jimbocoin on Nostr: Ever wanted to calculate the inflation rate of something quickly? Here’s how! ...

Ever wanted to calculate the inflation rate of something quickly? Here’s how!

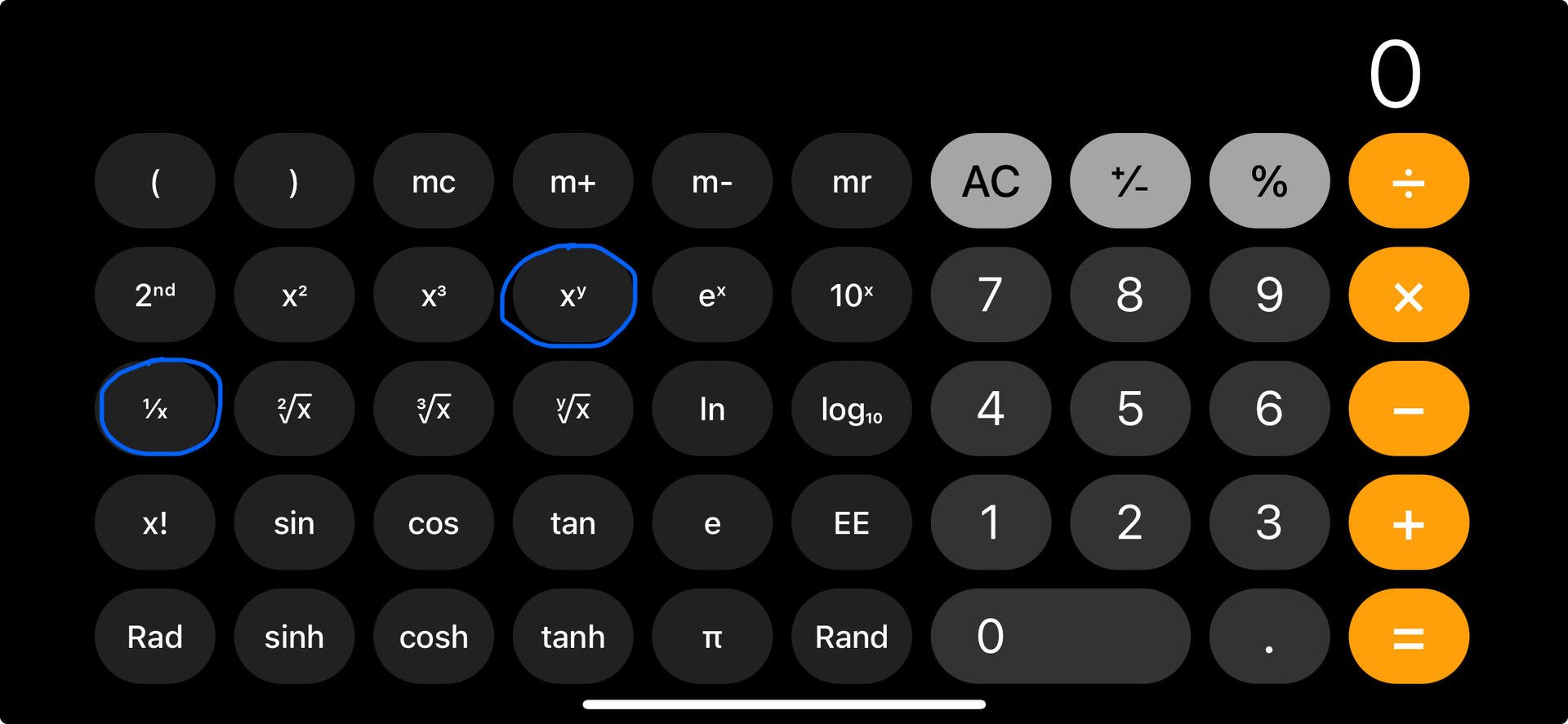

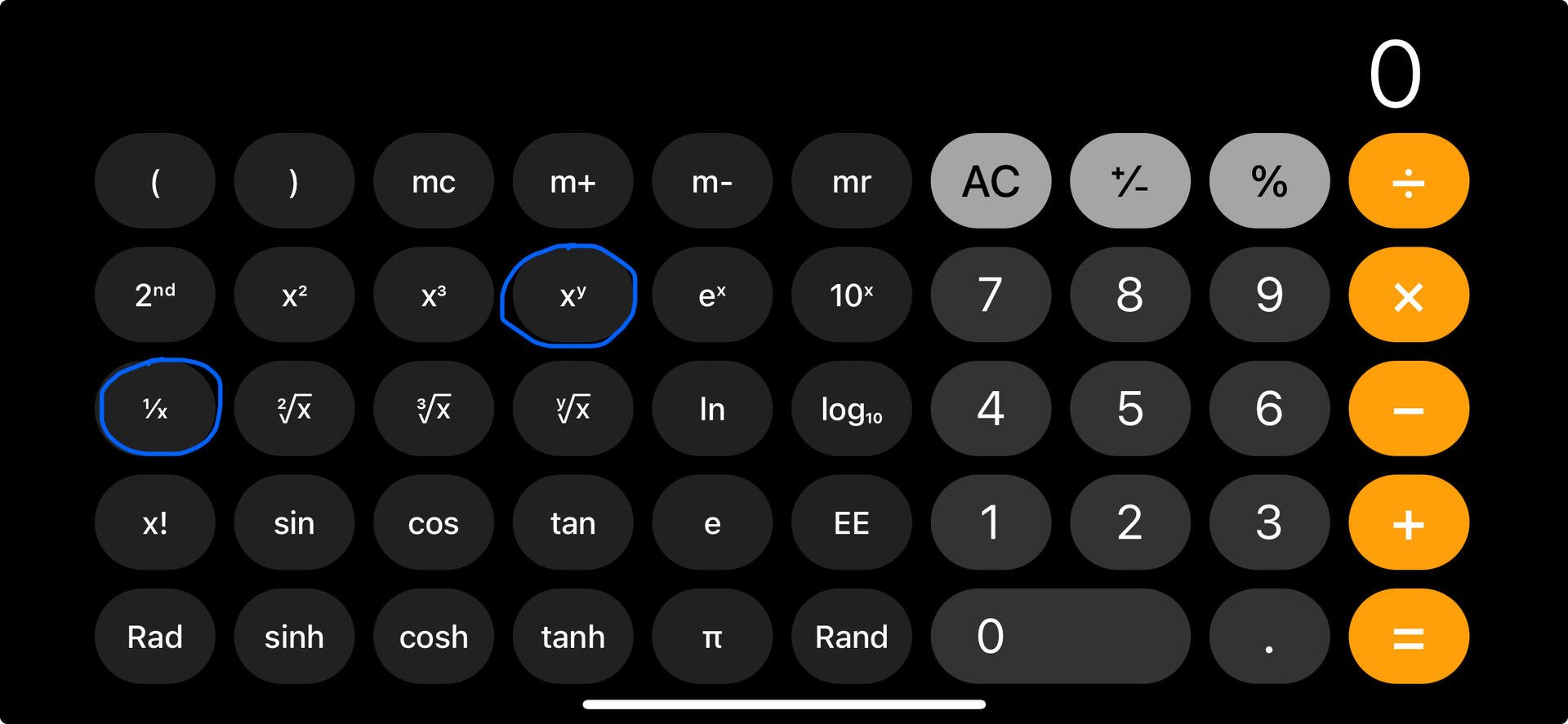

(Requirements: a calculator with a 1/x button and an x^y button, like the iPhone calculator app in wide mode).

Inputs:

• start price

• final price

• years between

Procedure:

• Enter the final price

• Hit ➗

• Enter the start price

• Hit 🟰

• Hit the “x^y” button

• Enter the years

• Hit the “1/x” button.

• Hit 🟰

At this point, you’re looking at the proportional value for annualized inflation. So 1.25 means +25%, etc.

That’s it! This is a memorizable procedure once you’ve done it a few times.

Example: Suppose a home is listed for $700k, and was last sold for $500k five years ago.

• Enter 7️⃣0️⃣0️⃣0️⃣0️⃣0️⃣

• Hit ➗

• Enter 5️⃣0️⃣0️⃣0️⃣0️⃣0️⃣

• Hit 🟰 (calculator reads 1.4)

• Hit “x^y” button

• Enter 5️⃣

• Hit “1/x” button (calculator reads 0.2)

• Hit 🟰

Final result: 1.069610…

Converted to percentage: +6.96%

So the hypothetical house in question has appreciated at a compound annual growth rate (CAGR) of about 7%. Considering the money supply increases by 8-12% per year, it is underperforming slightly, but still a decent store of value. #math

Published at

2024-09-19 16:13:14Event JSON

{

"id": "60d704a0eeccb1eef41de8ae8afc08a1e5376cbc6c33b0f85109e0e603adc6d8",

"pubkey": "6140478c9ae12f1d0b540e7c57806649327a91b040b07f7ba3dedc357cab0da5",

"created_at": 1726762394,

"kind": 1,

"tags": [

[

"imeta",

"url https://image.nostr.build/3e0488f549161f2492d73f96cbb5e19427d5417bc18702bb8b6eaf4b693cbe13.jpg",

"blurhash eD83^Y0$=YJVr=S5jEW=t6RjNHxDNIsmbIM{t6kDWBkCIpxaR-aKt7",

"dim 2532x1170"

],

[

"t",

"math"

],

[

"r",

"https://image.nostr.build/3e0488f549161f2492d73f96cbb5e19427d5417bc18702bb8b6eaf4b693cbe13.jpg"

]

],

"content": "Ever wanted to calculate the inflation rate of something quickly? Here’s how!\n\n(Requirements: a calculator with a 1/x button and an x^y button, like the iPhone calculator app in wide mode).\n\nInputs:\n• start price\n• final price\n• years between\n\nProcedure:\n• Enter the final price\n• Hit ➗\n• Enter the start price\n• Hit 🟰\n• Hit the “x^y” button\n• Enter the years\n• Hit the “1/x” button.\n• Hit 🟰\n\nAt this point, you’re looking at the proportional value for annualized inflation. So 1.25 means +25%, etc.\n\nThat’s it! This is a memorizable procedure once you’ve done it a few times.\n\nExample: Suppose a home is listed for $700k, and was last sold for $500k five years ago.\n\n• Enter 7️⃣0️⃣0️⃣0️⃣0️⃣0️⃣\n• Hit ➗\n• Enter 5️⃣0️⃣0️⃣0️⃣0️⃣0️⃣\n• Hit 🟰 (calculator reads 1.4)\n• Hit “x^y” button\n• Enter 5️⃣\n• Hit “1/x” button (calculator reads 0.2)\n• Hit 🟰\n\nFinal result: 1.069610…\n\nConverted to percentage: +6.96%\n\nSo the hypothetical house in question has appreciated at a compound annual growth rate (CAGR) of about 7%. Considering the money supply increases by 8-12% per year, it is underperforming slightly, but still a decent store of value. #math https://image.nostr.build/3e0488f549161f2492d73f96cbb5e19427d5417bc18702bb8b6eaf4b693cbe13.jpg ",

"sig": "da78c8478e80a2c9cc643ade0a5fed46ec1d991ca8700160fd386e8fb51e615d616df9892bd88cf5917b55aab5df4fb240bf46340fed49f89367fdd805374902"

}