Things to remember….under current US tax law, your cost basis nolonger matters when you die. Your ₿itcoin, land, stock, house, (whatever you own) gets a “step-up” to market value at date of death. What does this mean? If die tomorrow and ₿itcoin value is $ 110,000. If I own one bitcoin, it now has a cost basis of $110,000. If my spouse sells it, there is no income tax on the transaction. If she doesn’t , from that point forward she would have an income tax on any proceeds she receives over $110,000. The same goes for stocks, real estate….you name it. It doesn’t matter if I paid $ .50 for my bitcoin. The basis steps up to current value at date of death. It will be important to document that value.

If it’s in the Will, it will most likely be subject to probate. Probate essentially means to look to the Will for instructions and authority.” Also if there is a probate, the Will becomes public record at the local courthouse.

For the safety of your family’s, please don’t put Bitcoin information and instructions in your Will.

Got questions, reach out and I’ll answer them. Just remember, my is free and it’s worth what you’ve paid for it. It you have serious ₿itcoin, go talk to an attorney and an accountant before you settle on how you finalize your plan.

If I were asked, I’d leave the attorney out of the final plan, especially if they will be helping to administer the Estate and your Will.

I’d have a trusted friend with a key, a spouse with a key, an oldest child with a key, and if a 5th key is needed, probably the girlfriend.

JK on the girlfriend. I’d probably just do a 2 of 4 multi sig setup. 😂😂😂

quoting🧔♂️ A Dad’s Plan: How I Made Sure My Family Can Access Our Bitcoin if I Go Missing

note1ev0…06lv

My name’s not important. I’m just a dad — a regular one. I work hard, I love my family, and I’ve put some of our savings into Bitcoin.

But I’ve always had one worry:

> “What if something happens to me? How will my family access the Bitcoin?”

That’s not paranoia. It’s responsibility. Whether it’s an accident, illness, or I just get stuck off-grid, I don’t want my wife and kids locked out of what I built for them.

So here’s what I did.

---

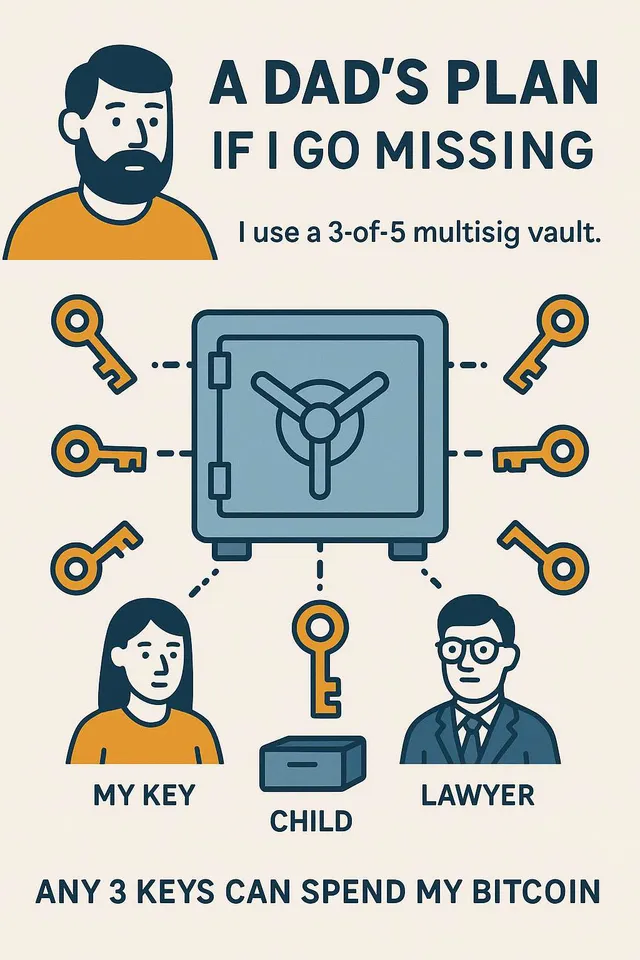

🔐 Enter: 3-of-5 Multisig

Think of it like this:

I created a vault with 5 keys.

But to open it, you need any 3 out of those 5 keys.

That means:

It’s secure (no single key can do anything),

It’s flexible (even if 2 keys are lost or unavailable, the rest can still access it),

And it’s perfect for families.

---

🧩 Who Holds the 5 Keys?

Here’s how I set it up:

1. I hold one key — of course.

2. My wife holds one key.

3. My oldest child holds another.

4. My lawyer holds a key in encrypted digital custody.

5. One key is secured in a safe deposit box, only accessible with clear instructions in my will.

That means:

If I go missing or can’t act, my wife + two others can unlock the funds.

Even if one or two keys are lost or compromised, we’re still fine.

---

⚖️ But What About Trust?

I picked each key holder carefully. And I made sure:

Everyone understands their role (hold, don’t act unless agreed).

No one can act alone.

There’s no single point of failure — not even me.

I also left clear written instructions, legal documentation, and stored passphrases with secure custodians.

---

💸 What Happens if I Die?

Because it’s 3-of-5:

My wife, child, and lawyer can still access the funds.

No waiting for probate.

No bank paperwork.

Just trusted people using the keys we’ve already agreed on.

This is faster, more private, and more reliable than any fiat system I’ve ever used.

---

🧾 What About Taxes?

Great question. Bitcoin is not invisible to the government.

If I die, and the Bitcoin is accessed, it still goes through:

Capital gains reporting if sold.

Inheritance tax issues depending on jurisdiction.

So I’ve worked with a professional to:

Log the cost basis,

Write out the legal ownership plan,

And make sure my family isn’t left with confusion or penalties.

---

🧠 Final Thoughts

This isn’t about paranoia.

It’s about preparedness.

Multisig (like 3-of-5) gave me the peace of mind that my family can:

Access our funds if something happens to me,

Do it safely and legally,

And without depending on any one person, company, or system.

If you’re a dad (or mum) with Bitcoin and loved ones — I urge you to think through this. It’s one of the most loving things you can do.

Because protecting your family doesn’t end when you’re gone. And with Bitcoin — you can protect them better than any bank ever could.

---