The World Economy Is Becoming Unglued; Models Miss Real-World Behavior

_Authored by Gail Tverberg via Our Finite World blog,_ (https://ourfiniteworld.com/2023/06/30/the-world-economy-is-becoming-unglued-models-miss-real-world-behavior)

_**A common belief is that if the world does not have adequate energy, the result will be high prices. These high prices will allow more fossil fuels to be extracted or will allow renewables to substitute for fossil fuels.**_

(

(  )

)In my view, the real issue is quite different:

**Inadequate energy supply of the types the economy requires can be expected to affect the economy in a way that causes it to become “unglued.” The economy will gradually fall apart as infighting becomes more of a problem.**

Goods won’t necessarily be high-priced; many simply won’t be available at any price. Political parties will fragment. Conflict within countries, such as the recent Wagner conflict with the military leadership in Russia, will become more common.

It has become fashionable to use models to predict the future, but simple models do not consider real-world dynamics. They don’t consider the importance of already existing infrastructure and the types of energy products this infrastructure requires. They don’t consider the importance of continuing food production. They don’t consider the dynamics of “not enough goods and services to go around.”

**In this post, I will look at some pieces of evidence that suggest we should expect the world economy to become unglued as limits are hit.**

A corollary is that we cannot expect a transition to a world powered by renewables to work.

\[1\] It is easy to show that the energy supplies of a finite world will eventually fall short.

Anyone can model the energy supplies of a finite world as a bucket of sand and a scooper. If the scooper is used to remove the sand from the bucket, it will eventually become empty. If we start with a larger bucket of sand, perhaps the process can be delayed. Or, if we use a smaller scooper, the process will be delayed. But the result will be the same.

Back in 1957, Rear Admiral Hyman Rickover of the US Navy gave a speech (https://ourfiniteworld.com/2007/07/02/speech-from-1957-predicting-peak-oil/) in which he said,

> For it is an unpleasant fact that according to our best estimates, total fossil fuel reserves recoverable at not over twice today’s unit cost, are likely to run out at some time between the years 2000 and 2050, if present standards of living and population growth rates are taken into account.

In this speech, Rickover pointed out the importance of fossil fuels to maintain our standard of living and to win wars. It was clear to the military that fossil fuel energy supplies were tremendously important in preventing future problems for the economy.

\[2\] History shows that economies tend to grow and eventually collapse.

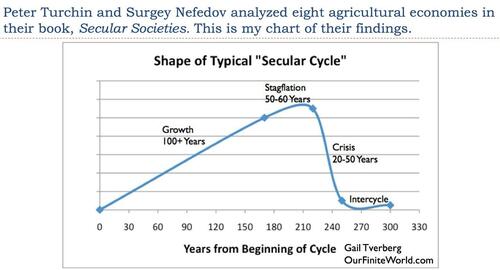

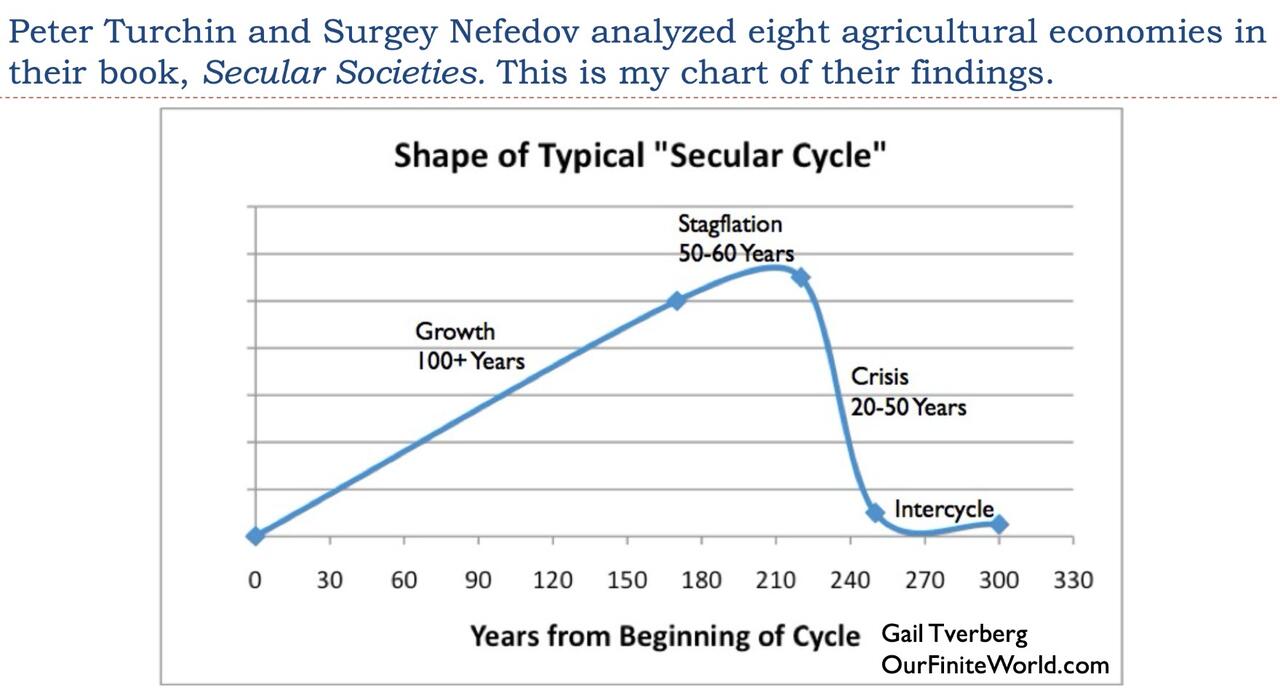

Economies tend to operate in cycles, as illustrated in Figure 1.

(

(  )

)_Figure 1. My chart of the findings of Peter Turchin and Surgey Nefedov in their 2009 book, Secular Cycles (https://www.amazon.com/Secular-Cycles-Peter-Turchin/dp/0691136963)._

The eight economies analyzed by Turchin and Nefedov moved into a new area or acquired a new energy resource. These economies tended to grow for a long periods, well over 100 years, until the populations hit the carrying capacity of the available resources. These economies were able to work around these resource limits during a period of Stagflation, which typically lasted about 50 to 60 years. Eventually, the problems became too great to be overcome. A Crisis Period of falling population and GDP, lasting 20 to 50 years, typically ensued.

\[3\] The world economy today seems to be following a similar cycle based on its use of fossil fuels. In fact, we seem to be in the Crisis Period of such a cycle.

Today’s fossil fuel-based world economy started growing at varying times, in various places around the world, becoming well established by the early 1800s. It seems to have hit a Stagflation Period between 1970 and 1980. Recent patterns in oil supply per capita, interest rates, and debt levels suggest to me that the world economy has entered the Crisis Period of the current cycle.

To me, oil supply, particularly crude oil supply, is exceptionally important in keeping the economy growing because it is heavily used in producing the food supply and transporting it to market. In fact, it is heavily used in transportation of all kinds. …

https://www.zerohedge.com/geopolitical/world-economy-becoming-unglued-models-miss-real-world-behavior