monsieurdeivid on Nostr: The Risk of Curve Yield Inversion (small thread 🧵) A yield curve is simply a line ...

The Risk of Curve Yield Inversion

(small thread 🧵)

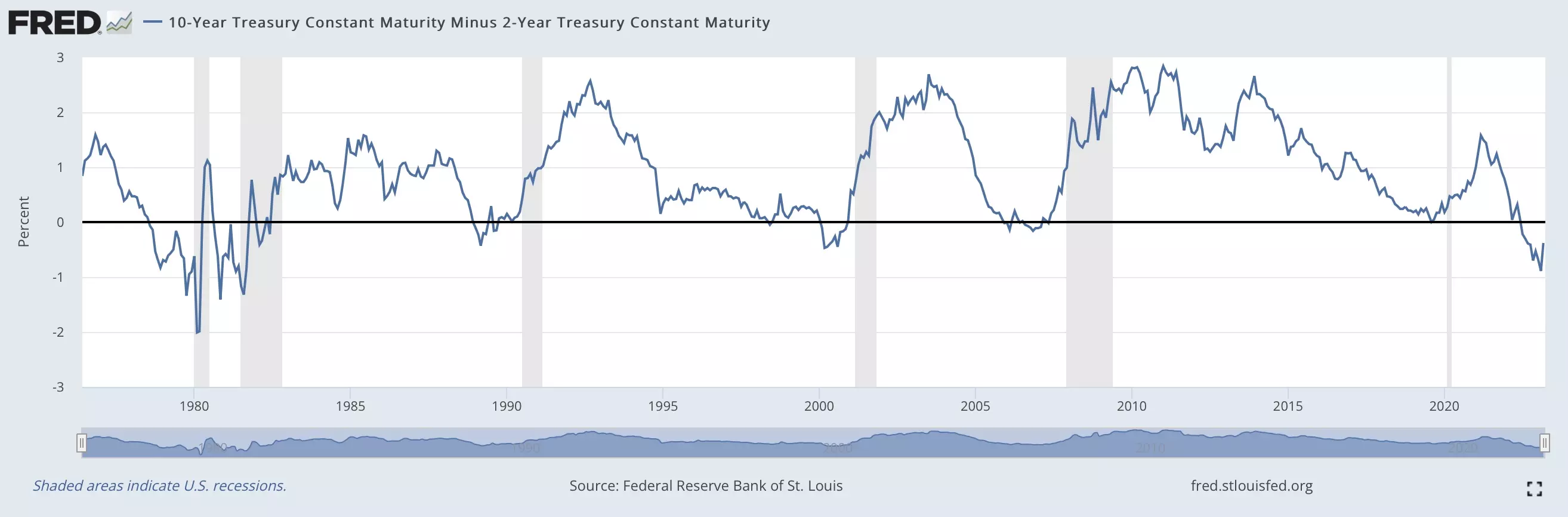

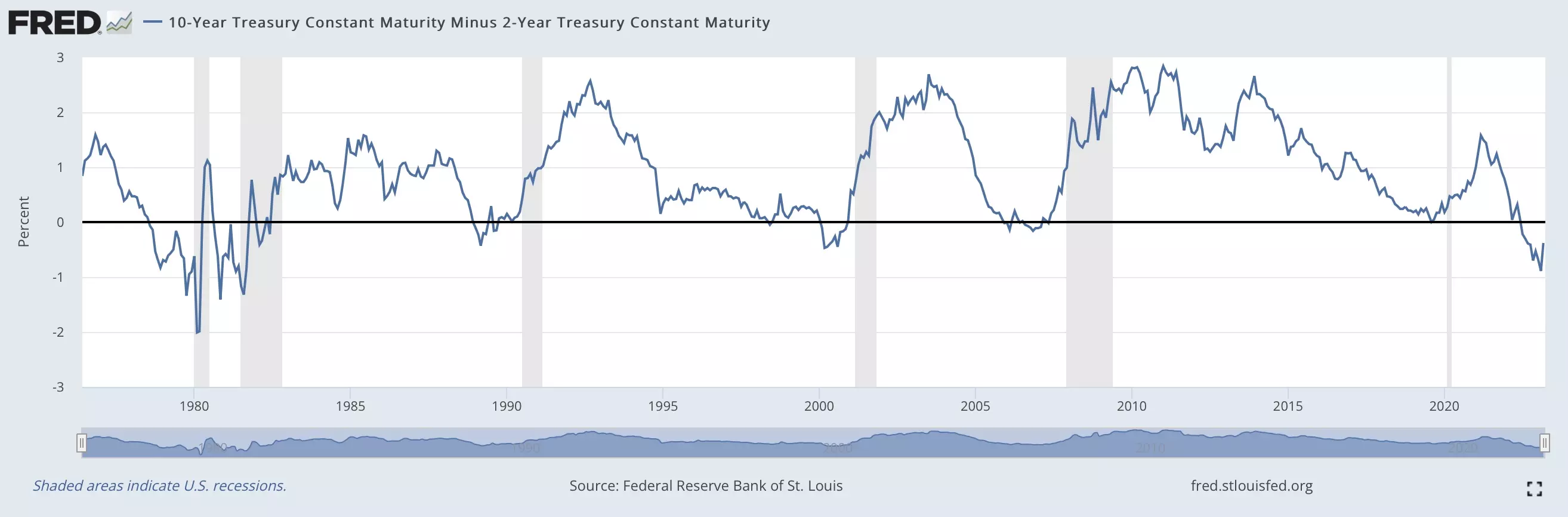

A yield curve is simply a line that connects the yields, or interest rates, of bonds that have different maturity dates.

Short-term bonds, like the 2-year Treasury, usually reflect expectations of future Fed interest rates, while long-term bonds, like the 10-year Treasuries, reflect future inflation rate expectations.

A great indicator that suggests bad times ahead is the Curve Yield Inversion. That arrives when the spread between the 10-year Treasury Bond and the 2-year Treasury Bond is negative. Usually it means a recession, deceleration, crisis or whatever you called it is coming in 1-2 years.

Look at this link below:

https://fred.stlouisfed.org/graph/?g=Ng4eIn this other video there is some correlation between FED rates, stock market, recession and even Bitcoin.

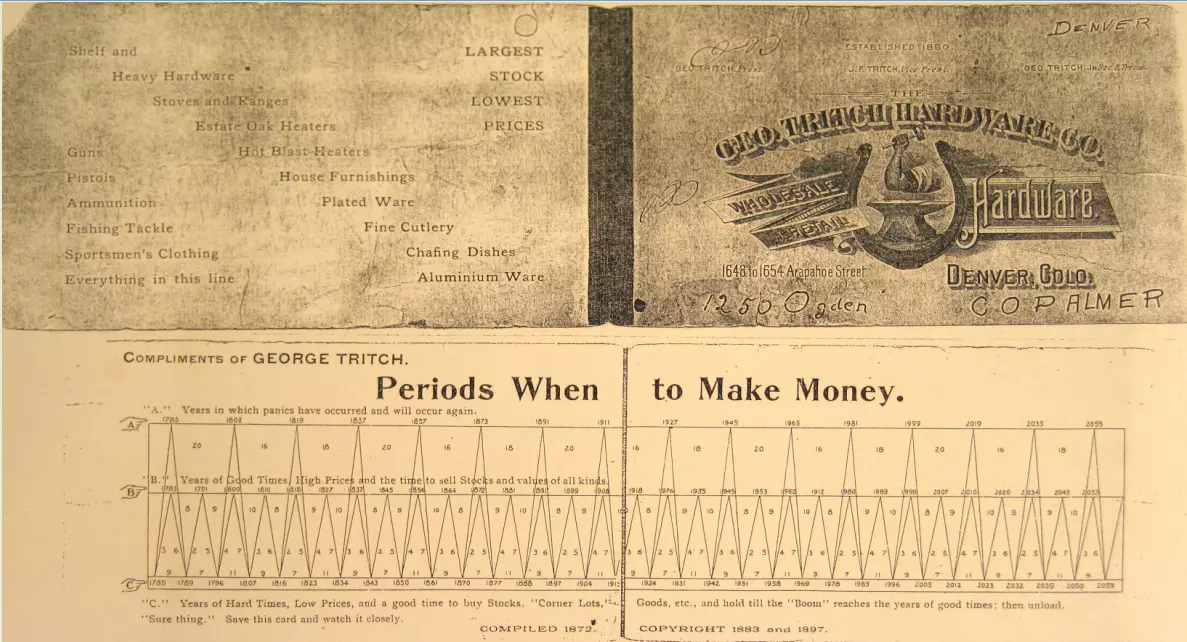

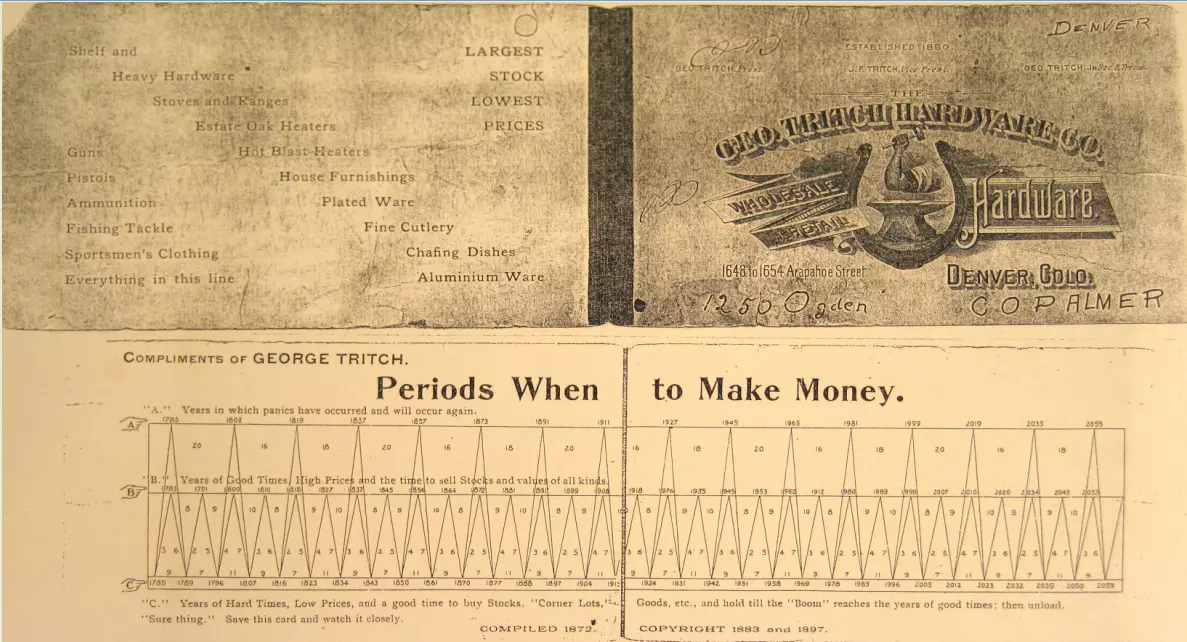

https://twitter.com/ColinTCrypto/status/1639293045383262210?s=20Finally, at last picture we see the "Periods When To Make Money", created at 1892. (2023 bottom year)

#FED #rates #recession #bonds

Published at

2023-03-26 15:31:39Event JSON

{

"id": "93edcb5331faf06563e0dc2ee7cb13df97c7575f42a29f05227735f4f5cc2a88",

"pubkey": "000000f4ee65f4d0ebdabeb027f5551033880791541340b1df71611ee0d30469",

"created_at": 1679844699,

"kind": 1,

"tags": [

[

"t",

"fed"

]

],

"content": "The Risk of Curve Yield Inversion\n(small thread 🧵)\n\nA yield curve is simply a line that connects the yields, or interest rates, of bonds that have different maturity dates. \nShort-term bonds, like the 2-year Treasury, usually reflect expectations of future Fed interest rates, while long-term bonds, like the 10-year Treasuries, reflect future inflation rate expectations.\n\nA great indicator that suggests bad times ahead is the Curve Yield Inversion. That arrives when the spread between the 10-year Treasury Bond and the 2-year Treasury Bond is negative. Usually it means a recession, deceleration, crisis or whatever you called it is coming in 1-2 years.\n\nLook at this link below:\nhttps://fred.stlouisfed.org/graph/?g=Ng4e\n\nIn this other video there is some correlation between FED rates, stock market, recession and even Bitcoin.\nhttps://twitter.com/ColinTCrypto/status/1639293045383262210?s=20\n\nFinally, at last picture we see the \"Periods When To Make Money\", created at 1892. (2023 bottom year)\n\n#FED #rates #recession #bonds\n\nhttps://void.cat/d/8p5YHTCdRNhGzcvVpd4zWb.webp\n\nhttps://void.cat/d/JRzLwm2YAkpJmn3LAj4Uj6.webp",

"sig": "950df11d05b4d2b7e10b11c771d2b213eae1ebe15bc5e9e7485b224093379167656830e1c1bfc204d11a7c4859fa6ceeda6366b678ccea57482f91b14cbc505d"

}