peruvian_bull on Nostr: Our monetary system does not work how do you think it does. An economics courses they ...

Our monetary system does not work how do you think it does.

An economics courses they will tell you that when the Fed bank reserves, those bank reserves are multiplied out into loans which then create deposits.

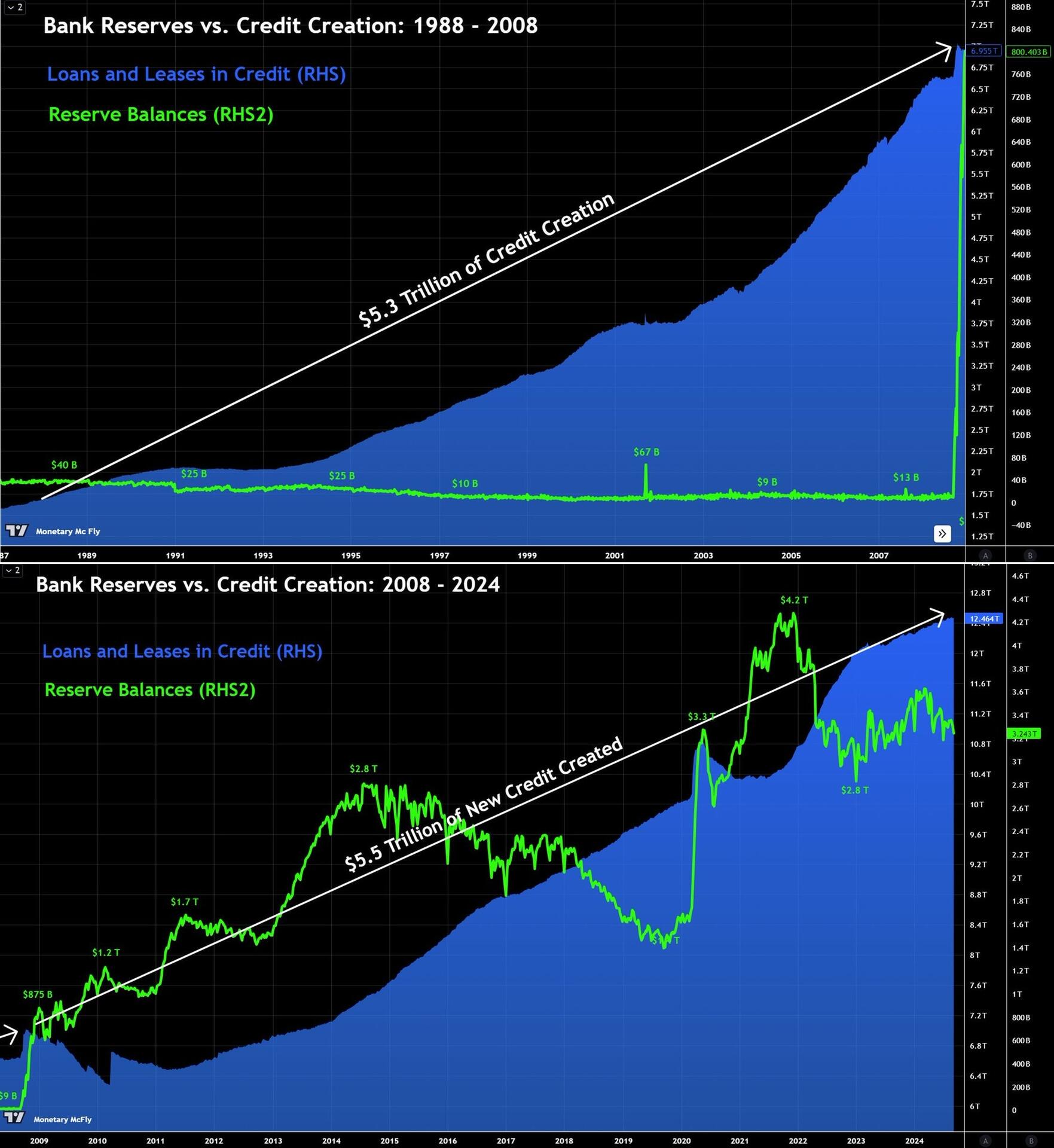

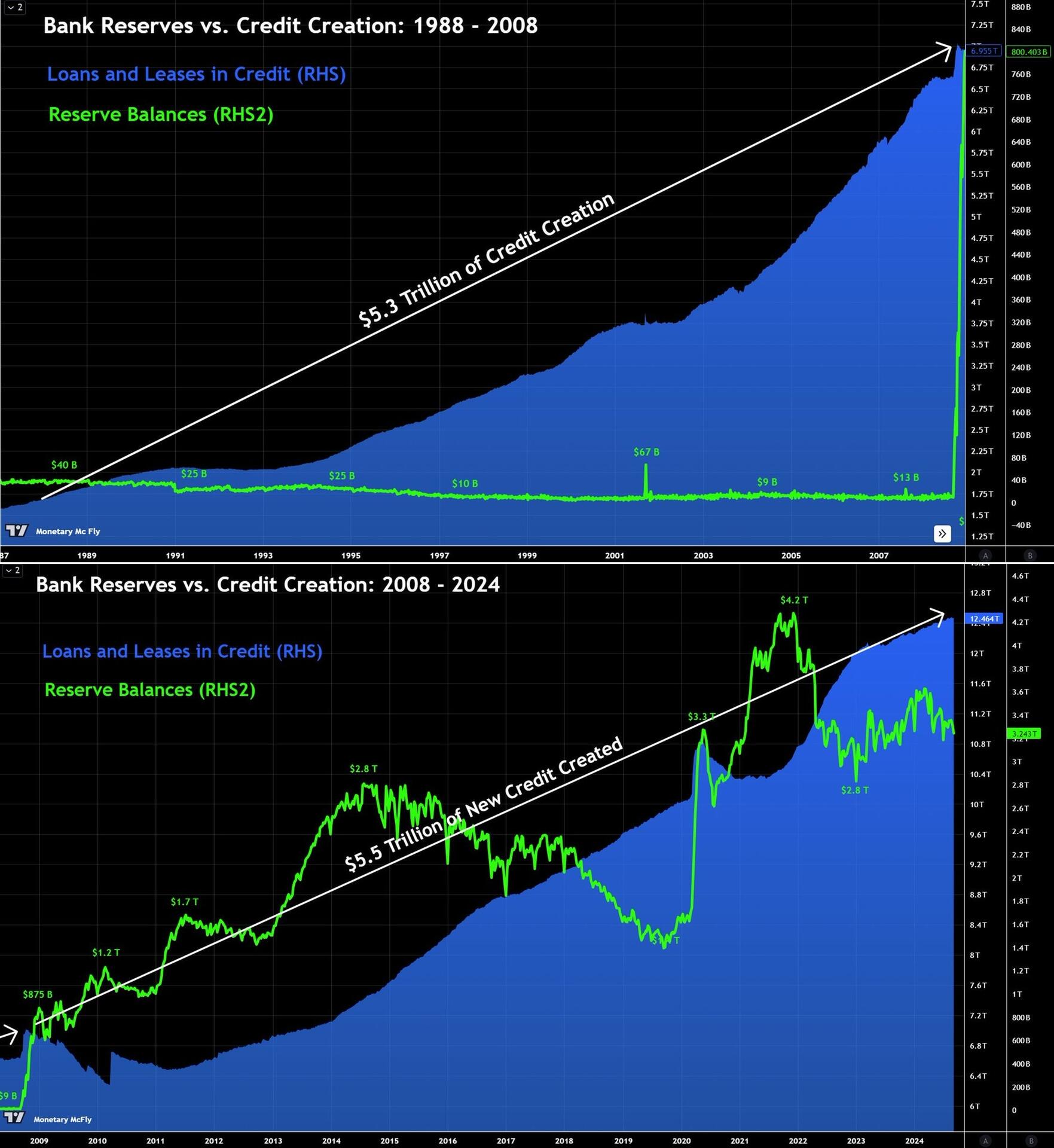

That view is incorrect. Reserves are strictly financial economy money and do not directly correlate to private credit creation with only one exception (Treasury General Account).

In fact, in 1986 we had around $2.8 trillion of M1 money supply and yet bank reserves were only $39billion. Fast-forward to 2008 and money supply was sitting above $7 trillion and bank reserves had fallen to 10 billion.

So if bank reserves don’t actually facilitate credit creation, then what do they do?

Essentially, they act as accounting entries on bank balance sheet to settle interbank payments, But ironically, Banks can just use their own ledgers to settle directly with each other using cash.

All of this changed in 2008 when the fed began their massive QE program and injected $2 trillion of bank reserves into the system in short order, stuffing the banks with a new asset that had to be parked somewhere.

The rise in base money in the form of reserves, therefore flowed into the financial markets, equities, derivatives and bonds, and serve to ignite the most aggressive market in US stock market history.

Published at

2024-09-17 19:42:29Event JSON

{

"id": "cb72ff5e4e5cb41caae12a5b039306f93c2308364661bd734dce30834d76cebc",

"pubkey": "33b6410755319f1b38b9c37c914251c95a8776faecde36cd0fc635c355b073a5",

"created_at": 1726602149,

"kind": 1,

"tags": [

[

"imeta",

"url https://image.nostr.build/d5aa3371f3f530618e81d806159a9038a23d6d8f30b208b2ef31fb8e74560298.jpg",

"blurhash eI3cuHZ_acbyjBejj]kFacj]ahkDaxf5kCaFjYf.adf6oGo*k9abfn",

"dim 1881x2048"

],

[

"r",

"https://image.nostr.build/d5aa3371f3f530618e81d806159a9038a23d6d8f30b208b2ef31fb8e74560298.jpg"

]

],

"content": "Our monetary system does not work how do you think it does.\n\nAn economics courses they will tell you that when the Fed bank reserves, those bank reserves are multiplied out into loans which then create deposits.\n\nThat view is incorrect. Reserves are strictly financial economy money and do not directly correlate to private credit creation with only one exception (Treasury General Account).\n\nIn fact, in 1986 we had around $2.8 trillion of M1 money supply and yet bank reserves were only $39billion. Fast-forward to 2008 and money supply was sitting above $7 trillion and bank reserves had fallen to 10 billion. \n\nSo if bank reserves don’t actually facilitate credit creation, then what do they do? \n\nEssentially, they act as accounting entries on bank balance sheet to settle interbank payments, But ironically, Banks can just use their own ledgers to settle directly with each other using cash. \n\nAll of this changed in 2008 when the fed began their massive QE program and injected $2 trillion of bank reserves into the system in short order, stuffing the banks with a new asset that had to be parked somewhere. \n\nThe rise in base money in the form of reserves, therefore flowed into the financial markets, equities, derivatives and bonds, and serve to ignite the most aggressive market in US stock market history. https://image.nostr.build/d5aa3371f3f530618e81d806159a9038a23d6d8f30b208b2ef31fb8e74560298.jpg ",

"sig": "d604c3216d861530a21593ba991b487a400f3762b9d2f192aed9690b86d1eff8bd96903e3f3e761c0e4ab2f61b07390595d700c579d84255048ce95c6f20a701"

}