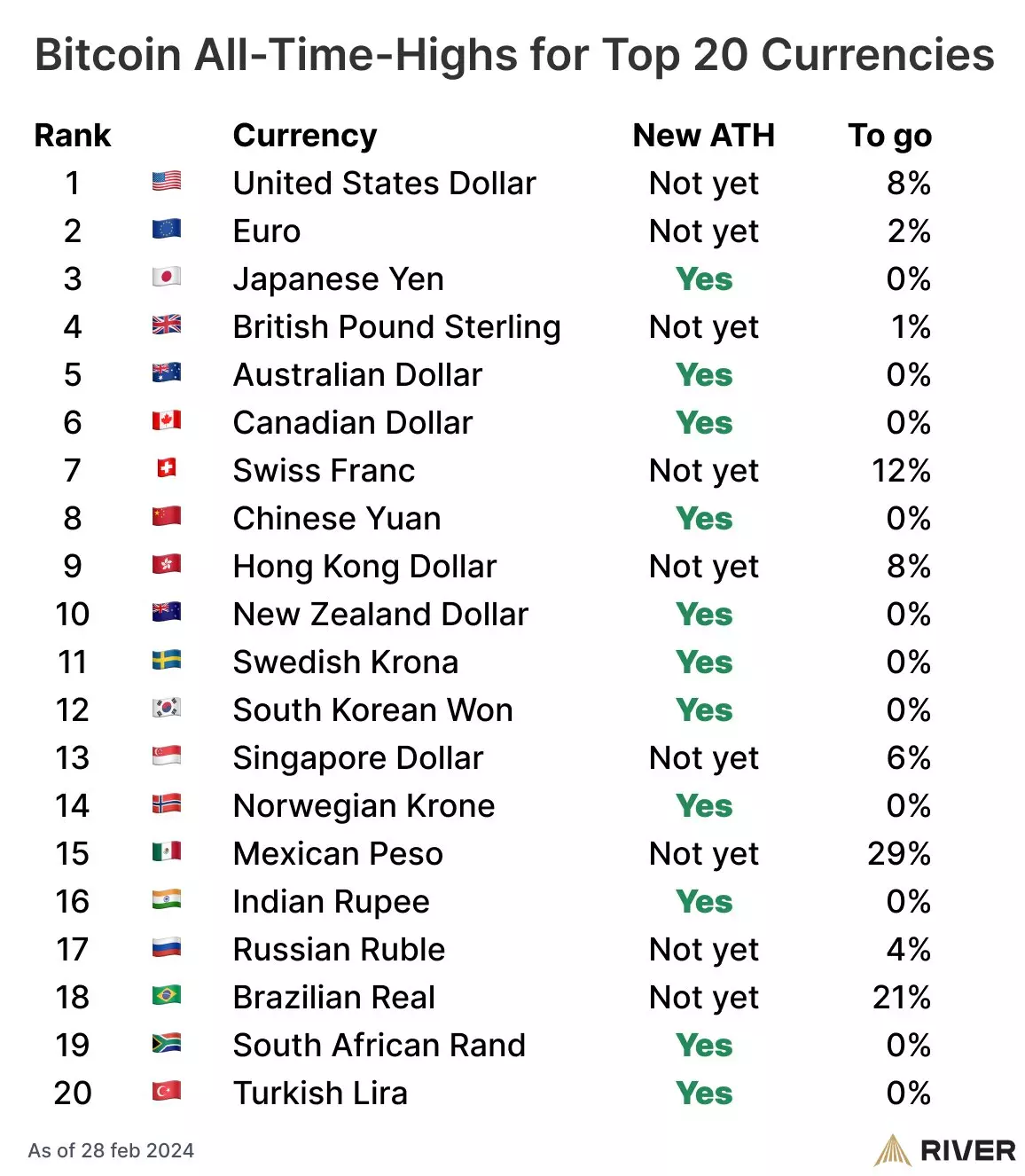

➡️"Bitcoin has already reached all-time-high prices in 11 of the top 20 global currencies.

The rest will follow as governments continue to print money to cover for their deficit spending.

People are opting out of this madness around the world, and we get called crazy for it." fellow Dutchie...Sam Wouters (picture 1)

When we talk about Bitcoin ATH, we usually mean in USD or if you are living in Europe in EURO. But in 11 of the top 20 fiat currencies, they have already hit a new ATH. Crazy don't you think? Bitcoin is the apex predator and you can't stop it. It is coming...it's coming to a currency near you!

➡️Great tweet by Dennis Porter:

"Today, over $5.5 trillion in assets sits in state pension funds.

If even 3% of AUM in state pensions leaks into the Bitcoin ETF that would equal $165 billion of new inflows.

Since launching, the Bitcoin ETFs have attracted $8 billion of inflows.

I’ll let you do the math."

Dennis is spot on!

➡️On the 26th of February GBTC sent only 776 Bitcoin to Coinbase premium ($39m).

Since the ETFs launch, the 11th of January is the lowest amount of Bitcoin so far that GBTC sent to Coinbase before the opening of the trading day.

The two trading days before GBTC sent more than $150m of BTC to Coinbase premium and the total outflow at the end of the day was $55m and $44m.

On the 2nd of March: "Today was another huge liquidation by Genesis out of GBTC: $492MM in outflows. But after this and yesterday's $600MM, there is almost nothing left of the $1.3BN Genesis was cleared to liquidate."

You might be saying, now that we witnessed a positive inflow last week, and the price of Bitcoin reacted accordingly last week.

More ETF news...

➡️ BlackRock spot Bitcoin ETF "broke its personal record again" trading over $1.3 billion on the 27th of February. Before the market opening on the 27th...

"Another thing about IBIT volume that's notable is the amount of pre-market activity.. check this out, it's already seen $80m traded.. only 5 ETFs have seen more activity ahead of mkt open. Unprecedented for 2-month-old ETF."

Just to put it in perspective how fucking insane the IBIT ETF is:

"IBIT is the newest member of the $10 Billion Club, the fastest ever to get there. Only 152 ETFs in this club (out of 3,400) including $GBTC. First $10b so touch bc so much has to come from flows (in $IBITs case 78% of aum is flows). Second $10b is easier because market appreciation bigger variable." Eric Balchunas

"Let's not forget that in August 2022, 1.5 years ago, Black Rock and its wealthiest clients front-ran their own spot Bitcoin ETF announcement and ultimate approval. The price at this time was just over $20,000.

They also gobbled up the FTX dip down to $15,500. Like him or not, Larry Fink is playing chess while most others are still playing checkers"- Oliver L. Velez

More BlackRock Bitcoin ETF news:

➡️Blackrock debuts the iSHARES Bitcoin Trust ETF (IBIT39) on B3, Brazil’s major stock exchange.

The initial management fee is set at 0.25% but will drop to 0.12% after the fund reaches $5 billion in assets under management (AUM).

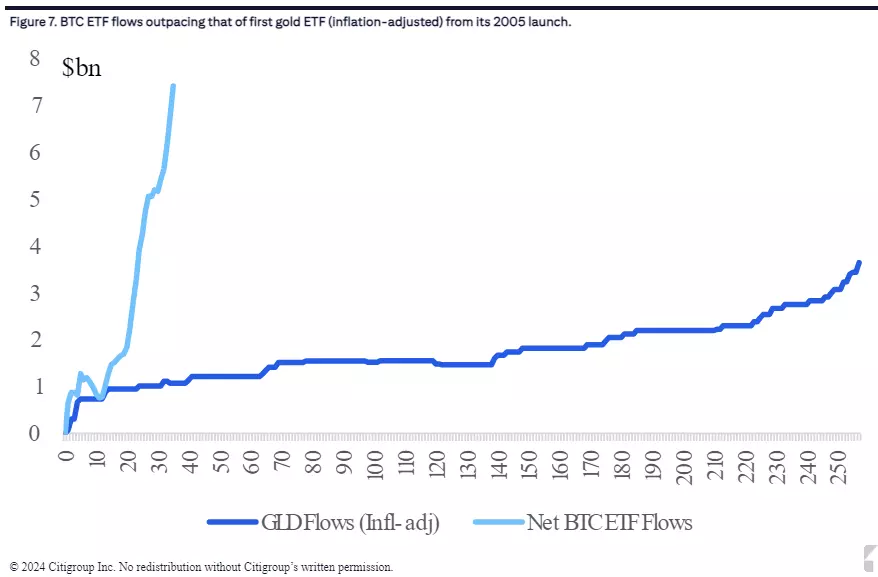

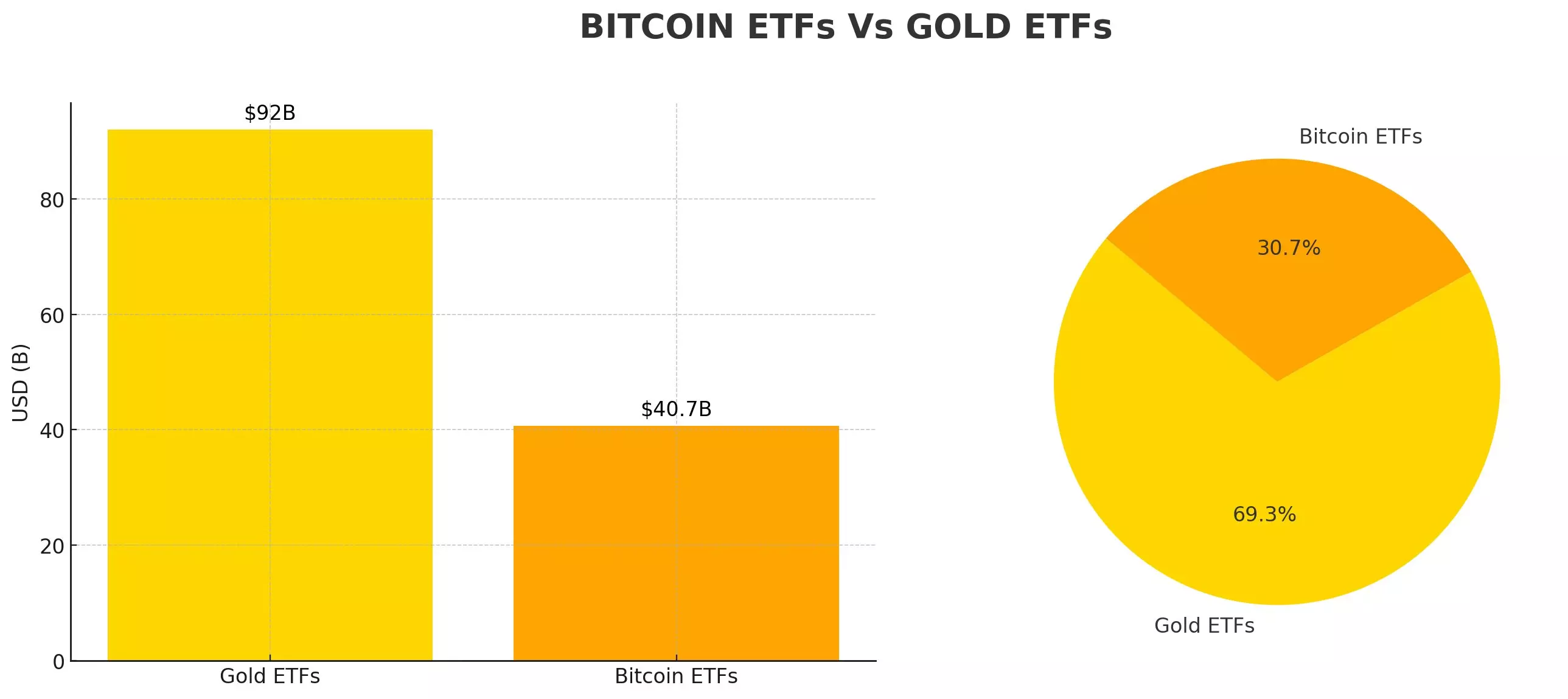

➡️Bitcoin is demonetising Gold ETFs as the 'Store of Value' narrative takes hold.

Bitcoin ETFs are taking in billions, while Gold ETFs are bleeding assets. picture 2+3

ETFs are catching up to Gold ETFs for assets.

$40.7 for BTC

$92b for Gold

After just 31 trading days! Mindblowing!

➡️Coinbase reports that Texas voters are interested in presidential candidates' positions on Bitcoin.

4.7M Texas adults (21%) own 'crypto', and 74% of them are likely to support candidates who stand alongside the national cryptocurrency industry.

➡️According to Bitinfocharts, Google Trends for Bitcoin is now back to 2015 levels (when Bitcoin was $200). It’s over $50,000 now and the general public couldn’t care less.

➡️Mr. 100 bought 5x 100 Bitcoin on the 25th of February (USD 26m), after buying 4x 100 BTC the day before. Mr. 100 has purchased an average of 100 Bitcoin per day since November 2022. It now holds 51,164 BTC worth $3.1 billion. Mental!

https://www.zerohedge.com/markets/mystery-whale-has-quietly-accumulated-over-3-billion-bitcoin-15-months

➡️Tim Buckley is stepping down as CEO of Vanguard at the end of the year. Kind of a shocker tbh although he has been there 33 years. Greg Davis was appointed President. The board is on search now for a new CEO.

Now some people may say this all has to do with the decision not to start a Bitcoin ETF, others will say this has nothing to do with Bitcoin. In the end, I don’t see why it wouldn’t have to do with the Bitcoin decision. Being that it’s the hottest ETF product of our lifetime. And Vanguard would likely have been #1. Plus how many customers did they anger/lose by banning the other ETFs? It doesn’t help that Bitcoin mooned too. "Higher Bitcoin prices aren't the problem. Exposing yourself as knowing nothing about economics, finance, or technology.

That's the problem.

Vanguard had 3 options:

a) be right and make money

b) be wrong and make money

c) be wrong and lose money

They went with C."

➡️Someone who just started DCA'ing $1,000 per week into Bitcoin will probably never reach a whole coin.

➡️Some clown news from the crazy world called Ethereum. You know, the mother shitcoin from which all shitcoin sprung. Ethereum Foundation's Michael Neuder wants to change the issuance curve of Ethereum; takes inspiration from the Central Bank of Japan.

I am not surprised...if you are still investing in ETH... HFSP! I am not going to sugarcoat it anymore.

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In North America, we have ISM and Payrolls, testimony from Fed Chair Powell and a Bank of Canada policy meeting. In Europe, the focus will be on the European Central Bank meeting and post-meeting press conference with ECB president Lagarde. In Asia, with inflation and earnings data in Japan, China aggregate financing and RBM loan growth, Korea industrial production and CPI, Australia GDP and the Bank Negara policy meeting.

👉🏽Nvidia is now worth more than the GDP of Russia, South Korea, Australia, Spain, Indonesia, Turkey,

Although Nvidia again skyrocketed last week we see that institutional money is rotating out of tech.

https://twitter.com/KobeissiLetter/status/1762118405266563108

👉🏽Over the last 16 years, US stocks have gained 427% vs. 85% for International stocks and 36% for Emerging Markets. This is the longest cycle of US outperformance that we’ve ever seen.

This sounds great, but it is the biggest Ponzi scheme on earth. Currently DEBT/Ratio is at an unsustainable 137%. Now ask yourself? Did the market grow that much because of sheer productivity and technology or is it more based on liquidity (hence: DEBT)? More on this topic below, segment Macro/Geopolitics.

Oh regarding the unsustainable 137 % debt/GDP. In terms of debt-to-GDP, the last time the U.S. saw this level was during World War II.

🏦Banks:

👉🏽"New York Community Bank stock crashes 20%+ after reporting "material weakness in internal controls."

The weakness is reportedly related to loan review resulting from ineffective oversight and risk assessment.

NYCB is the same bank that acquired the collapse of Signature Bank during the regional bank crisis.

This comes just weeks after the bank posted an unexpected $260 million loss in Q4 2023.

The stock is now at its lowest level since 1997."

In general, the delinquency rate among large banks hits 3%, the highest in 11 years.

The delinquency rate among small banks hits 7.80%, the highest on record.

👉🏽On the first of March: THE WHITE HOUSE: THE BANKING SYSTEM REMAINS SOUND, AND IS RESILIENT.

Buckle up people, buckle up! haha

🌎Macro/Geopolitics:

In last week's Weekly Recap I already mentioned that the US borrowed a shit lot of money. This week... oh well they did the same:

"While everyone was busy talking about AI stocks this week, the US borrowed another $100 BILLION in 4 days. Currently, total US debt stands at a record $34.5 trillion, up $11.2 TRILLION since 2020.

At the current pace, the US deficit for this fiscal year will cross $3 trillion, nearly double the $1.6 trillion deficit that Congress estimated. Over the last 100 days, total US debt is up a whopping $1 trillion, an average of $10 billion per day.

We should see $35 trillion+ in US debt within a couple of months."-TKL

Now if you don't believe you need Bitcoin, here is a statement by the Bank of America:

"The US national debt is rising $1 trillion every 100 days, according to Bank of America. They estimate it will take just 95 days for the debt to climb to $35 trillion from $34 trillion, compared to the 92 days it took to grow to $33 trillion from $32 trillion.

This is making “debt debasement” trades attractive like bitcoin and gold says BoA."

Okay one more statement: The U.S. national debt is rising by the entire market cap of Bitcoin every ~100 days.

Opt-out: Bitcoin

👉🏽Another HUGE call from Apollo on the first of March:

"The Fed will not cut rates this year, and rates are going to stay higher for longer."

Apollo says the US economy is not slowing down, and the Fed pivot has provided a strong tailwind to growth since December. They also note that many measures of inflation are pointing higher again including Supercore Inflation at 4.5%.

Meanwhile, asking rents are rising, more cities are seeing rising rents and home prices are rising.

Just 2 months ago, markets were pricing in 6 rate cuts in 2024.

The Fed's job is far from done." - TKL

Ergo: the struggle for everyday people will remain. Inflation will remain, and the difference/gap between the financial economy and the real economy will remain. Higher for longer just like what happened in the 1970's. If breaking inflation was as easy as raining rates for a few quarters, everyone would do it. I have said it multiple times don't get surprised if inflation will re-accelerate in the upcoming year(s).

👉🏽"Good Morning from Germany, which is obviously in a recession. At least that is what many indicators suggest: economic slack – demand falling increasingly short of potential output – is reappearing, acc to HFE. Widening slack stabilizes or depresses prices because in such an environment pricing power of comps is weakened." Holger Zschaepitz

👉🏽"Eurozone CPI slowed less than anticipated in Feb, highlighting stickiness in inflation. Headline inflation eased to 2.6% YoY in Feb, above the 2.5% consensus estimate in the BBG survey. Core inflation came down by 0.2%-pt to 3.1%, also an upward surprise compared to a 2.9% consensus estimate.

👉🏽A strong visual representation of the actual cost of corruption: https://twitter.com/MacroAlf/status/1763982945897906403

🎁If you have made it this far I would like to give you a little gift:

Very inspiring keynote by Daniel Batten at Bitcoin Atlantis in Madeira on the mitigation of methane emissions.

https://www.youtube.com/watch?v=bikLdxCKQjc

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption