Multi-currency accounts

International money transfers

FX (foreign exchange) at “interbank rates”

Virtual and physical cards

Business expense management

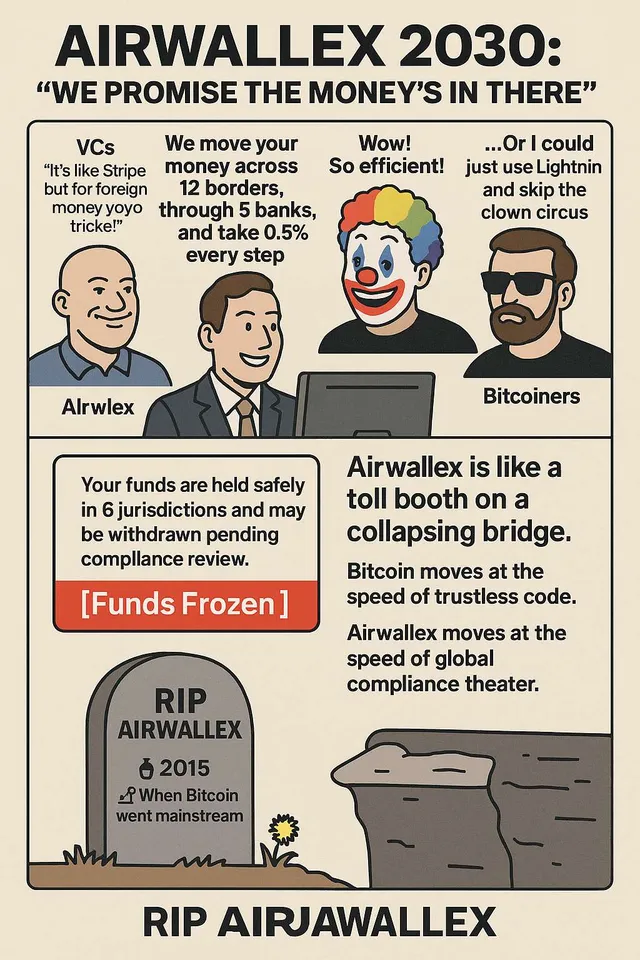

Their main pitch is: “We’re Stripe for global money movement.”

Why It's Viewed as a Potential Scam or Future Crater Risk

Here’s the breakdown of the skepticism and risk signals:

---

💸 1. VC-Huffing Hypergrowth with No Clear Profit Path

Airwallex has raised over $900 million, with investors like Sequoia Capital China, Tencent, and DST Global. Like many fintechs, they run on:

> High burn → subsidized FX → thin margins → chase scale → delay profit.

That works until capital tightens or users expect trustless rails (like Bitcoin).

---

🏦 2. Fiat IOU Machine in an End-of-Fiat World

They're not trustless. They:

Custody funds via regulated partners.

Offer FX as a "service" but rely on opaque pricing.

Sit between you and your money — with chargeback, clawback, compliance freeze risk.

As fiat regimes fragment and CBDCs or BTC rails take over, these middleman services get crushed.

---

🧱 3. Not Disruptive, Just Compliance Tech for Old Money

Airwallex is mostly a band-aid for the existing financial surveillance state. KYC, AML, licensing, endless regulations.

Bitcoiners look at Airwallex and see:

> “Another tool for nation-state capital control.”

They don’t challenge the premise of trust. They just optimize rent extraction.

---

🚫 4. No Real Moat

Dozens of competitors: Wise, Revolut, Stripe Treasury, etc.

Long-term pressure from Lightning, stablecoins, and Bitcoin-first neobanks.

If users start demanding non-custodial programmable money, this all implodes.

---

🧨 5. Final Boss Risk: CCP + Collapse of Global Trust

Tencent is an investor. If geopolitical tensions escalate (China vs. West), there’s non-zero risk Airwallex ends up on some sanctions/blacklist or data exposure scandal.

---

TL;DR

Airwallex = Overfunded, fiat-based, VC-bloated money wrapper with no trustless foundation.

As trust in fiat melts and demand for sovereign, peer-to-peer systems grows, Airwallex craters. Slowly at first, then suddenly.

---

Want a meme version?