Although some financial influencers did mention that the US economy is strong and thriving based on the Q4 GDP report they are missing or leaving one tiny part out of that same report.

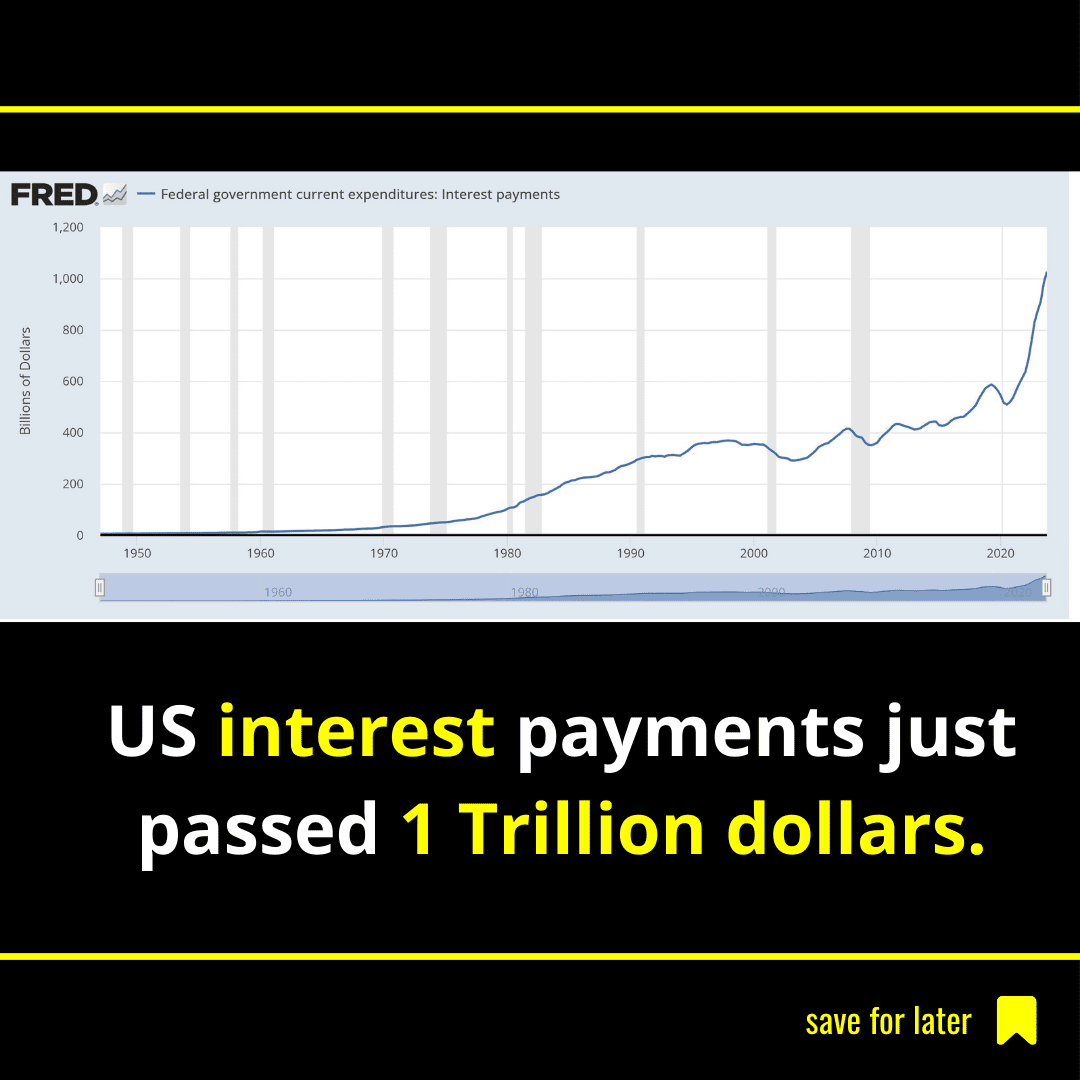

Annualized interest on the federal debt now exceeds $1 trillion and is projected to reach $3 trillion, annualized rate, by Q4 2030 - INSANE and UNSUSTAINABLE.

Even if you adjust for inflation and put everything in real terms (chained 2017 dollars), interest is still going to skyrocket with the current trends.

Now on that chart... It assumes steady growth rates for gov't expenditures, GDP, price indices, etc. - the line is rising rapidly because of the size of the debt and the cost to service it along with the institutionalization of multi-trillion-dollar deficits in the absence of either war or recession...

Ergo: This number goes up because of refinancing debt. Most of this was with <1% rates and is now >5%. That's a huge increase and the government can't stop that. Debt rolls over anyway. If no one wants them, the government buys its bonds which causes inflation.

Either 1) rates will go back down to 0% in some fashion which will result in a huge slowdown in growth or deflation, or

2) the government will be forced to cut spending/raise taxes by markets. When was the last time the government cut spending?

There is another option, the option that macroeconomist Luke Gromen already mentioned several times last couple of months/ years.

3) We will have a massive inflationary cycle where inflation makes all those numbers trivial.

Now for the so-called fin fluencers, I have one question. An increase in real GDP of $1.5 trillion with an increase of public debt of more than $2 trillion is that a strong economy?

This so-called "public stimulus" always means more debt, which in turn means more taxes, lower growth, weaker real wages for families, as well as a tougher environment for small businesses. Right?

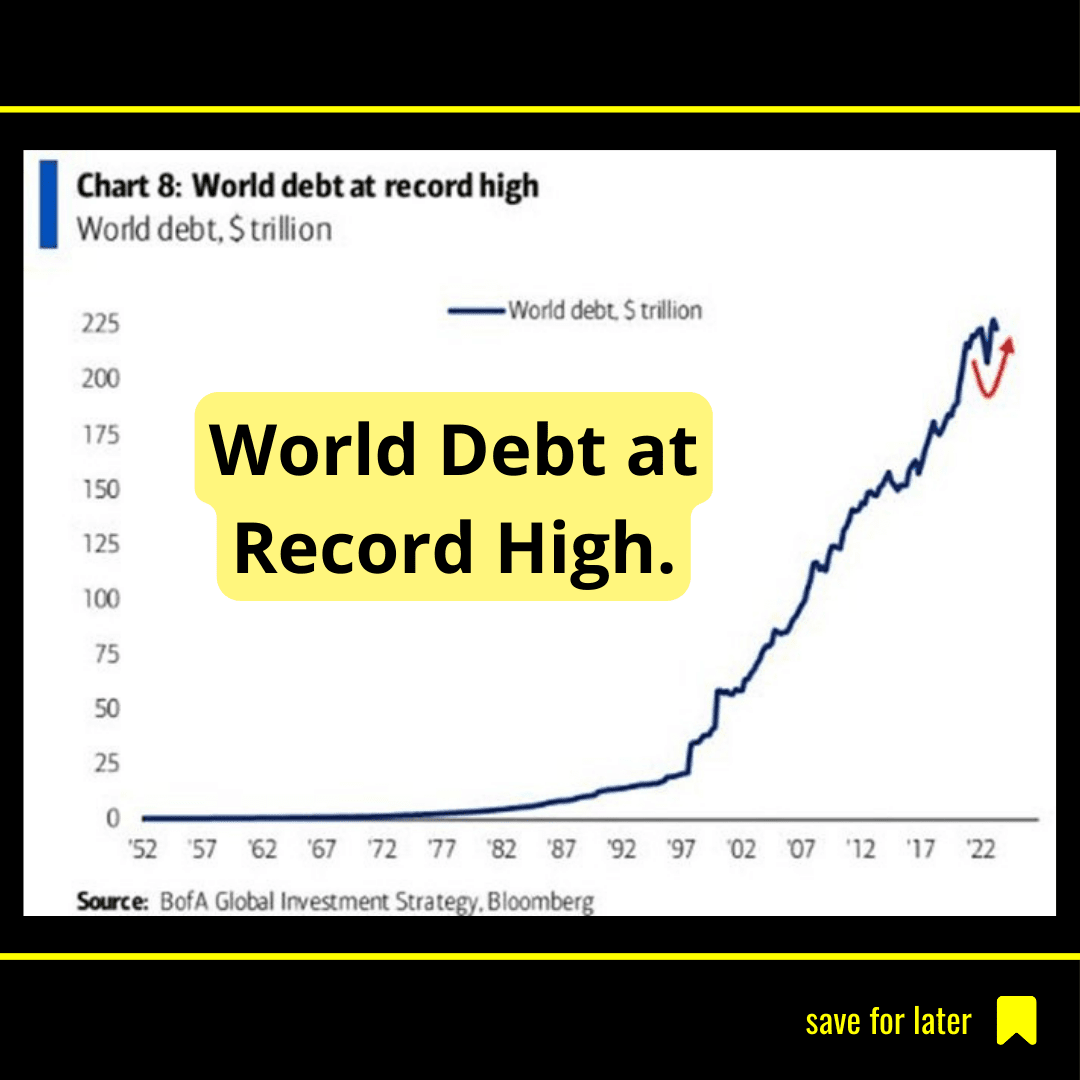

The above is only focused on the US.

Below you will find a picture of the world debt. (Second slide)

No read the above segment again and tell me why it isn't a good thing to hold a % of your portfolio in Bitcoin.

👉🏽More on the debt part:

"For anyone who's still counting:

The US government borrowed $47 billion of debt on the 28the of January alone.

Since the debt ceiling crisis "ended" in June 2023, total US debt is up ~$3 trillion.

Since October 1st, the US government has borrowed ~$10 billion PER DAY.

The worst part?

For the next 340 days, the US debt ceiling is effectively uncapped.

If we keep borrowing at current rates, we could see over $37 trillion of federal debt this year." - TKL

So tell me why it isn’t a good thing to hold a % of your portfolio in Bitcoin.

Well if you read this on Nostr.. probably you are already 100% in Bitcoin😁🤣🧡

The above is a segment out of my latest Weekly Recap, for more:

https://njump.me/nevent1qqszqyewvge73wexsd43zf474hkgdeul520uu694h5kelnpn63furpqzyq78msk9slhvupg0h3jcpxckp8geyplcyhwhva2tnyz7nj5q2ep2slzvk7y

Credit picture: TheBTCtherapist

Study, learn, hodl, decouple.

#bitcoin 🧡

▃▃▃▃▃▃▃▃▃▃▃▃▃▃▃

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It’s that simple.🎯

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. 🧡

Felipe - BitcoinFriday

#zap 🧡 #nostr #BTC #Bitcoin #plebchain #grownostr #stacksats #bitcoineducation #adoption #worldofdebt #usdebt