https://habla.news/u/BitcoinActuary@BitcoinNostr.com/1713609535105

quoting

naddr1qv…h4nlThis is a slight refactoring of an article I wrote in April 2021.

I take a long term macroeconomic view on bitcoin, and just bitcoin, for being an incredible emerging store of value over a long term time horizon. It’s remarkable how many potential pitfalls there are for newcomers to the space when the optimal course of action is so simple -

Buy and hold bitcoin.

One of the pitfalls for many is trying to trade bitcoin. It arises from the fact that it has an open market to trade 24⁄7, with very low fees to trade, and is incredibly volatile - a magnet for traders.

Everyone should be aware of the legendary blog post that first coined the word HODL. Link here if you haven’t seen it, and I salute them. It shows that even early on, there was an appreciation by some of the futility of trying to trade bitcoin to realise higher returns, rather than simply just holding.

My only worry is others misinterpreting it when he says “I know I’m a bad trader”. I would go further and argue that with very few exceptions, we are all bad traders. Most just don’t realise it, as they benefit from a rising market overall.

I’ll admit though, the process of buying bitcoin has been in danger of leading me to try and second guess the price movements too, regardless of my stated long time horizon. And if you have ever found yourself planning a Bitcoin purchase, but then seeing the short term movement in price and then holding off by a day, or a week, then perhaps that’s you too.

So how to stop ourselves from becoming traders, even when just buying with a long term outlook? There is a fair appreciation of Dollar Cost Averaging (DCA). This is simply the concept of regular predetermined buys to reduce entry price volatility.

Now to the main point of this article. At every turn with Bitcoiners lies the phrase “Buy the Dip”. It’s everywhere! But could it backfire?

Let’s define such a strategy by putting some parameters as follows “Buy $x of Bitcoin when the price has fallen at least y% from its recent local maximum.” This is intuitive and would appear to get you some cheaper entry prices than simple DCA’ing over time.

As soon as I became aware that this is a common phrase, I was immediately sceptical of whether it was ever worth following compared to a DCA approach.

Obviously, there is limitless backtesting potential on this subject. I did so for the 6 months from October 1st 2020 to March 31st 2021 in the previous bull market.

In my test, I included a base level DCA strategy basic control strategy of investing \(100 on every Monday since October 1st 2020 (\)2,600 in total)-weekly DCA. This would have accumulated approx 0.118 btc, at an average cost of $22,007, over the 6 months.

So how about trying to invest the same overall amount to gradually “buy the dips” as a comparison?

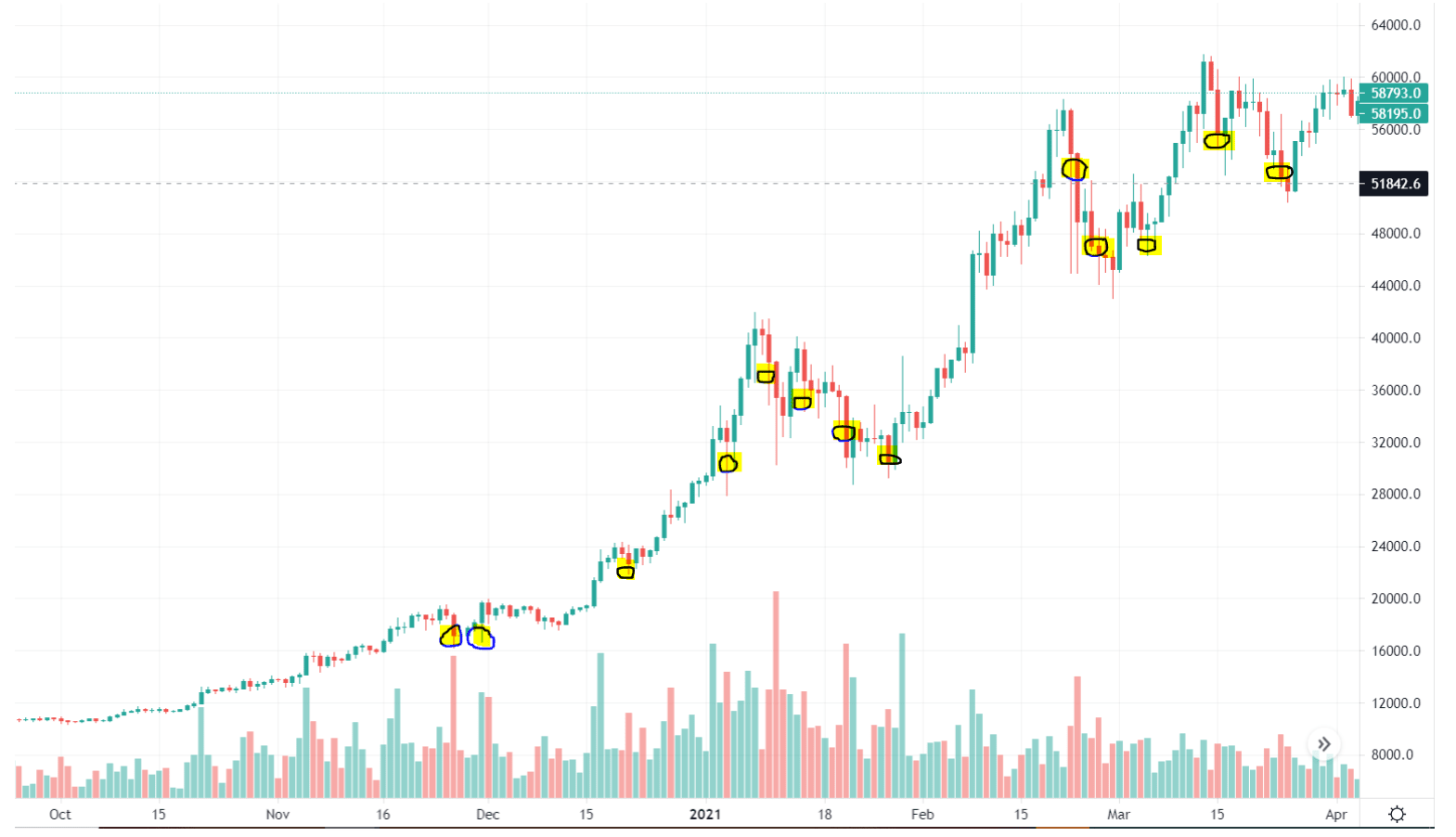

The graph below shows 13 theoretical entry points from the period from Oct 1st 2020 to 31 March 2021 for “Buying the 10% dip”. This could be have been done in practice by buying a set $ amount once the price dropped down 10% from that most recent high.

If we split out \(2,600 total spend from earlier into \)200 for each dip, for these entry points this would have bought us 0.082 btc in total, at an average price of \(31,800 for Bitcoin at these times. Remember, that’s compared to over 0.11 btc acquired at an average price of \)22k for the DCA approach.

The difference is huge. Dollar Cost Averaging would have acquired around 40% more bitcoin than attempting to buy the 10% dips over the 6 month period.

The reason in this case is simple, and could be seen by layering on regular DCA points on the above graph. Towards the start of the bull run, Bitcoin’s price rose in a stealthy and steady fashion, with no 10% dips to speak of until late November. The prices of the early DCA buys would have been largely missed by anyone patiently waiting for the 10% dips. Hence the average $ price paid is far higher.

Ok, I get it. It’s as spurious for me to argue that a strategy like this doesn’t work as it would be to argue it does work. It’s also not really valid to compare DCA to “Buying the dips”. You can’t even budget the same total amount in advance as I have done, as you don’t know how many dips there will be. Plus, this is only one example. However as often as not, those waiting for dips can be essentially punished for doing so.

Trying to buy the drip in itself means placing parameters over how to buy the dip. This in itself is very tricky — do you choose a 5% dip? 10% dip? Working it through, the exact choice of dip makes no difference to the underlying realities.

I don’t want to be dragged into arguing for any particular trading strategy over another. There are no doubt plenty of range trading periods where buying the dip looks good by contrast. My point is that trying to “buy the dip” in reality leads you halfway into trying to trade Bitcoin. Don’t trade Bitcoin.

Why am I so against trading Bitcoin in general? Many people do make money trading Bitcoin. Fiat money. They set their benchmark for success as making money in dollars, when in reality they are under performing buy and hold bitcoin over time. By this I mean they end up with less btc than they could have acquired had they had simply bought and held btc with their funds right at their starting point. Profit in fiat is misleading.

History has shown in the last decade - it is very very difficult to trade Bitcoin, using Bitcoin as your starting basis and benchmark, and come out on top. Even simply “buying the dip” is in some way trying to trade.

There are only two methods that I can see of avoiding this curse of trading. One is some form of DCA, and the other is simply existing on a Bitcoin standard.

One analogy as to why either of these beat the trading curse is making a truly random selection each time when you play Rock Paper Scissors. In the long run that is not going to outperform your opponent but equally it will protect you from losing to them.

As Marla Daniels once observed in the Wire ‘The game is rigged, but you cannot lose if you do not play’. In Bitcoin we have at least two different forms of not playing —

(1) not attempting to trade it, as above, and

(2) exiting asset holdings denominated in fiat currencies. With large amounts of monetary debasement, and increasingly desperate search for yield and returns, this is the largest rigged game of all.

Admittedly though, Buy the Dip is also a wider phrase. I know not everyone out there is trying to “buy the dip” as a strategy. Use of the phrase is often expressed as a narrative of solidarity. During price falls, strong hands buy in more and at a better entry price. This is as opposed to panicking and selling, as the weak hands are known to do when confronted by volatility and price falls. So buying the dip is a “keep calm and carry on” phrase, if you like.

To support the above argument, just consider Michael Saylor, whose billions probably lend weight and credibility to his actions.

Saylor doesn’t try and buy the dip. He just buys.