matta on Nostr: 🤔 monetizing the debt…. Government Debt The U.S. government often spends more ...

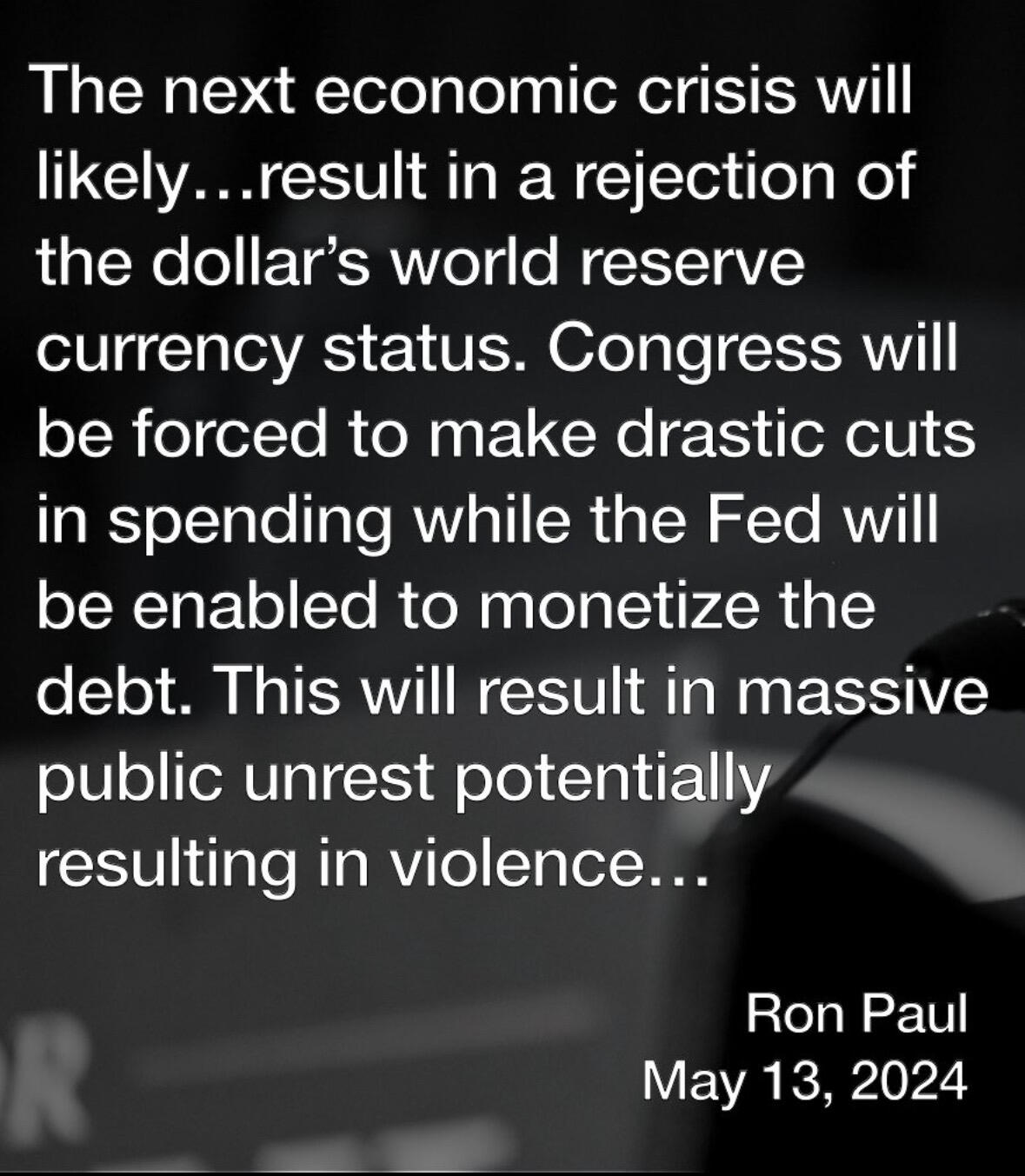

🤔

monetizing the debt….

Government Debt

The U.S. government often spends more money than it collects in taxes. To cover this gap, it borrows money by issuing Treasury bonds (a type of IOU). These bonds promise to pay back the money with interest in the future.

Selling Bonds

Typically, the government sells these bonds to investors, such as banks, other countries, and individuals.

The Fed Buys Bonds

When the Fed decides to monetize the debt, it buys some of these Treasury bonds. But here's the catch: instead of using existing money, the Fed creates new money for this purpose.

Creating Money

The Fed has the unique power to create money out of thin air. So, when it buys the bonds, it credits the banks' accounts with new money that didn't exist before.

…. in summary, monetizing the debt means the Fed is buying government debt with newly created money, which can help boost the economy but also carries risks like inflation.

Published at

2024-05-25 14:50:25Event JSON

{

"id": "9eef2ea835eb88e521471ca812417cffb498ad1725fa3180634530c788ac3d73",

"pubkey": "8fda2199c4399fad7ff4126b402f1f5ee157fdbe4c0951e64dfe31aaec877ff1",

"created_at": 1716648625,

"kind": 1,

"tags": [

[

"imeta",

"url https://image.nostr.build/e2fd914a8761c51952032238a0fb895ccdd0932cec0ae880b27ba67cdf55e2d6.jpg",

"blurhash e59@S6%M9FxuIU-;ofRjt7M{00a|xuj[t7oft7WBayt7M{RjofofRj",

"dim 1179x1353"

],

[

"r",

"https://image.nostr.build/e2fd914a8761c51952032238a0fb895ccdd0932cec0ae880b27ba67cdf55e2d6.jpg"

]

],

"content": "🤔 \nmonetizing the debt…. \n\nGovernment Debt \nThe U.S. government often spends more money than it collects in taxes. To cover this gap, it borrows money by issuing Treasury bonds (a type of IOU). These bonds promise to pay back the money with interest in the future.\n\nSelling Bonds\nTypically, the government sells these bonds to investors, such as banks, other countries, and individuals.\n\nThe Fed Buys Bonds\nWhen the Fed decides to monetize the debt, it buys some of these Treasury bonds. But here's the catch: instead of using existing money, the Fed creates new money for this purpose.\n\nCreating Money\nThe Fed has the unique power to create money out of thin air. So, when it buys the bonds, it credits the banks' accounts with new money that didn't exist before.\n\n…. in summary, monetizing the debt means the Fed is buying government debt with newly created money, which can help boost the economy but also carries risks like inflation. https://image.nostr.build/e2fd914a8761c51952032238a0fb895ccdd0932cec0ae880b27ba67cdf55e2d6.jpg ",

"sig": "777195626378d17563833a493846185308e5fb3c9e5ccd6a43cbe7439a31cbb783b30a86392c4e119881cd5c786f13bc23bee09b11a00d0ef2a2549c18ed46e8"

}