bitcoinist on Nostr: Shaking off the leverage degenerates is a normal thing in #Bitcoin. When in doubt, ...

Shaking off the leverage degenerates is a normal thing in #Bitcoin.

When in doubt, just zoom out:

+23% in the last month

+45% since the start of the year

+131% in 1 year

Over the week: -11%

Bitcoin volatility will only intensify:

1. The dollar is entering a death spiral: interest coupons on bonds are record-breaking

2. A new cycle of Federal Reserve's monetary policy easing is beginning

3. Halving in a month

4. ETFs are just warming up

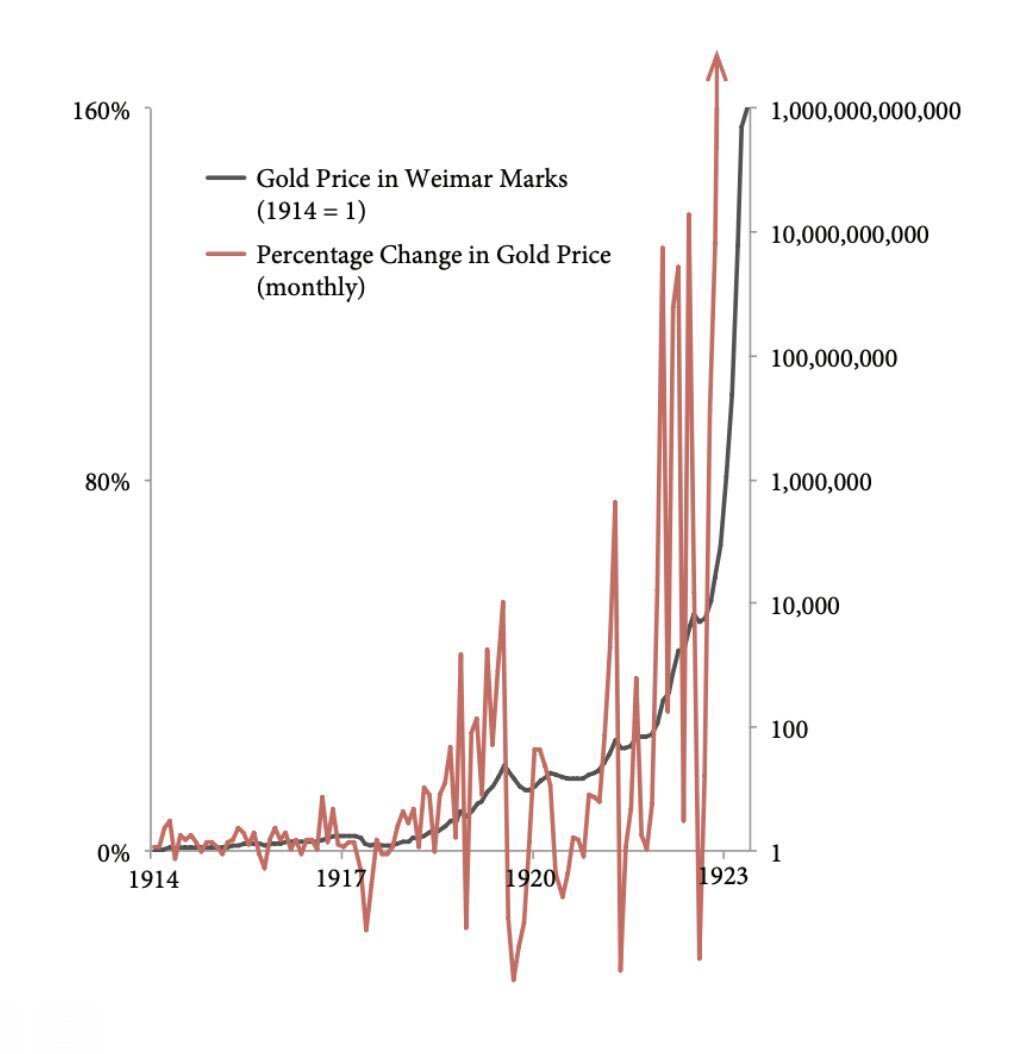

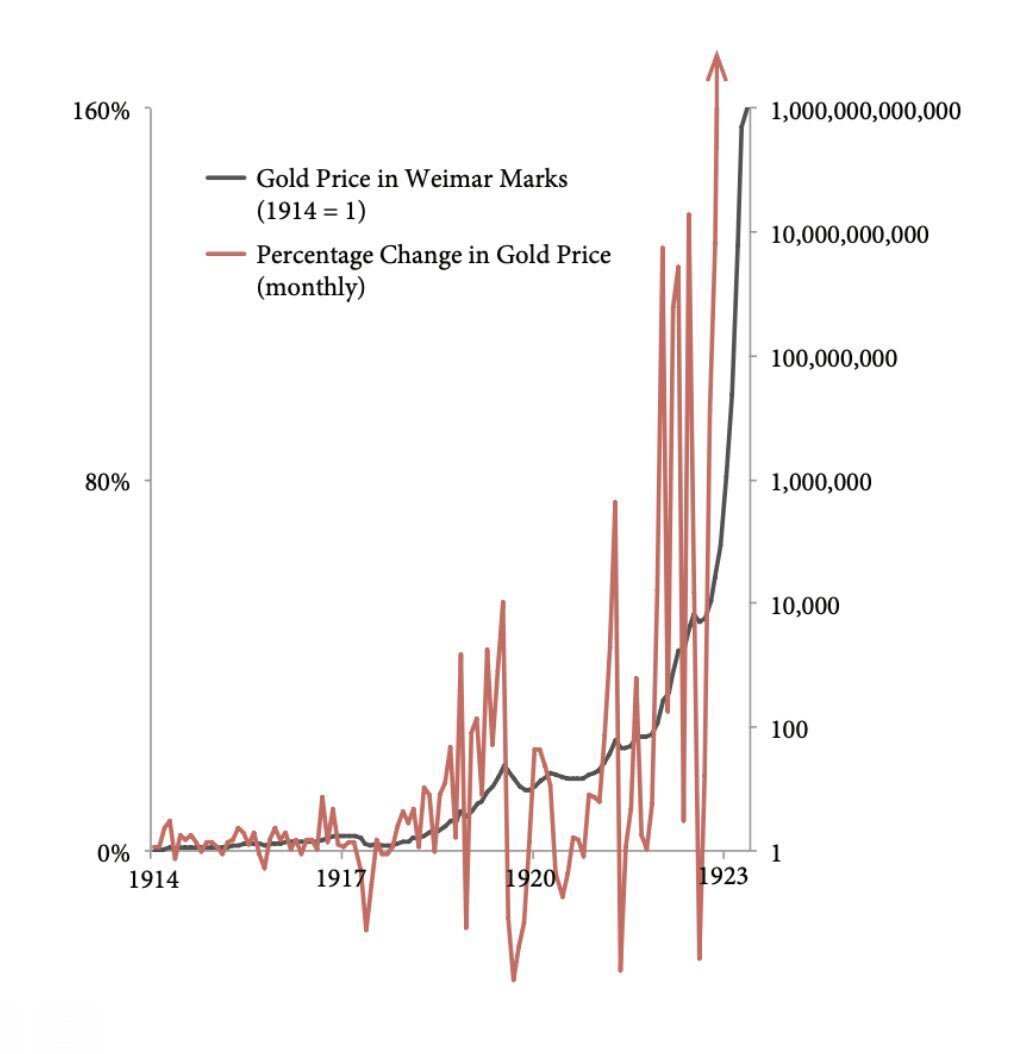

If you look at the history of the collapse of world reserve currencies, it always happens against the backdrop of wild price fluctuations. This is normal.

In a month, Bitcoin will become twice as "hard" as gold (the stock-to-flow ratio), for the first time in human history we will have an asset harder than gold.

A vivid historical example of the hyperinflation of imperial currency is on the chart below. This is how the price of gold jumped before it went into hyperinflation. Gold is not fluctuating like that now because the Federal Reserve has learned to manipulate the gold price. Bitcoin cannot be manipulated like this due to free instant delivery/verification on spot markets. Unlike gold, which is traded mainly in derivatives, and the real stocks hardly move at all.

Bitcoin is like a lifeboat on the Titanic that has already started to sink. The number of spots is limited, and the dollar is going down. It might shake more, but that's not a reason to be scared, it's a reason to buy more.

It's riskier to sell in order to buy cheaper than to miss the next major leg up.

Do not trade, it’s an accumulation game and trading will always leave you with less Bitcoins.

Published at

2024-03-19 08:02:15Event JSON

{

"id": "cbdb053274e62356869d32eb6399c2c47cd99e5d37e4dae1a68a3a3d31330491",

"pubkey": "130c97de970406471a8208b3c7659c06106099ab26d2de5f3373fbc542341441",

"created_at": 1710835335,

"kind": 1,

"tags": [

[

"imeta",

"url https://i.nostr.build/xEEKG.jpg",

"blurhash e7S$if-=?^Mc%MyDt7Mxs:x]o}MxVs%gRPw{aytSWBMx?vt7D%M{kD",

"dim 1022x1054"

],

[

"imeta",

"url https://i.nostr.build/wGGDd.jpg",

"blurhash e14U{P4-Vs?vIAr@XSxHI:$*4n.8-;9F?I?bIUWB-;D%.8i_I:-pE1",

"dim 2048x986"

],

[

"t",

"bitcoin"

],

[

"r",

"https://i.nostr.build/xEEKG.jpg"

],

[

"r",

"https://i.nostr.build/wGGDd.jpg"

]

],

"content": "Shaking off the leverage degenerates is a normal thing in #Bitcoin.\n\nWhen in doubt, just zoom out:\n\n+23% in the last month\n+45% since the start of the year\n+131% in 1 year\n\nOver the week: -11%\n\nBitcoin volatility will only intensify:\n\n1. The dollar is entering a death spiral: interest coupons on bonds are record-breaking\n2. A new cycle of Federal Reserve's monetary policy easing is beginning\n3. Halving in a month\n4. ETFs are just warming up\n\nIf you look at the history of the collapse of world reserve currencies, it always happens against the backdrop of wild price fluctuations. This is normal.\n\nIn a month, Bitcoin will become twice as \"hard\" as gold (the stock-to-flow ratio), for the first time in human history we will have an asset harder than gold.\n\nA vivid historical example of the hyperinflation of imperial currency is on the chart below. This is how the price of gold jumped before it went into hyperinflation. Gold is not fluctuating like that now because the Federal Reserve has learned to manipulate the gold price. Bitcoin cannot be manipulated like this due to free instant delivery/verification on spot markets. Unlike gold, which is traded mainly in derivatives, and the real stocks hardly move at all.\n\nBitcoin is like a lifeboat on the Titanic that has already started to sink. The number of spots is limited, and the dollar is going down. It might shake more, but that's not a reason to be scared, it's a reason to buy more.\n\nIt's riskier to sell in order to buy cheaper than to miss the next major leg up.\n\nDo not trade, it’s an accumulation game and trading will always leave you with less Bitcoins. https://i.nostr.build/xEEKG.jpg https://i.nostr.build/wGGDd.jpg ",

"sig": "b75ff353006cf4aca24b18bcbebb9f9ca243118d17b98118a65d0cf201d804888c284b9b0217556288a27999a5b5b097763ca4c866861baee9d5927ac35a4247"

}