Event JSON

{

"id": "ef33744c3bc63b3ae17817deefb4d061d9f2a50e647b1f0d0a15b28fdc36c21e",

"pubkey": "ba335e71086a601e3ddb4a4c08159289f74a2a270444a909a57fb2704e5bfc08",

"created_at": 1733498166,

"kind": 1,

"tags": [

[

"imeta",

"url https://image.nostr.build/90600211d91132356f0079c1d84c131d1e509ee19c329229b47924ea42c5fdd3.jpg",

"m image/jpeg",

"x f0e1917a53a795d4f050ecf277f6dc8e2b52b90f965495db9412b2b120375990",

"ox 90600211d91132356f0079c1d84c131d1e509ee19c329229b47924ea42c5fdd3",

"blurhash LBSY{o-:bY?a_NRjt6ay-YoNj]j]",

"dim 1920x1106",

"alt 90600211d91132356f0079c1d84c131d1e509ee19c329229b47924ea42c5fdd3.jpg",

"thumb https://image.nostr.build/thumb/90600211d91132356f0079c1d84c131d1e509ee19c329229b47924ea42c5fdd3.jpg",

"image https://image.nostr.build/resp/1080p/90600211d91132356f0079c1d84c131d1e509ee19c329229b47924ea42c5fdd3.jpg",

"size 152207"

],

[

"t",

"btc"

],

[

"t",

"bitcoin"

],

[

"t",

"nostr"

],

[

"t",

"siamstr"

]

],

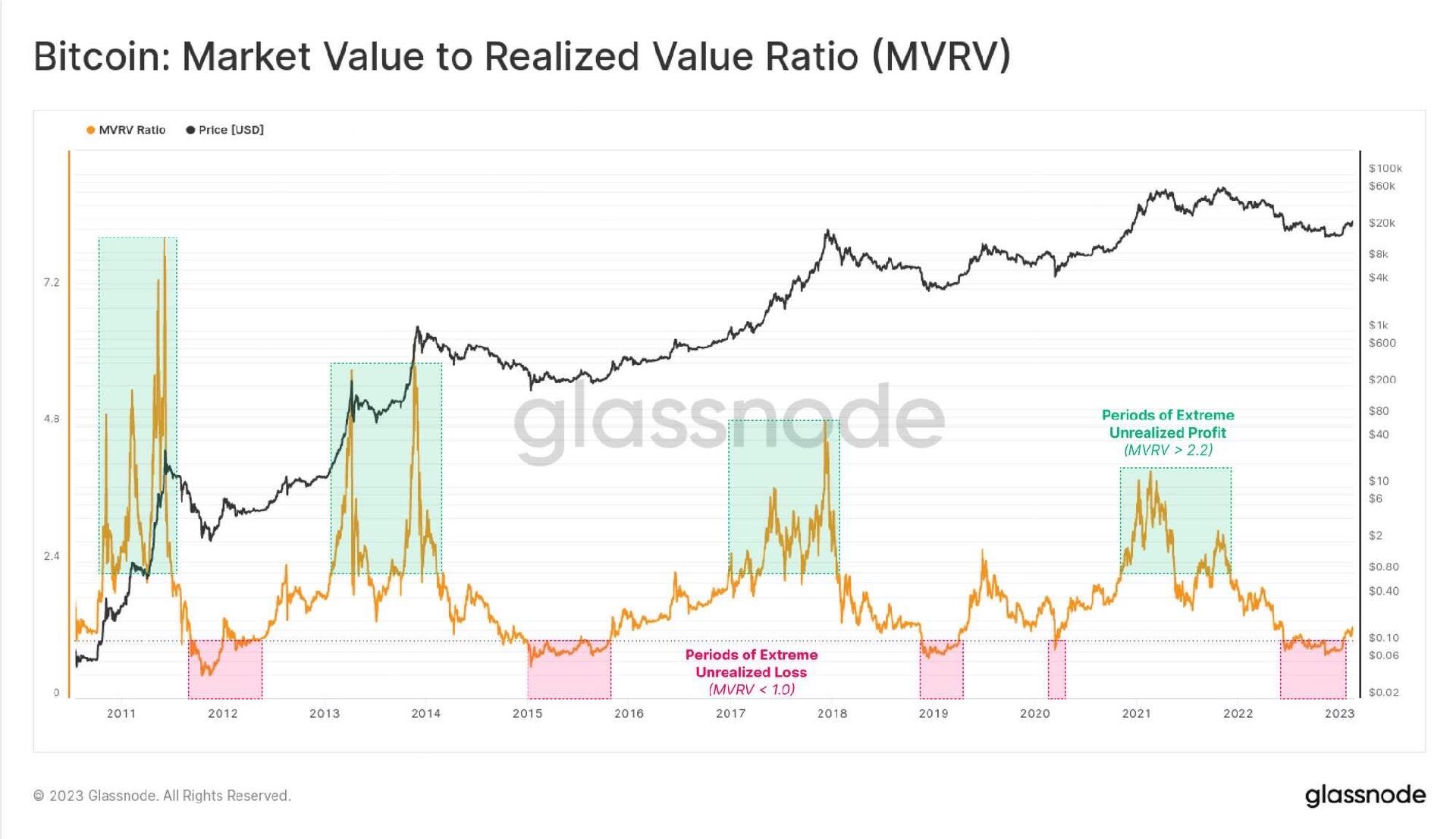

"content": "https://image.nostr.build/90600211d91132356f0079c1d84c131d1e509ee19c329229b47924ea42c5fdd3.jpg\n\nThe MVRV (Market Value to Realized Value) ratio for Bitcoin compares its market price to the price at which each Bitcoin last moved (the realized price). Typically, an MVRV ratio between 1 and 3 suggests fair valuation. During times of market exuberance, the ratio can exceed 4 or 5, signaling potential overvaluation and speculative conditions. For instance, during Bitcoin’s 2017 bull market, the MVRV reached a peak of 7.6, suggesting significant overvaluation at a price of around $19,000. Higher MVRV values, such as those above 10, are rare but theoretically possible during extreme market bubbles, signaling potential for sharp corrections or crashes .\n\nIf Bitcoin’s price were to rise to $232,400 with an MVRV ratio of 7, it would reflect a dramatic overvaluation, as this would be about seven times the realized value, which is approximately $33,200. Such a high MVRV ratio is extremely rare and would typically indicate speculative mania in the market, where the price far exceeds the underlying value, potentially marking the end of the bull run and the onset of a significant correction .\n\n#btc #bitcoin #nostr #siamstr",

"sig": "6275cf19975cc96a382d6d7d0c40dba097cb5813a18bf637f1b73adbabda9b437c3b4c2f650512eee6b58f9cbfc0d2fe76138da787c9722c1fc42fa02974956d"

}