"Thanks to human ingenuity and progress, life was meant to become increasingly affordable over time.

Government fiat currency is literally designed to obscure this phenomenon and consistently leech productivity and purchasing power gains from its citizens via inflation (monetary debasement).

As it turns out, Bitcoin fixes this.

And Bitcoin will help usher in the next age of human flourishing.”

― Dr. Jeff Ross

🧡Bitcoin news🧡

➡️Let me start this weekly recap with some encouragement for the new group of hodlers.

A normal Bitcoin bullrun pullback is 30%. Back in December, we were already on the longest winning streak in Bitcoin's history. There is no bull market without dips.

"If you're new to Bitcoin and jealous of HODLers who bought earlier, don't be.

They went through hell, and now it's your turn.

Last week's dip is nothing. Get used to it.

Learn to manage your emotions.

And if you are stressing out day and night, sell until it no longer stresses you out.

Buy Bitcoin with money you won't need for +4 years.

Bitcoin is a long-term hold, not a short-term trade."

➡️Last weekend we received the news that anonymous 'crypto' wallets are now illegal in the EU. WRONG!

I have shared my view on Instagram, so let me repeat it here.

In short:

Unhosted to unhosted is still legal.

Unhosted to hosted will require KYC.

The draft bill/legislation isn't 'live' yet. There will be a final vote on the matter on the 22nd of April. It will go into force three years (!) after publication in the EU’s journal. No earlier than 2027/2028. It’s ugly legislation, as is the direction the EU is heading in, but the current draft bill isn’t as dramatic as some media state it is.

I will quote Freddie New on this matter:

"This needs to be taken seriously but, as always, it's crucial to read the text of the actual legislation. TLDR Self-custody is not illegal:

1. This is a prohibition of anonymity, not of Bitcoin. If you can prove eg through signing a message, that you control the keys to an address, it is not anonymous and is then linked to you. I understand that

Trezor and Swiss Bitcoin Pay are already working on UX to enable this.

2. The most apparent effect will be increased customer due diligence before you transfer in and out of self-custody.

3. Your coins in self custody, and self-custody itself, are unaffected. The wording clearly states, in bold, "The prohibition does not apply to providers of hardware and software or providers of self-hosted wallets insofar as they do not possess access to or control over those crypto asset wallets."

Don't panic - read the actual source:

https://data.consilium.europa.eu/doc/document/ST-6220-2024-REV-1/en/pdf

For the Dutch readers, please read Peter Slagter's thread for more info:

https://twitter.com/pesla/status/1771509534487380158

For all readers, please read the excellent thread by Patrick Hansen:

https://twitter.com/paddi_hansen/status/1771929859704389954

But let me make one thing very clear. What makes the EU regulators think they have any right to know anything about any transaction you have made?

"It prohibition of privacy, one of Bitcoins core values. So on a deeper level, IT IS being made illegal. Just because they cannot make it practically illegal, they make its ideological fundaments illegal."

So no, it isn't as alarming as most people on Twitter and Instagram put online. Point blank misinformation, but from a privacy point of view, I do think it's alarming. A private key is a secret. Only the most tyrannical governments demand you reveal all your secrets to them.

But I also view this as really the EU just codifying for Bitcoin. It's a recognition that it is real, here to stay and not a tulip. Bitcoin is private property. Decentralized digital property is a new concept. In the long term, as always, governments will be the ones who need to adapt. The change may be radical.

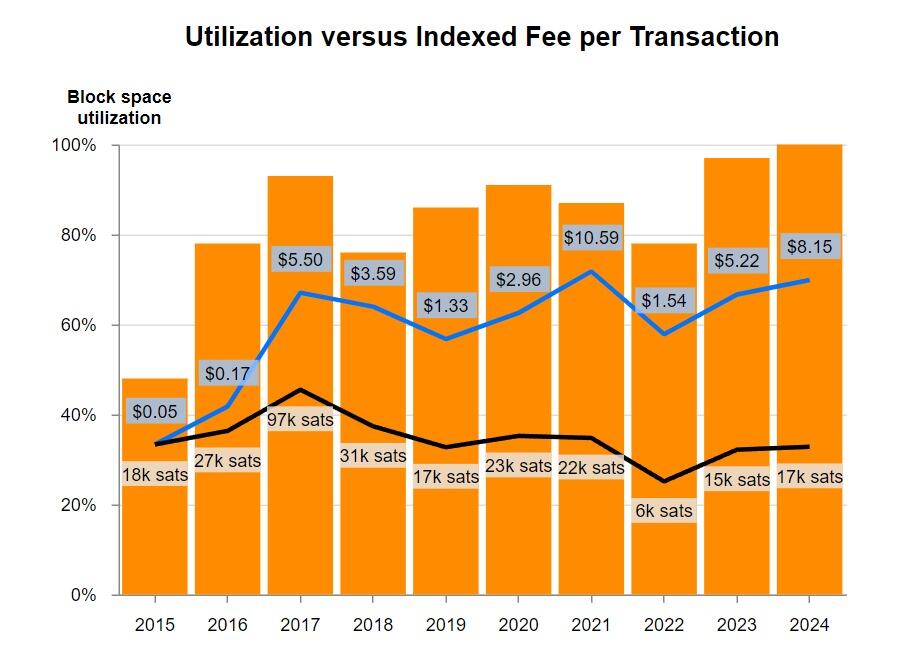

➡️"Average Bitcoin transaction fees have not increased in Bitcoin terms over the past decade, despite system utilization increasing"- Pierre Rochard

(Picture 2)

➡️MicroStrategy acquire an additional 9,245 BTC for $623 million.

They now HODL 214,246 Bitcoin at an average price of $35,160 per bitcoin.

On top of that MicroStrategy also raised $600m for 7 years with a tiny 0.875% interest rate.

$100m more than the initial announcement.

➡️On the day we received the news that the Bank of Japan raised interest rates for the first time in 17 years (see for more info on that topic segment Macro & Geopolitics), we also received the news that the world's biggest pension fund, Japan's $1.4 Trillion Government Pension Investment fund, is looking into buying Bitcoin. They are exploring (asking for more information) about Bitcoin as a 'diversification tool. ".

Now ask yourself:

"What happens when EVERY pension fund in the world wants Bitcoin?

Every government?

Every central bank?

Keep in mind Bitcoin is hovering around 2021's all-time high...

Even adjusted for inflation we should be around $80,000.

If you haven't bought yet and you're waiting for a dip, you're gambling.

I hope it happens because I'll buy more.

But if it doesn't?

You'll lose 50-75% of your purchasing power."

Bitcoin is the only way pensions will be able to fill their funding gaps in the coming decade.

➡️$840B global bank Standard Charted says "The gold analogy remains a good starting point for estimating the ‘correct’ Bitcoin price level".

Gold market cap = $14 Trillion

Bitcoin market cap = $1.4 Trillion

Bitcoin at $680,000 would equal Gold's market cap.

Now this is just an analogy, not a guaranteed forecast.

➡️Are you ready for the Bitcoin halving or do you need to stack more Bitcoin? Approximately on the 20th of April, the halving will take place.

➡️ "Despite Bitcoin being up 128% over the last 12 months and down 13% in the last ~8 days, 67.6% of coins have not moved in over a year." https://unchained.com/hodlwaves?utm_source=twitter&utm_campaign=3-20-2024

"The percentage of coins not moving remains elevated compared to previous cycles.

IMO, this is a sign Bitcoin remains in the early stages of a bull market.

The fact that this volatility hasn't shaken many coins, is very promising. Supply is tight.

If history repeats, coins will only move at vastly higher prices."- Joe Burnett

➡️Bitcoin ETF news from last week:

On the 18th/19th of March: Biggest outflow from Grayscale yet.

On a day when GBTC saw record liquidations (to meet bankruptcy obligations of Genesis and others) and when Bitcoin tumbled, Blackrock's IBIT saw a surge of inflows. ETF demand is relentless and price indiscriminate."

GBTC has not had ONE DAY of net inflows since it converted to a spot ETF.

On the 18th of March, they recorded $643 million in outflows—the single biggest individual ETF outflow in nearly 15 years.

The second biggest?

Also GBTC, on January 22nd when it had a $641mm outflow.

They have shed ~37% of their Bitcoin since launch, with about ~385,000 BTC left to dump.

On the 23rd of March: "Nearly $1 billion of net outflows this week for the spot Bitcoin ETF."

➡️BlackRock Head of Digital says "For our clients, Bitcoin is overwhelmingly the number one focus".

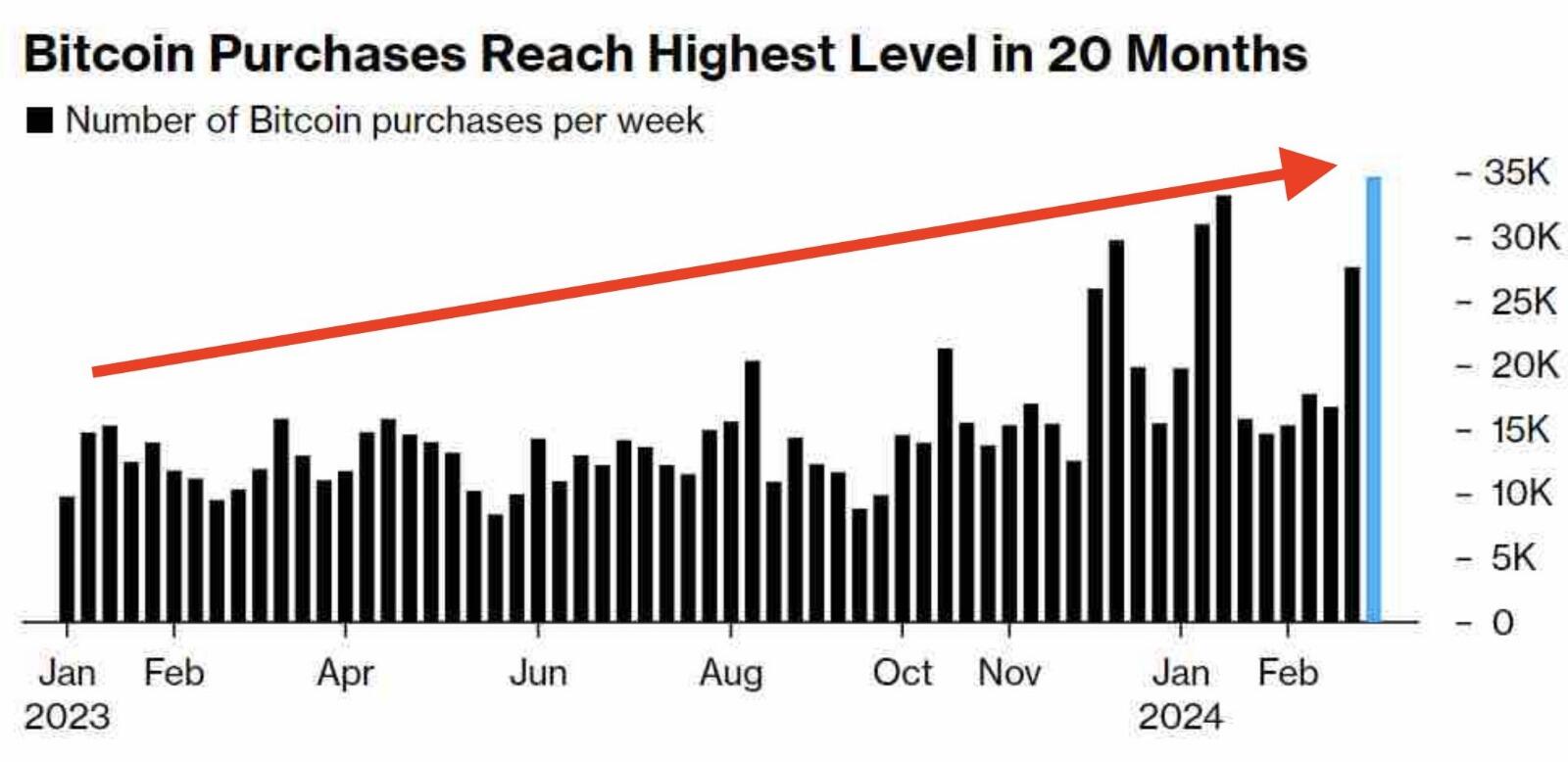

➡️Argentina's high inflation (276%) is driving citizens to Bitcoin as a hedge, with exchanges reporting the highest weekly Bitcoin purchase volume in 20 months (picture 3)

➡️Bitcoin supply on exchanges hit 4-year lows, dropping almost 40%, with no slowing signals ahead of the upcoming halving, according to CryptoQuant

➡️Many Bitcoin miners are moving rigs out of the US to Africa and South America ahead of the halving, per Bloomberg.

600K S19 machines are on the move due to cheaper energy. These rigs, once costing $11,500 each, may be worth only $350 after the halving.

➡️Bitcoin is a worldwide problem," says Iceland Prime Minister Katrín Jakobsdóttir.

"With its abundant, CO2-neutral, and virtually free geothermal energy source, Iceland could build the largest and most prosperous empire humankind has ever seen - just by mining Bitcoin.

But no, I know shit about Bitcoin, BuT iTs BaD FoR tHe EnViRoNmEnT because WEF said so."

She is left-green (the worst possible combination).

Source FT interview: https://archive.ph/f2phT

➡️SEC is investigating the Ethereum Foundation and wants to define Ethereum as a security.

Yeah, nobody saw that coming...right?

"Whether ETH is legally classified as a security or not, it's a worthless distraction compared to Bitcoin. And remember, when you buy an altcoin, you become the exit liquidity for preminers and centralized controllers of the altcoin.

When you buy Bitcoin, you become financially self-sovereign."

💸Traditional Finance / Macro:

What can you expect this week in the traditional financial market?

Main highlight ahead:

In the US, we have the PCE deflator, consumer confidence, and durable goods orders. In Europe, it’s the euro area consumer confidence, money supply, and French, Italian, and Spanish flash inflation. In Asia, we have the Japan and Australian CPI.

🏦Banks:

👉🏽no news

🌎Macro/Geopolitics:

👉🏽Let's start with some charts and some explanations.

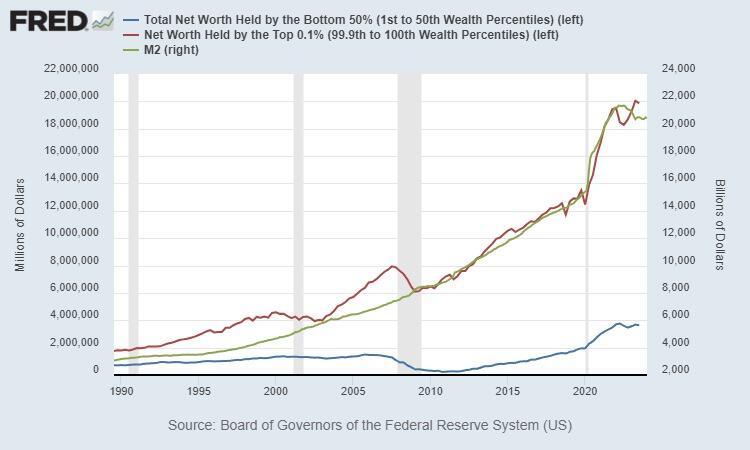

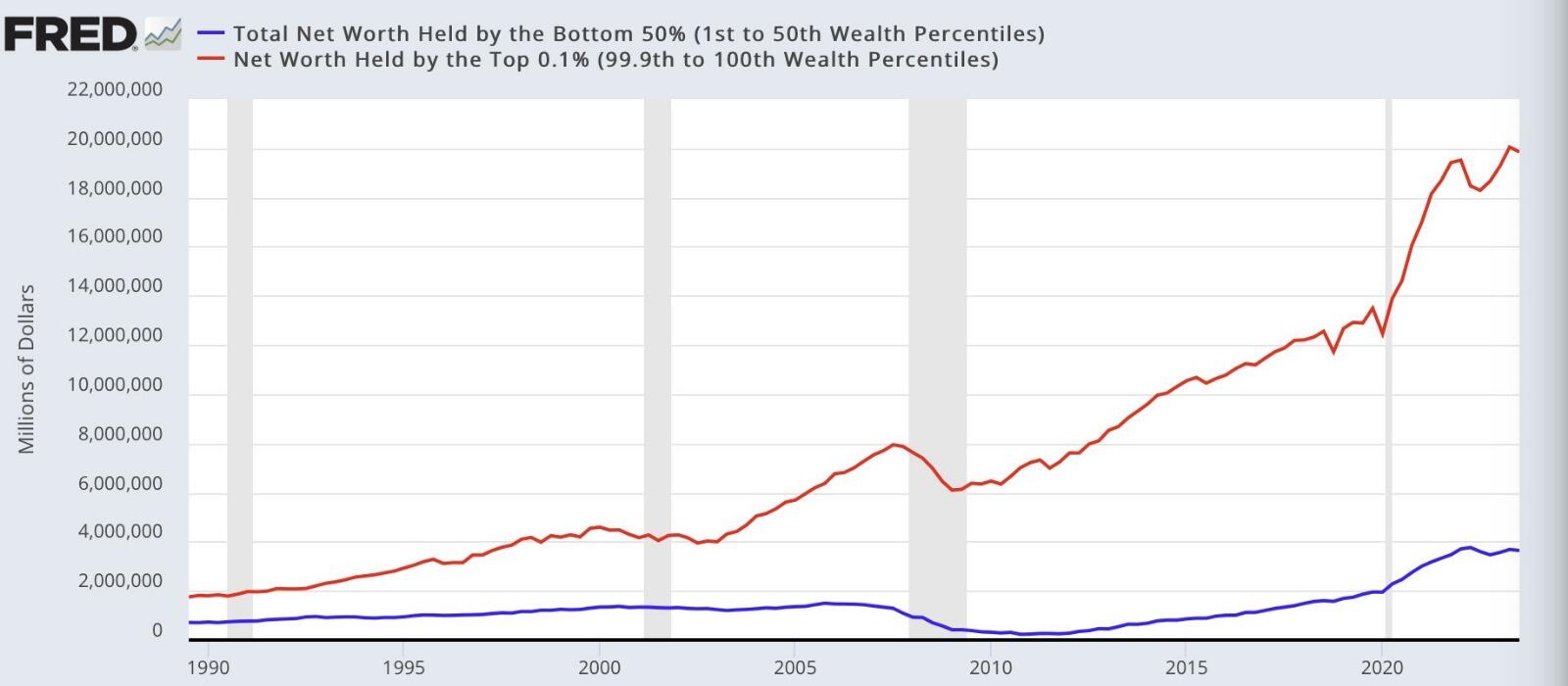

132,000 households versus 66,000,000 households.

35 years worth of data.

2 parties (red or blue), 1 central bank (the Fed), 1 result: Ever wider disparity.

(Picture 5)

Nothing stops this train and nothing will change if we don't get to the underlying issue:

developing monetary policy.

Just look at what happens when you add M2.

(Picture 4)

What does M2 stand for:

The M2 money supply is a broader measure of the money stock within an economy, which includes all components of the M1 money supply along with additional types of financial assets. M1 money supply represents the most liquid forms of money, such as physical currency (coins and banknotes) and demand deposits (checking accounts). M2 money supply, on the other hand, encompasses M1 money supply and adds near money or less liquid financial assets, such as savings deposits, time deposits (under $100,000), and money market mutual funds.

M2 is mostly used as a classification for money supply in the eurozone and America;

Central banks and monetary authorities closely monitor M2 money supply as part of their monetary policy framework. By adjusting interest rates, open market operations, and reserve requirements, central banks can influence the growth rate of M2 money supply to achieve their objectives, such as price stability and sustainable economic growth

To sum it up we call this the Cantillon effect.

"The logic of the Cantillon effect is incontrovertible. Of course, money printing will create winners and losers. If it didn’t, the government and run-of-the-mill counterfeiters wouldn’t have an incentive to run their printing presses.

The data confirms Cantillon’s insight from the 1730s. Measures of money printing and bank credit expansion are highly correlated with a variety of measures of economic inequality. While any healthy economy would have some inequality, it’s certain that putting the government in charge of the money supply has exacerbated it."

Source/more info:

https://mises.org/mises-wire/four-charts-show-cantillon-effects

Whilst at it, read the following article: https://www.zerohedge.com/personal-finance/insanity-our-world-driven-money-printing

👉🏽On the 19th of March Fed Chair J. Powell: "Appropriate to slow pace of asset runoff soon."

Translated: The Reverse Repo is getting to a level that will cause The Fed to compete with the Treasury for liquidity, so we will soon end QT.

OR

US inflation is almost at an acceptable level.

The Fed needs to taper QT once the RRF is drained and as that reserve level approaches $2.5T, the key level he has indicated before. Once below that, they worry about another repo spike a la 2019. QT must stop to allow the Treasury room to keep floating more debt.

What does this all mean for Bitcoin (assets in general), a massive tailwind as this all is a liquidity game.

What does 'runoff' mean? QT

What does 'reverse repo' mean? It is basically banks' money coming back out of lockup at the Fed and into banks' hands. Kind of like QE.

Remember 'history doesn't repeat itself, but it often rhymes.'

"Bernanke (2008): QE is temporary and the Fed’s balance sheet will soon be lower than when we started.

Powell (2024): It’s appropriate to slow the pace of QT fairly soon"

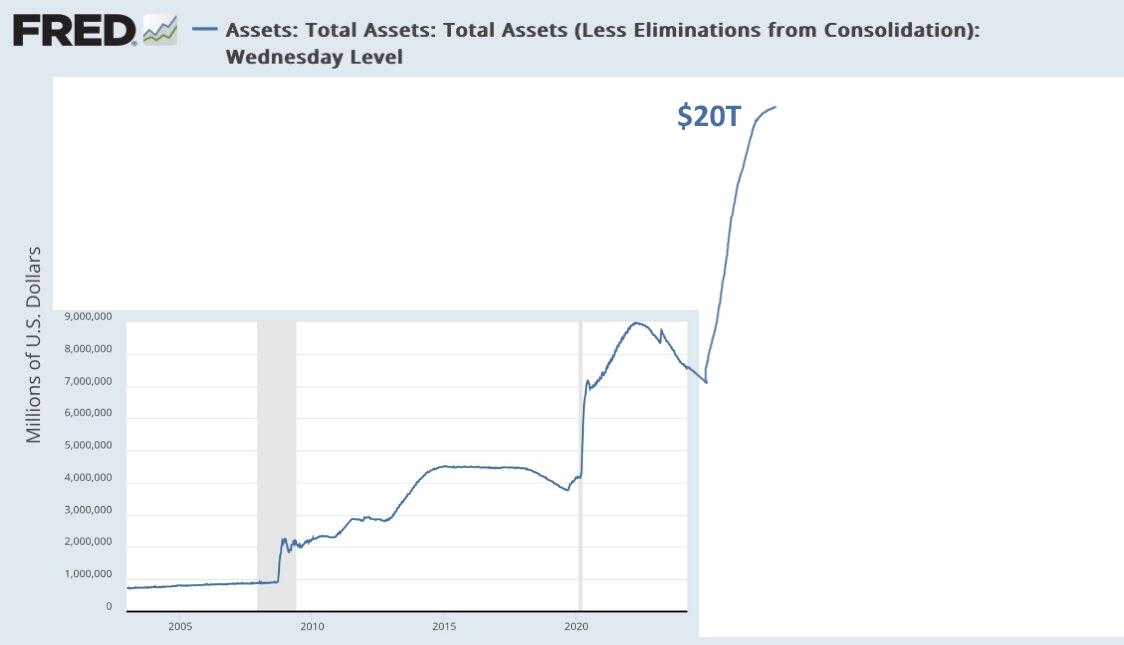

(Picture 6)

$20 trillion fed balance sheet incoming.

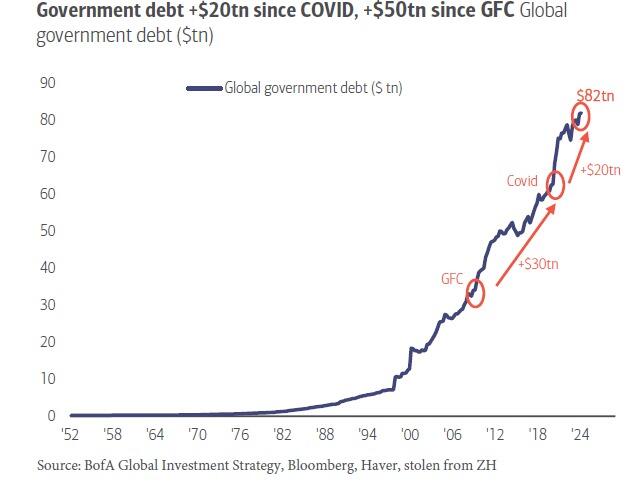

Global government debt is a record $82 trillion:

up $20 trillion since Covid

up $50 trillion since Lehman

... and up 7x this century in under 25 years!

The US debt-to-GDP ratio stands at 123.7%, near the all-time record of 126.2% reached in 2020

It is estimated by the Congressional Budget Office that in 2034 it will reach 130.6%.

Since 1800, 51 out of 52 countries with a ratio above 130% have defaulted

(Picture 7)

Anyway, if you want to know more about the Fed meeting from last week I highly recommend James Lavish's thread:

https://twitter.com/jameslavish/status/1770495805067264230

👉🏽"POWELL: DON'T SEE CRACKS IN THE LABOR MARKET

what cracks? All new jobs since 2018 have gone to immigrants, and 250,000 illegals enter the country every month." -Zerohedge

Since November, the US has lost 1.8 million full-time jobs.

In the last 12 months, the US labor market has seen a 921,000 increase in part-time jobs while the full-time jobs count declined by 284,000

Headlines: The US has been adding jobs for 38 straight months.

Yikes!

👉🏽 On the 19th of March Japan raised their interest rates for 1st time in 17 years (2007) amid higher inflation & rising wages. BoJ also scrapped its complex yield curve control program while pledging to continue buying long-term govt bonds as needed. It also ended its purchases of ETFs. Nikkei gained 0.7%, 10y Japanese yields dropped 3bps to 0.73%.

By raising rates BoJ is putting pressure on other central banks. Likely we will see rate cuts & restart of QE in the near future by the Fed, and probably also the ECB.

Remember Japan holds over $1.1 Trillion in just US debt alone. The BoJ will become net sellers of this debt very soon. At a time when the US needs more net buyers of its debt.

Great thread by MacroAlf on the implications for global markets:

https://twitter.com/MacroAlf/status/1769991687504384463

👉🏽Last week I already mentioned:

"KPMG study among the 350 CFOs of the largest German subsidiaries of international groups shows that there is record-high skepticism with respect to Germany as an investment destination..."

Not only on the Bitcoin - unhosted wallet part the EU seems to be allergic to new and better tech.

The boss of Dow Inc. said the price of electricity in Europe is so high that there are doubts about the long-term future of some of the chemical company’s industrial customers in the region.

Source: https://archive.ph/V6r0r

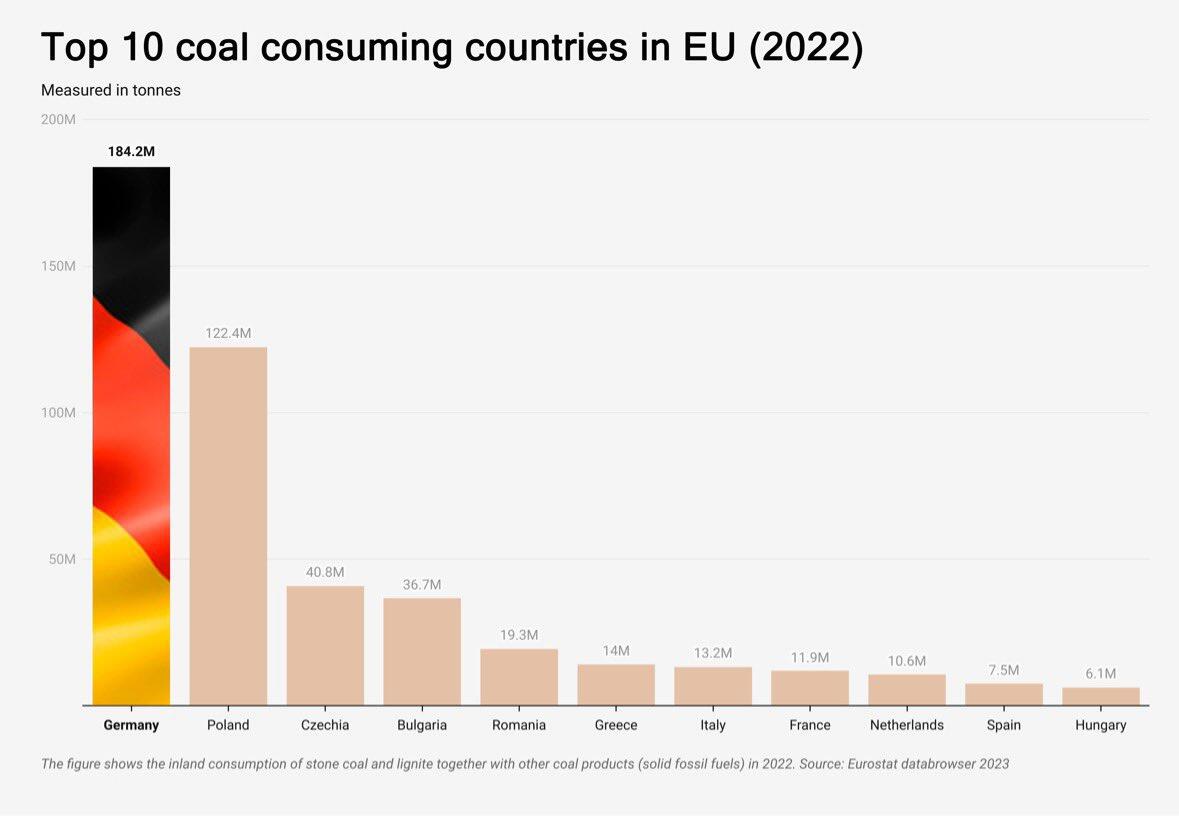

The decision to close German nuclear power plants will go into history books as the biggest economic, geopolitical, and environmental mistake since WWII.

"In this context: Salzgitter AG estimates that reducing CO2 emissions in the European steel industry to 95% requires 400TWh of additional power annually. This is >2/3 of what Germany currently produces in total.

Source: The long road to green steel | Economy | DW | 07/26/2019" - Swen Roschlau

(Picture 8)

👉🏽China has started blocking the use of Intel and AMD chips in government computers.

US sanctions stopped sales of advanced chips to China, so they quickly developed their own technology.

👉🏽Every generation has its own bubble. Human nature does not change, only the bubbles change. (Picture 9)

"Wall Street never changes, the pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes." ~ Jesse Livermore

🎁If you have made it this far I would like to give you a little gift:

https://youtu.be/48r0VO9m1yc?si=tN0woyKHj8BLr5Pb

Free knowledge!

Credit: I have used multiple sources!

My savings account: Bitcoin

The tool I recommend for setting up a Bitcoin savings plan: @Relai 🇨🇭 especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.

⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node...be your own bank. Not your keys, not your coins. It's that simple.

⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats. #zap 🧡 #weeklyrecap #nostr #plebchain #BTC #Bitcoin #zap🧡 #plebchain #grownostr #stacksats #bitcoineducation #adoption