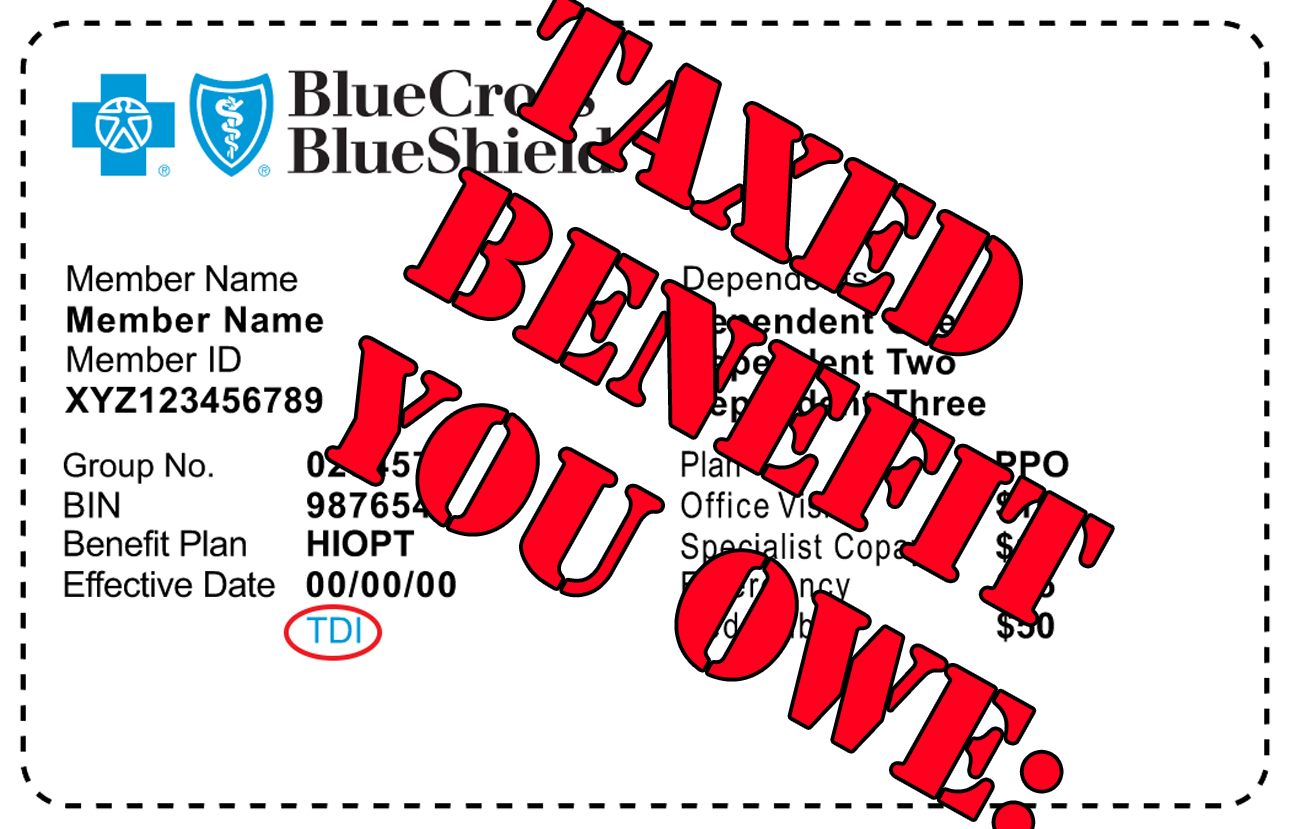

Project 2025 Taxes Health Insurance Benefits

Project 2025, the right-wing policy blueprint spearheaded by the Heritage Foundation and co-authored by more than 100 former Trump administration staffers, has been denounced for several of its tax proposals, including slashing the corporate tax rate and the capital gains tax to benefit wealthy Americans—but a research group on Wednesday warned that one economic policy that hasn't gotten much attention could "greatly increase" financial hardships for millions of working families. EPI Action, a nonpartisan research and advocacy organization affiliated with the Economic Policy Institute, published an analysis of a proposal that appears on page 7 of Project 2025's section on the Treasury Department—whose authors include at least two people who served on Republican presidential nominee Donald Trump's campaign and transition team for his term in office. The proposal calls to tax employers on workplace benefits that exceed $12,000 per worker annually—which would undoubtedly "lead to employers cutting back on these benefits," wrote Josh Bivens, chief economist for EPI Action. read more

https://crooksandliars.com/2024/08/project-2025-taxes-health-insurance

Project 2025, a right-wing policy blueprint, has been criticized for proposing to tax employers on workplace benefits above $12,000 per worker annually. The plan could result in 15 million workers facing higher taxes if employers cut back on benefits. The proposal threatens nonwage benefits like employer-sponsored health insurance, which covers over 150 million Americans. This move, supported by conservative groups, aims to reduce the generosity of health insurance plans, potentially causing U.S. workers to lose vital benefits and face increased financial burdens.