Event JSON

{

"id": "246659c648af352e7e03d668b645454acf26e69346dc5ecf2951ffbbd3d7f6f2",

"pubkey": "e4146d1d7fb2f7f6e6b3c799eaeaba6f7446fd28ccea2592671cb239a13f4d81",

"created_at": 1723350264,

"kind": 1,

"tags": [

[

"r",

"https://image.nostr.build/b2b258a0abcd62132243177dce8463dcc6addc757e906e9753ac12b7852a51bb.jpg"

],

[

"r",

"https://image.nostr.build/95e77d9f58822f9264286f86b85db5afd2786a4ee17f093da811726d5e5e2e3d.jpg"

],

[

"r",

"https://image.nostr.build/5873f3d10c53fec3281d1083cb36cd1aad71f42ae041b370051be489f8e21e3e.jpg"

],

[

"imeta",

"url https://image.nostr.build/b2b258a0abcd62132243177dce8463dcc6addc757e906e9753ac12b7852a51bb.jpg",

"m image/jpeg",

"alt Verifiable file url",

"x 2a911f932fc174a6b6bdbefdb032377cbbfe6176f903026c210403ed9ece9273",

"size 71145",

"dim 1573x733",

"blurhash Z03S6QEKiwXS-pE0-WE1-qa#InV[W.s;t7t7R%ofMwNZ%3NFaKSgaKNGjFkXoLNGxuS2M_WVn%R*",

"ox b2b258a0abcd62132243177dce8463dcc6addc757e906e9753ac12b7852a51bb"

],

[

"imeta",

"url https://image.nostr.build/95e77d9f58822f9264286f86b85db5afd2786a4ee17f093da811726d5e5e2e3d.jpg",

"m image/jpeg",

"alt Verifiable file url",

"x cab2d09ffc2d53c8dd1f10241fb093bcc4ec2a71a675910734691fcec7ff274b",

"size 58607",

"dim 1585x707",

"blurhash Z14n+1EL56$*fkrrogR*bGABxaxHbHayNFays:WB0x$*^QNus:I:aeoLe.^QI.9[xaf+%2WBNGWV",

"ox 95e77d9f58822f9264286f86b85db5afd2786a4ee17f093da811726d5e5e2e3d"

],

[

"imeta",

"url https://image.nostr.build/5873f3d10c53fec3281d1083cb36cd1aad71f42ae041b370051be489f8e21e3e.jpg",

"m image/jpeg",

"alt Verifiable file url",

"x 140926929882622a0982004a9ac34ea7abdf94e2742fe1df7bd89c31dc0350d2",

"size 72467",

"dim 1495x715",

"blurhash Z039DgRjR1yGaIM^ozWAnhkYV?V=RhRNadj]o$o#D4awtTfNVrRNo#aeo#R.kCo#%%o#ROo$MvV=",

"ox 5873f3d10c53fec3281d1083cb36cd1aad71f42ae041b370051be489f8e21e3e"

]

],

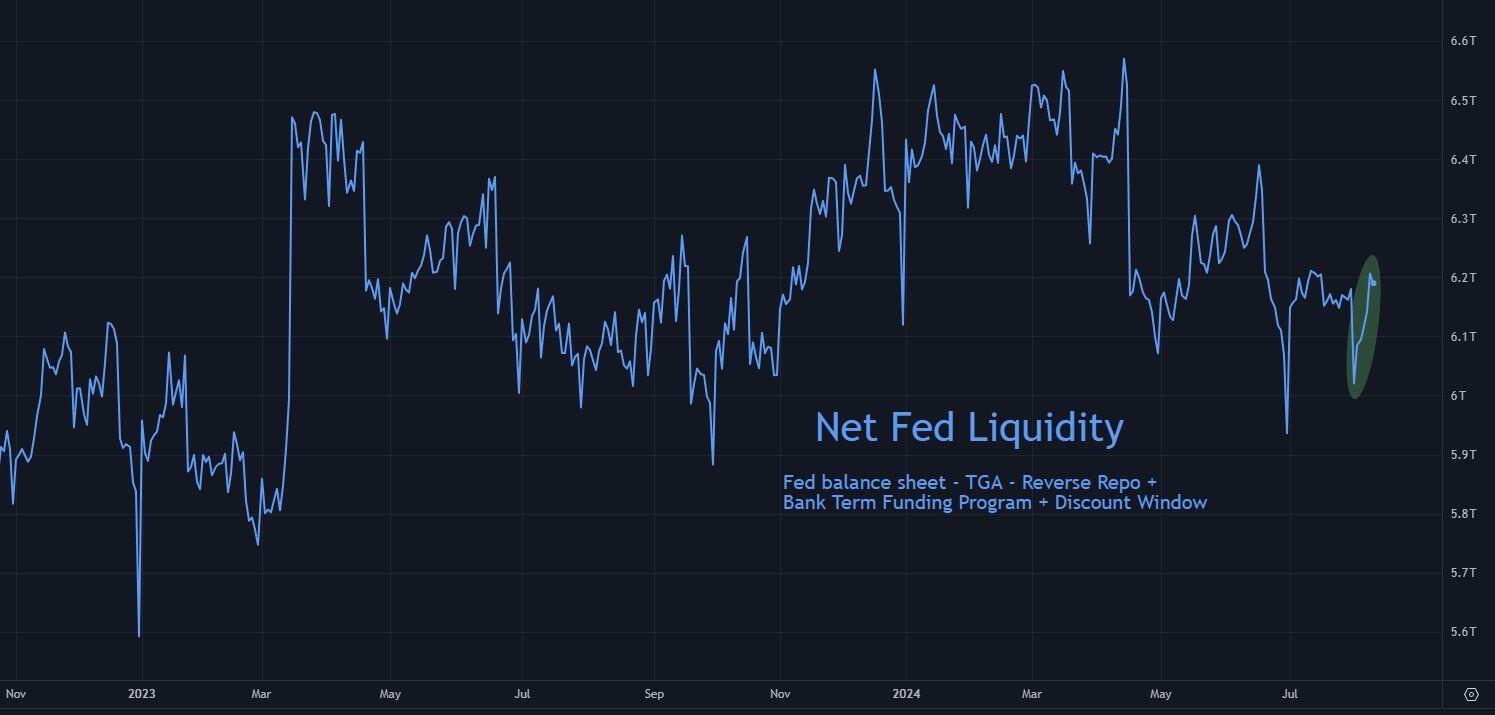

"content": "📈 Fed Liquidity rebounds strongly this week\n\nSince falling by $160bn last week, Net Fed Liquidity has shot back up by $170bn [chart 1].\n\nWithout drawing a direct causation - it's interesting to note that both the S\u0026P 500 (-3%) and bitcoin (-30%) fell through last week, and then both have rebounded strongly (so far) this week (S\u0026P 500 +4% and bitcoin +22%).\n\nThe ongoing flood of new T-bills from the US Government has finally caused Reverse Repo usage to start falling notably (liquidity injection), and it's now at its lowest level since May 2021, breaking down from an eight month flatlining [chart 2].\n\nThe Treasury General Account balance has also decreased significantly by around $70bn (liquidity injection) [chart 3].\n\nYou can find a more detailed explanation of these points in the thread below.\n\nAs we move into September, it's likely things will start to get worse for Fed liquidity due to seasonal factors.\n\nI'm still wary that Net Fed Liquidity is not showing enough upward momentum currently, and it's very likely to roll over in the second half of Q3, with a good chance it will fall to a new lower low by the end of September.\n\nIf this happens, the medium term downtrend that began in April 2024 will hold.\n\nBut I'm hopeful Q4 will be much better generally for Net Fed Liquidity.\n\nFor those following my Fed Liquidity Rhythm (thread in the comments) - we will be transitioning from a \"favorable Fed liquidity environment\" to an \"unfavorable Fed liquidity environment\" next week (August 15), lasting until September 31.\nhttps://image.nostr.build/b2b258a0abcd62132243177dce8463dcc6addc757e906e9753ac12b7852a51bb.jpg https://image.nostr.build/95e77d9f58822f9264286f86b85db5afd2786a4ee17f093da811726d5e5e2e3d.jpg https://image.nostr.build/5873f3d10c53fec3281d1083cb36cd1aad71f42ae041b370051be489f8e21e3e.jpg",

"sig": "c44c71eed18669f71238ad30536b33e8dc8bee651cd28da9bd026e78037f53d221964210e9bb52207b47bc2d44ef2aa9c47d94ef02ea28bf0b0326bf5de59681"

}