Jan Gold on Nostr: Our monthly Gold Price–TIPS Model Tracker for October shows the gold price added a ...

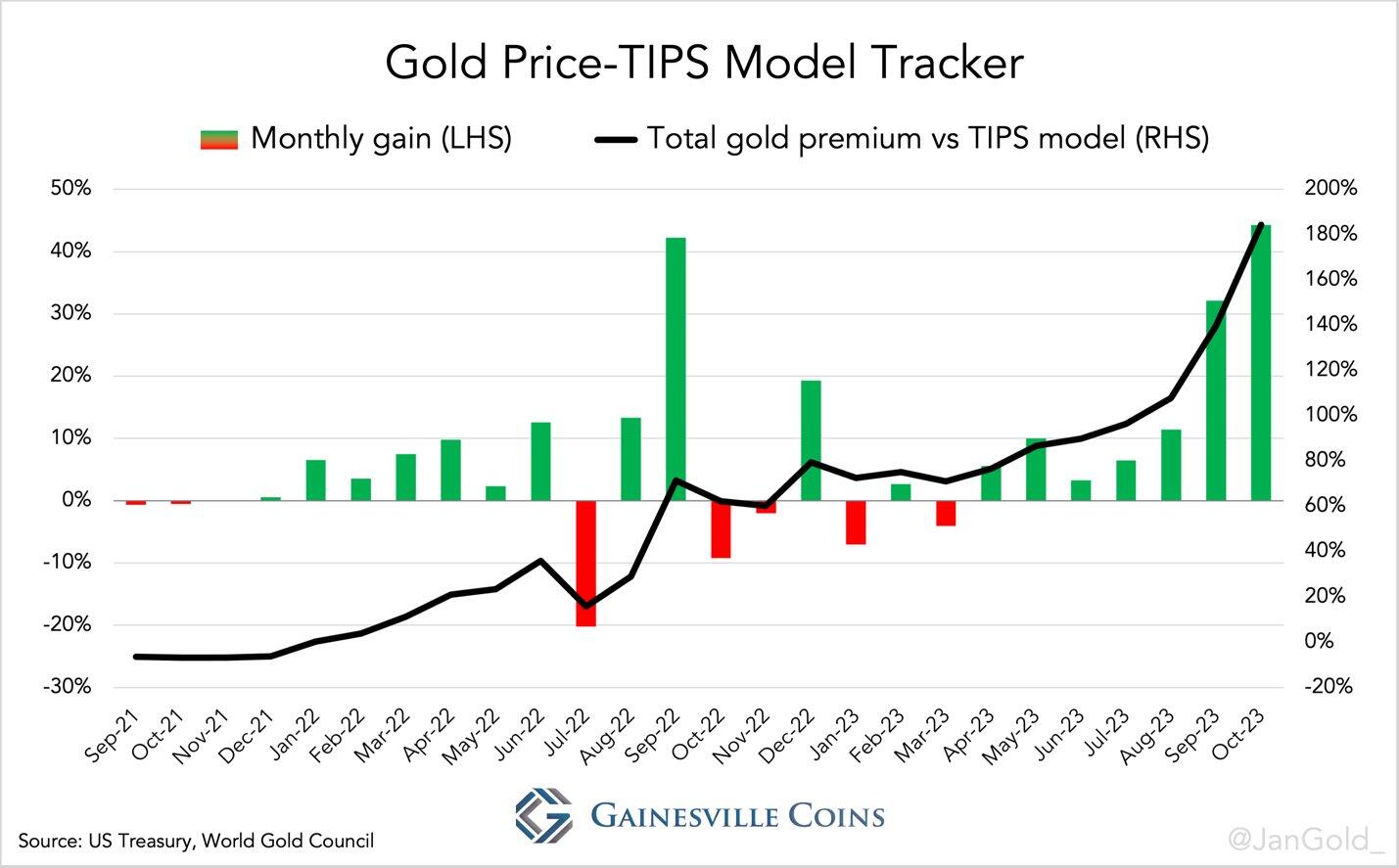

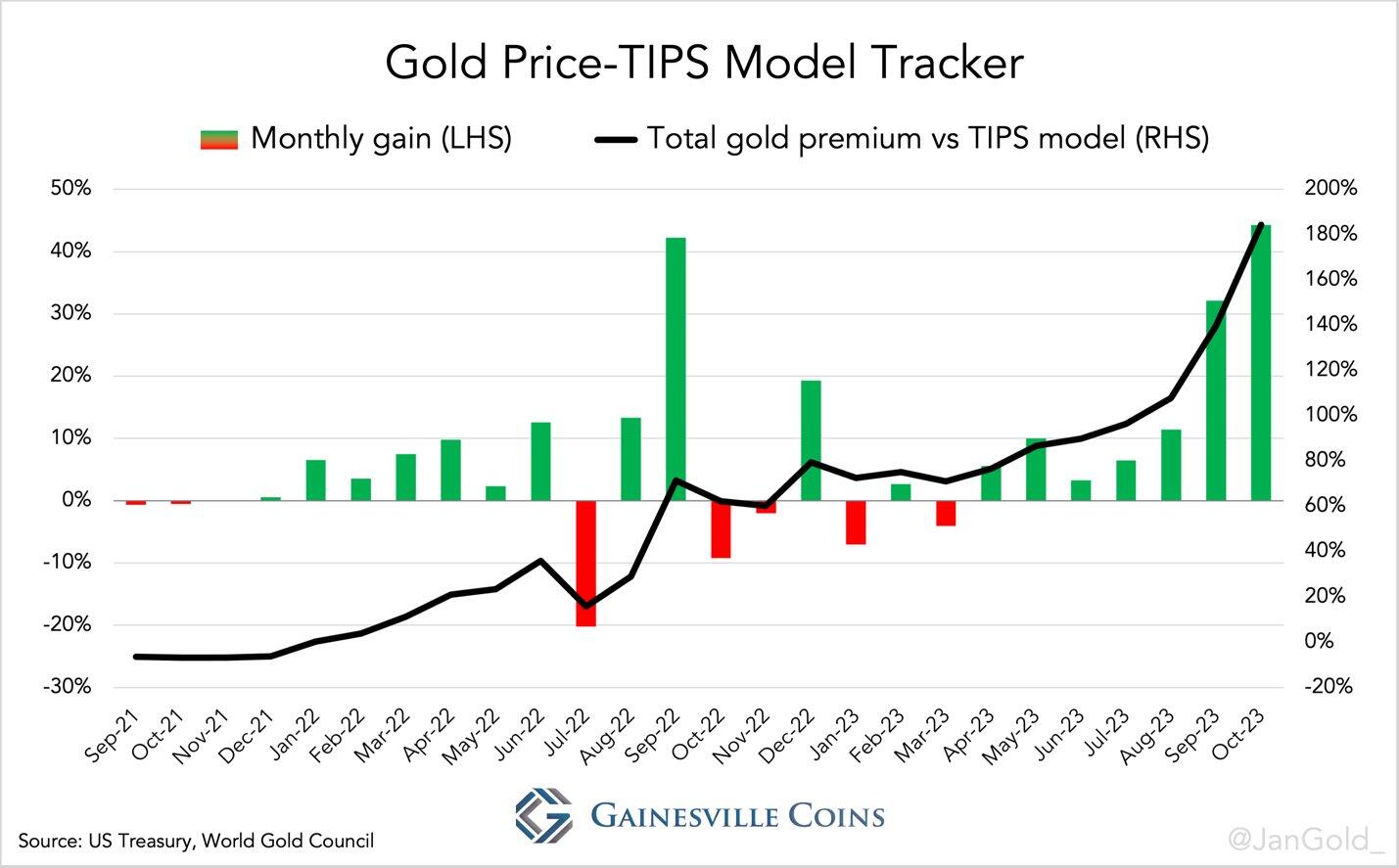

Our monthly Gold Price–TIPS Model Tracker for October shows the gold price added a record 44% to its premium relative to the TIPS yield. The total gold premium reached 184%.

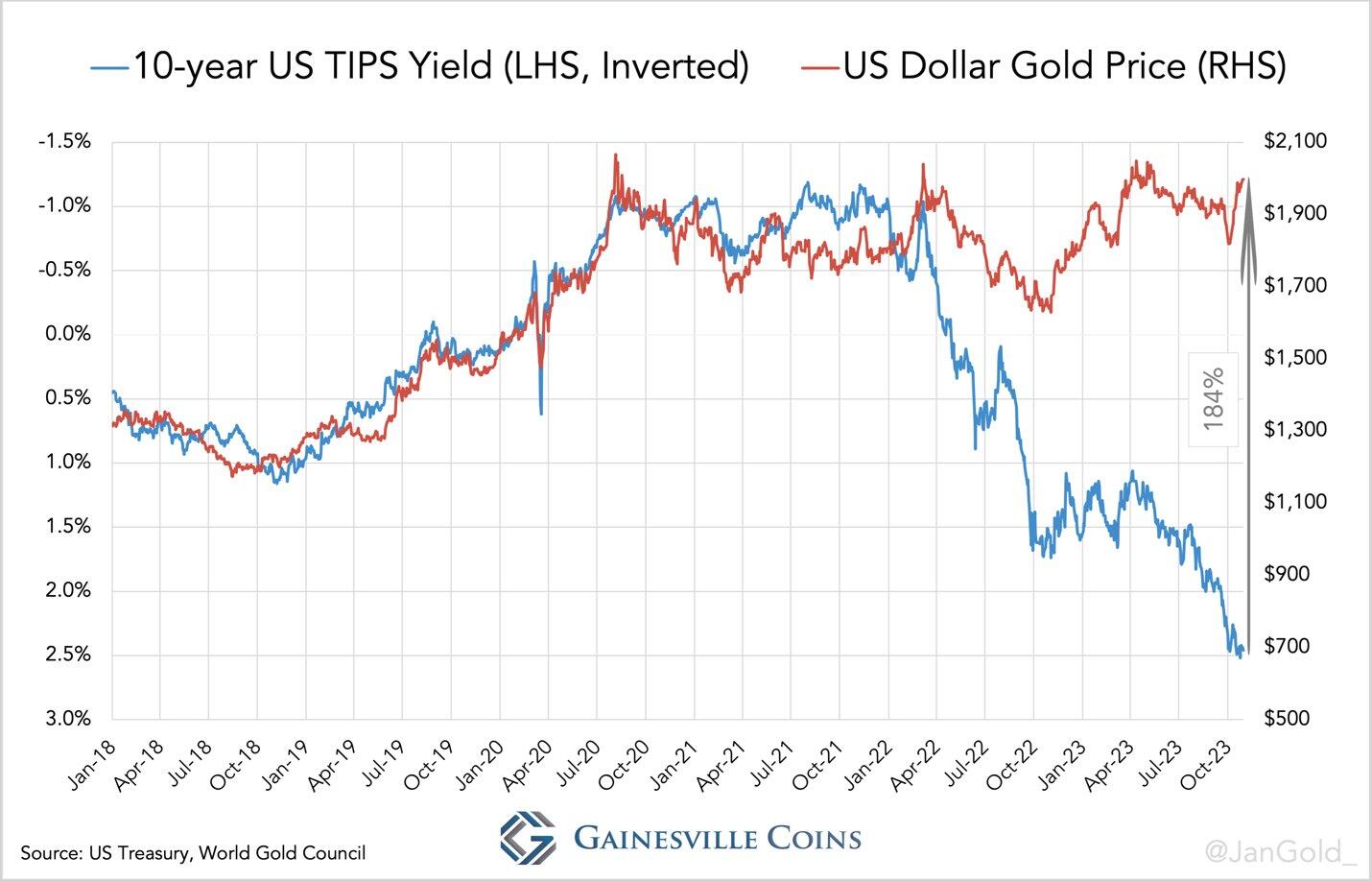

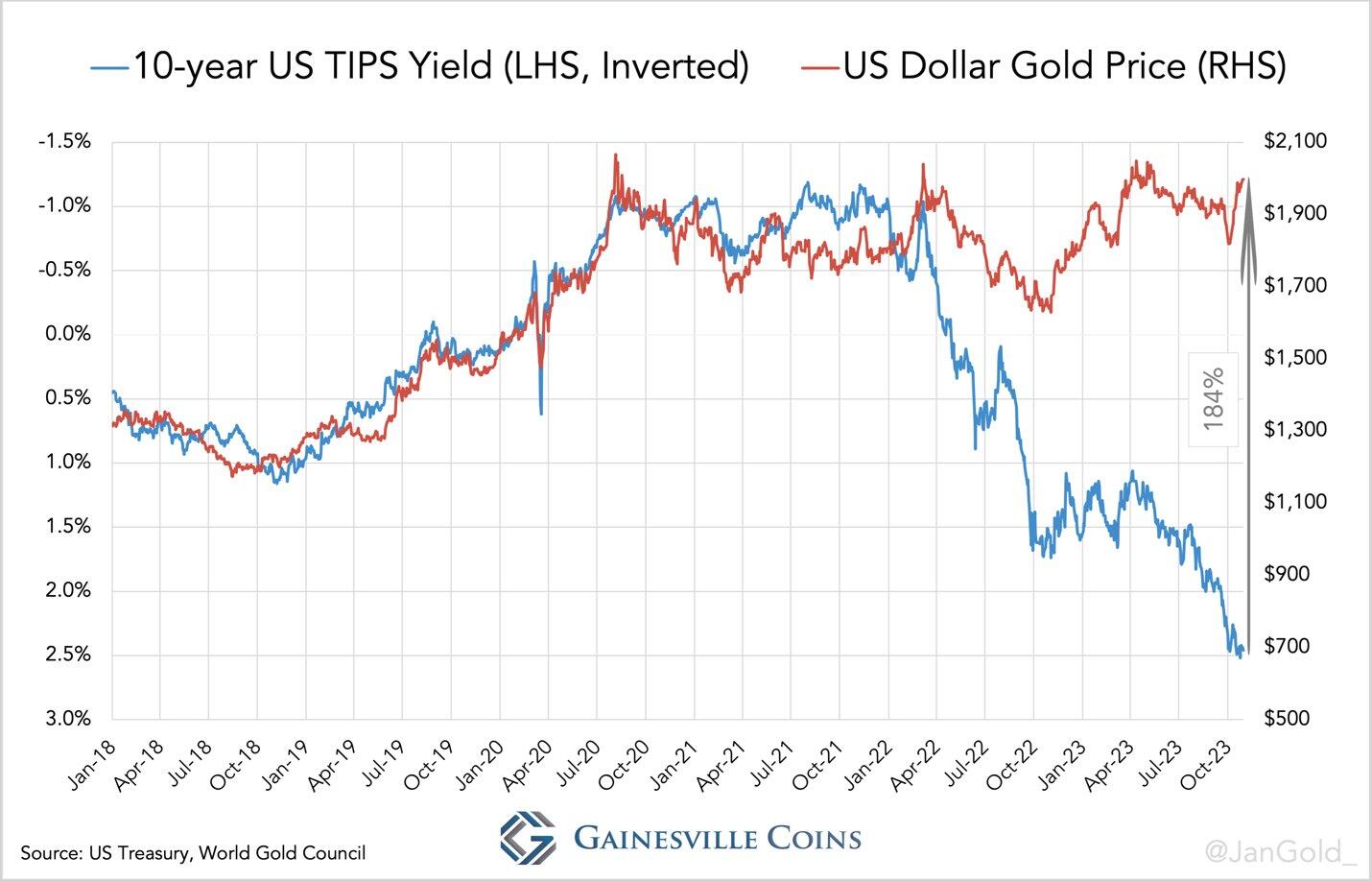

In the month of October, the US dollar gold price rallied 7% while real rates (10-year TIPS yield) went up from 2.24% to 2.46%. The total gold premium versus the “TIPS model” reached 184%, adding a record monthly gain of 44%, reflecting a form of de-dollarization.

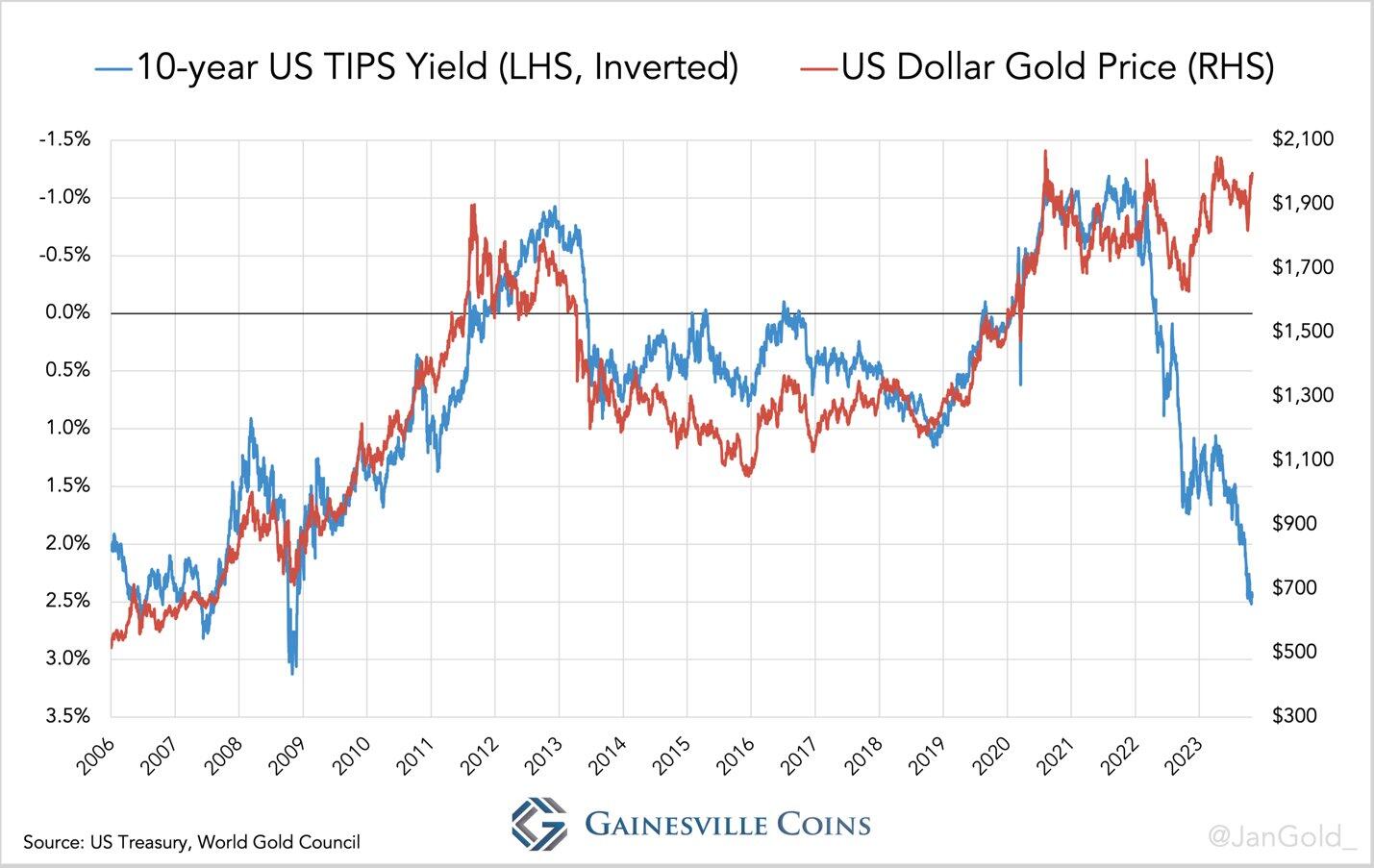

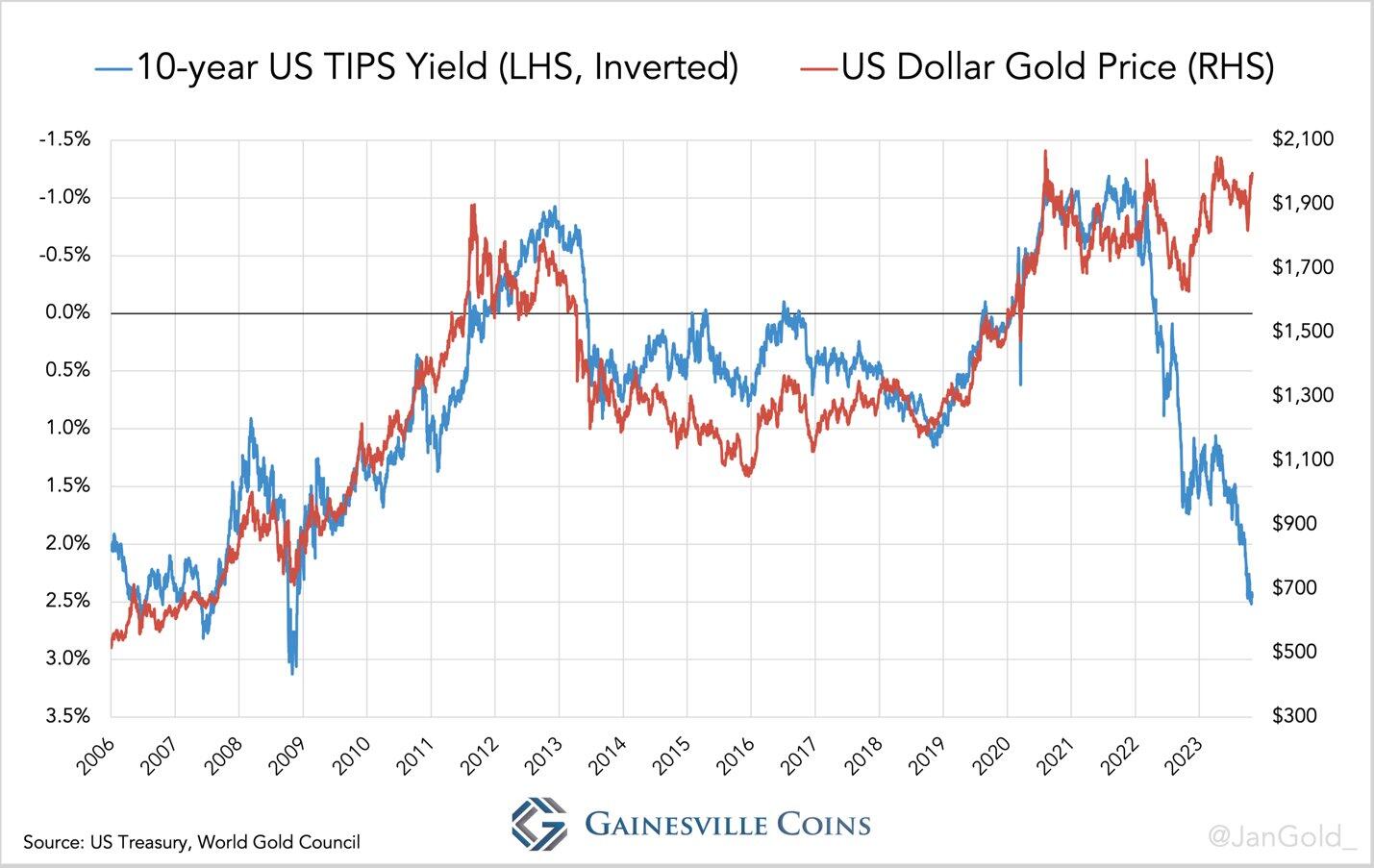

As we have reported extensively, at the start of the Ukraine war when geopolitical tensions increased, the gold price began moving higher than the 10-year TIPS yield, to which gold was inversely correlated since 2006, suggested. We measure the difference between the actual price of gold and the price suggested by the old model, with our Gold Price-TIPS Model Tracker (for more info on the Tracker read shorturl.at/rGIJY).

Since the war (February 2022) the market prices gold higher, as holding US government bonds has become riskier due to the confiscation of dollar assets held by Russia. The war in Gaza, which can spill over to other countries, is further igniting geopolitical tensions, and hence the gold premium to the TIPS model made a record jump in October 2023. The Tracker shows gold moved up 44% vs the TIPS model, and the total premium has now crossed 180%.

The Gold Price-TIPS Model Tracker is a measure of de-dollarization, not into renminbi or rupees, but into gold. We suspect inflation expectations (due to the US public debt and fiscal situation) are also a driver for the gold price to decouple from the TIPS yield.

Published at

2023-11-02 18:17:08Event JSON

{

"id": "ecc1c2392e41c6cfabc756dcaf064dd45790faa16558f5eefe7c63de5c2c32ca",

"pubkey": "717409aa05b3b992978ae4038ca88b6a1f4d3e08b5b91dfa546a0ea3efb9e99c",

"created_at": 1698949028,

"kind": 1,

"tags": [

[

"imeta",

"url https://image.nostr.build/b90b01ad3800eb8485dbbf4d4b1797b5c3f546bf8aa56aa17d42b249a64169bf.jpg",

"blurhash e5SPU;oztQ-;ozw{-;t7oztRyBW;a0WBfl_NIU9ani%14oRP.8oJaK",

"dim 1429x903"

],

[

"imeta",

"url https://image.nostr.build/1a6270abd4d77623e8a005300879523fc6cb56bbef51a1bc40774fe71e603d5f.jpg",

"blurhash e5SY{q%Mbaxuob$jx]tQWCofD$NH%MjYNI_NxZIUofxu9tIARPtR%M",

"dim 1430x918"

],

[

"imeta",

"url https://image.nostr.build/c7c0371a65c54c682517874cb6d08ed9011eb333206fbe079ec3de399b3f5b2e.jpg",

"blurhash e6SF@S=}-;?HIU?b%Ms:afWn$B9Z%1NFtR$jNF%hW.$+0c%3%MaLWB",

"dim 1429x887"

]

],

"content": "Our monthly Gold Price–TIPS Model Tracker for October shows the gold price added a record 44% to its premium relative to the TIPS yield. The total gold premium reached 184%.\n\nIn the month of October, the US dollar gold price rallied 7% while real rates (10-year TIPS yield) went up from 2.24% to 2.46%. The total gold premium versus the “TIPS model” reached 184%, adding a record monthly gain of 44%, reflecting a form of de-dollarization.\n\nAs we have reported extensively, at the start of the Ukraine war when geopolitical tensions increased, the gold price began moving higher than the 10-year TIPS yield, to which gold was inversely correlated since 2006, suggested. We measure the difference between the actual price of gold and the price suggested by the old model, with our Gold Price-TIPS Model Tracker (for more info on the Tracker read shorturl.at/rGIJY).\n\nSince the war (February 2022) the market prices gold higher, as holding US government bonds has become riskier due to the confiscation of dollar assets held by Russia. The war in Gaza, which can spill over to other countries, is further igniting geopolitical tensions, and hence the gold premium to the TIPS model made a record jump in October 2023. The Tracker shows gold moved up 44% vs the TIPS model, and the total premium has now crossed 180%.\n\nThe Gold Price-TIPS Model Tracker is a measure of de-dollarization, not into renminbi or rupees, but into gold. We suspect inflation expectations (due to the US public debt and fiscal situation) are also a driver for the gold price to decouple from the TIPS yield. https://image.nostr.build/b90b01ad3800eb8485dbbf4d4b1797b5c3f546bf8aa56aa17d42b249a64169bf.jpg https://image.nostr.build/1a6270abd4d77623e8a005300879523fc6cb56bbef51a1bc40774fe71e603d5f.jpg https://image.nostr.build/c7c0371a65c54c682517874cb6d08ed9011eb333206fbe079ec3de399b3f5b2e.jpg ",

"sig": "c1fdb0659a7efa319d9bfafaa1b5030dbc253d90059cf507096827f7bd51bbf79636c715406bed206c14a9335f85087df12fd9fb3d21ec6544fc4bfbd5f1f82d"

}