Money has 3 key functions:

1. Medium of exchange

2. Unit of account

3. Store of value

Volatility matters for 1 & 2 but not so much for 3.

Medium of exchange (MoE) - money acts as a universally accepted intermediary for transactions.

Unit of account (UoA) - money provides a common unit to measure the relative value of different goods.

Store of value (SoV) - money saves the purchasing power of earnings for future use.

Not all money that we use today is good at all 3. The dollar, for example, is a great unit of account and medium of exchange, but it’s a terrible store of value. Due to systematic inflation, people have to invest (gamble) their earnings to preserve their purchasing power, or watch as the value erodes away. One reason #bitcoin is a big deal is because, while it’s not currently a MoE or UoA, it’s an excellent store of value. It allows people to become savers, not gamblers.

Most monies go through stages of development, and if adopted organically, they are always accepted as a store of value before they can function as a medium of exchange. One of the biggest differences between a SoV and a MoE is their functions in the context of time, and it’s why volatility matters for one but not the other.

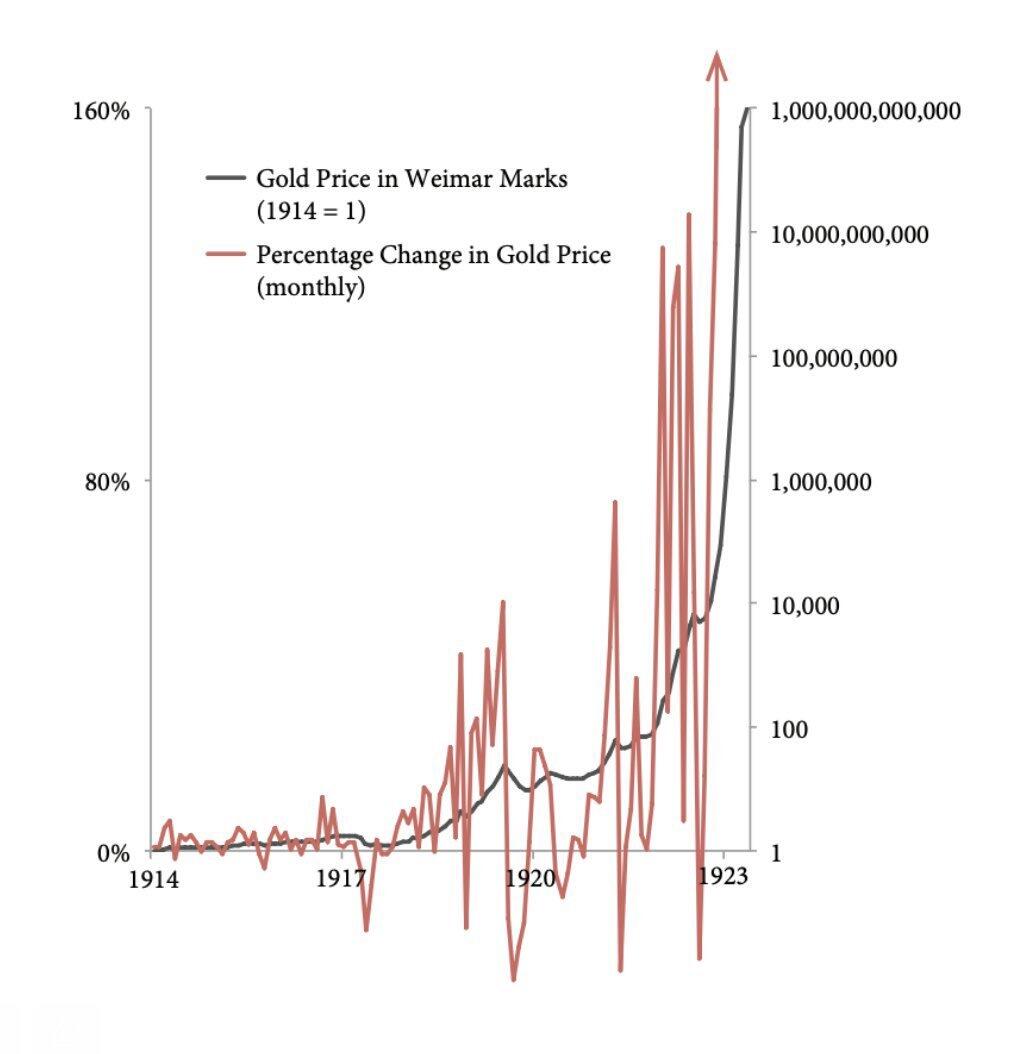

As a MoE it’s important that the value of money stays relatively stable day to day so you can predict future prices. As a SoV, money functions over a longer time period, so the daily price fluctuation is less important than the overall long term trend. As shown in the attached chart, the exchange rate of hard assets like gold can fluctuate violently day-to-day when denominated in failing fiat currencies, but they tend to trend up over the long term. This is what #bitcoin does with fiat currencies AND all other assets.

As #bitcoin gains global adoption, you should expect that its price will be volatile. It’s no easy feat to repair/replace the massively broken financial system that is currently used, and there’s naturally a lot of friction involved when adopting a new form of money. But if you zoom out, you can see clearly that #bitcoin is winning, thanks to its disinflationary supply and an increasing demand for assets that can’t be debased. As the dollar continues to inflate, the demand will only grow stronger.

Ultimately, it’s my opinion that everyone should own a non-zero amount of #bitcoin in their overall portfolio. It’s more risky to NOT own some, and if volatility is a major concern for you, there are two main solutions:

1. Increase your time horizon

or

2. Decrease your allocation