Data as of: March 30, 2025, 09.18 AM

Current Price: 83,175

PWH: 87,467.1

PWL: 81,125

Overall Market Analysis ⚡

Based on the provided 4-timeframe charts (15m, 1H, 4H, Day) and the utilization of various technical analysis tools, here's a comprehensive overview:

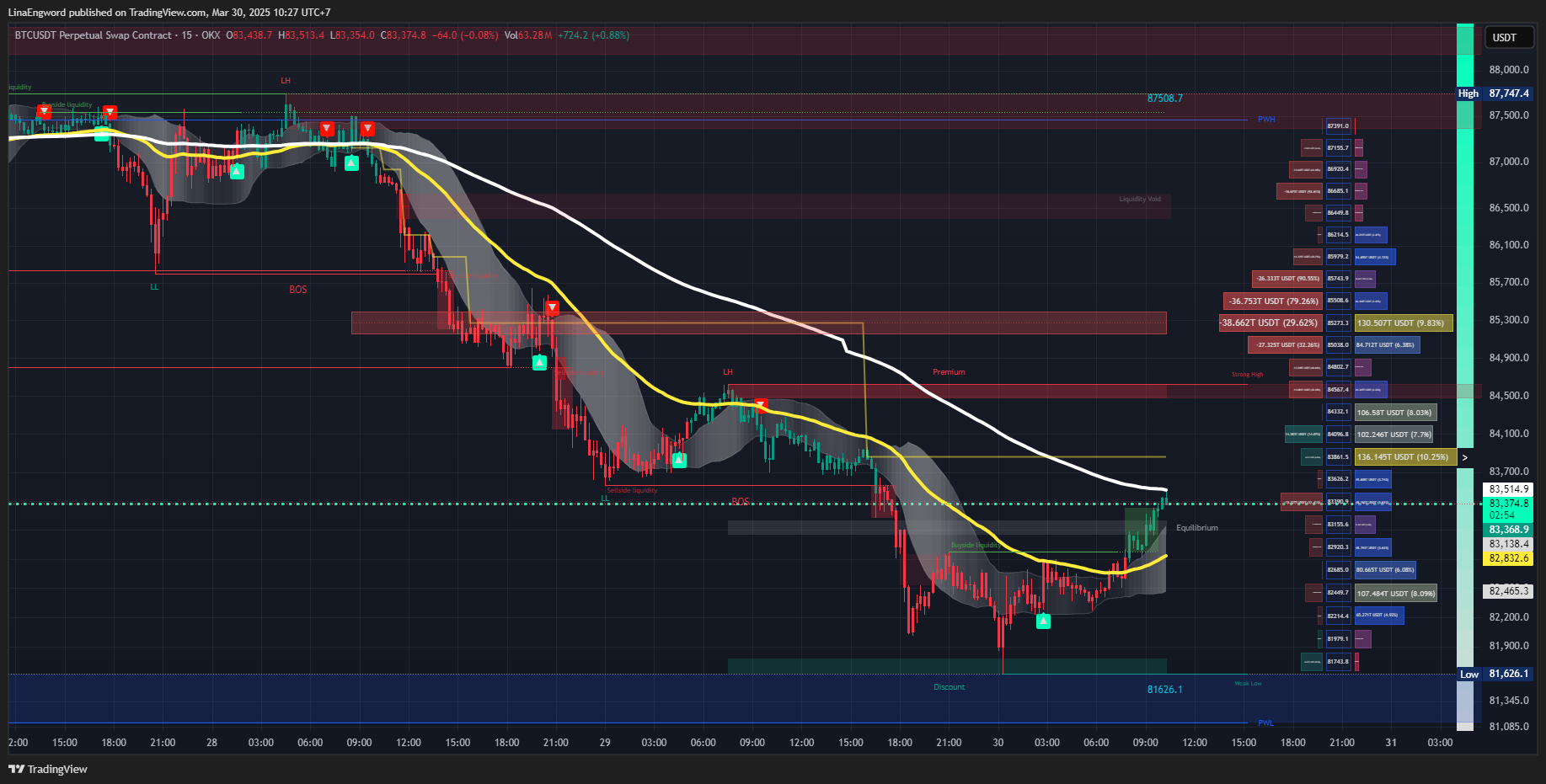

TF 15m (Short-term):

- High volatility, with price fluctuating within the PWH and PWL range.

- Both CHoCH Bearish and Bullish signals indicate market uncertainty.

- Buyside and Sellside Liquidity are relatively balanced.

- Money Flow is showing very erratic behavior.

- EMA: Price remains above the EMA 50 and 200, suggesting short-term bullish momentum.

- Trend strength : Showing un clear signals.

- Price pattern and chart pattern: Head and shoulders which indicate sell pressure.

TF 1H (Mid-term):

- Bullish momentum is showing signs of weakening.

- SMC and ICT: Showing BoS Bullish Signal.

- Sellside Liquidity outweighs Buyside Liquidity.

- Money flow: Showing a clear out flow of money.

- EMA: Price is above the EMA 50 and 200, but the EMA 50 is showing a potential downward crossover.

- Trend strength : Showing sell signals.

- Price pattern and chart pattern: Wedge pattern which indicates sell pressure.

TF 4H (Mid-to-Long-term):

- The overall trend is still bullish, but signs of a potential reversal are emerging.

- SMC and ICT : Showing BoS Bullish signal.

- Sellside Liquidity exceeds Buyside Liquidity.

- Money flow: Showing strong out flow of money.

- EMA: Price remains above the EMA 50 and 200.

- Trend strength : Showing clear sell signals.

- Price pattern and chart pattern: Double top which indicates sell pressure.

TF Day (Long-term):

- The overall long-term trend remains bullish.

- SMC and ICT : Showing BoS Bullish signal.

- Sellside Liquidity outweigh Buyside Liquidity.

- Money flow : Showing the money flow is decreasing in its out flow.

- EMA: Price is still above the EMA 50 and 200.

- Trend strength : Showing unclear signals.

- Price pattern and chart pattern: No clear pattern.

Trend Summary:

- Short-term (15m): High uncertainty.

- Mid-term (1H, 4H): Increasing sell pressure.

- Long-term (Day): Still bullish.

- Today's trend: Price correction downwards possible.

Overall: The BTCUSDT.P OKX market maintains a long-term bullish trend, but mid-term and short-term sell pressure is increasing. Be cautious of volatility and closely monitor potential price reversal signals.

Daily Trade Setups

Based on the analysis, here are three example trade setups:

Setup 1: Short Position (Short-term)

- Enter: 83,000

- TP: 82,000

- SL: 83,500

- RRR: 2:1

Explanation:

- Based on the CHoCH Bearish signal on the 15m timeframe and the Head and Shoulders pattern.

- Enter Trade once price reaches entry point, or set a sell limit order.

- Target price and stop loss levels set to manage risk.

Setup 2: Short Position (Mid-term)

- Enter: 84,000

- TP: 82,000

- SL: 85,000

- RRR: 2:1

Explanation:

- Based on the EMA 50 crossover on the 1H timeframe, wedge pattern, double top pattern, and sellside liquidity.

- Enter Trade once price reaches entry point, or set a sell limit order.

- Target price and stop loss levels set to manage risk.

Setup 3: Long Position (Long-term)

- Enter: 81,000

- TP: 85,000

- SL: 80,000

- RRR: 4:1

Explanation:

- Based on the long term bullish trend, and buyside liquidity.

- Enter trade once price reaches entry point or set a buy limit order.

- Target price and stop loss levels set to manage risk.

Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own research and exercise caution.

Chart Images:

TF15m :

- Overview: 'https://www.tradingview.com/x/zZH7qx2f/';

- Trend line : 'https://www.tradingview.com/x/gapjvk6N/';

- SMC: 'https://www.tradingview.com/x/2zOJZasJ/';

- Buyside & Sellside Liquidity : 'https://www.tradingview.com/x/cWZkI9I7/';

- Money Flow : 'https://www.tradingview.com/x/TP1R19pb/';

- EMA : 'https://www.tradingview.com/x/2PjTfpD8/';

- Trend Strength:'https://www.tradingview.com/x/ma9CcDVx/';

TF1H :

- Overview: 'https://www.tradingview.com/x/9Unm6DQy/';

- Trend line : 'https://www.tradingview.com/x/k5rV4LTa/';

- SMC: 'https://www.tradingview.com/x/Qi4rR3gd/';

- Buyside & Sellside Liquidity : 'https://www.tradingview.com/x/6e9zJnlb/';

- Money Flow : 'https://www.tradingview.com/x/MBPvOHBs/';

- EMA : 'https://www.tradingview.com/x/UibnKYWX/';

- Trend Strength:'https://www.tradingview.com/x/hWEma6oC/';

TF4H:

- Overview: 'https://www.tradingview.com/x/vzdcuXED/';

- Trend line : 'https://www.tradingview.com/x/mPzd9G1I/';

- SMC: 'https://www.tradingview.com/x/1cdCMueI/';

- Buyside & Sellside Liquidity : 'https://www.tradingview.com/x/qPrgYAxX/';

- Money Flow : 'https://www.tradingview.com/x/6rTBagjl/';

- EMA : 'https://www.tradingview.com/x/sN6lG04y/';

- Trend Strength:'https://www.tradingview.com/x/hb457FLd/';

TF Day:

- Overview: 'https://www.tradingview.com/x/y1MOI5Y7/';

- Trend line : 'https://www.tradingview.com/x/qy4YSuPg/';

- SMC: 'https://www.tradingview.com/x/mqFabKZh/';

- Buyside & Sellside Liquidity : 'https://www.tradingview.com/x/U9X7H7NR/';

- Money Flow : 'https://www.tradingview.com/x/CV3bVn5g/';

- EMA : 'https://www.tradingview.com/x/7uHK3Din/';

- Trend Strength:'https://www.tradingview.com/x/X61mSfbO/';