The War brought financial havoc to Europe as their currencies became unstable, but it enhanced the standing of the U.S. dollar among the world’s currencies. The US dollar remained linked to gold, and that gold supply was growing - causing inflation, of course.

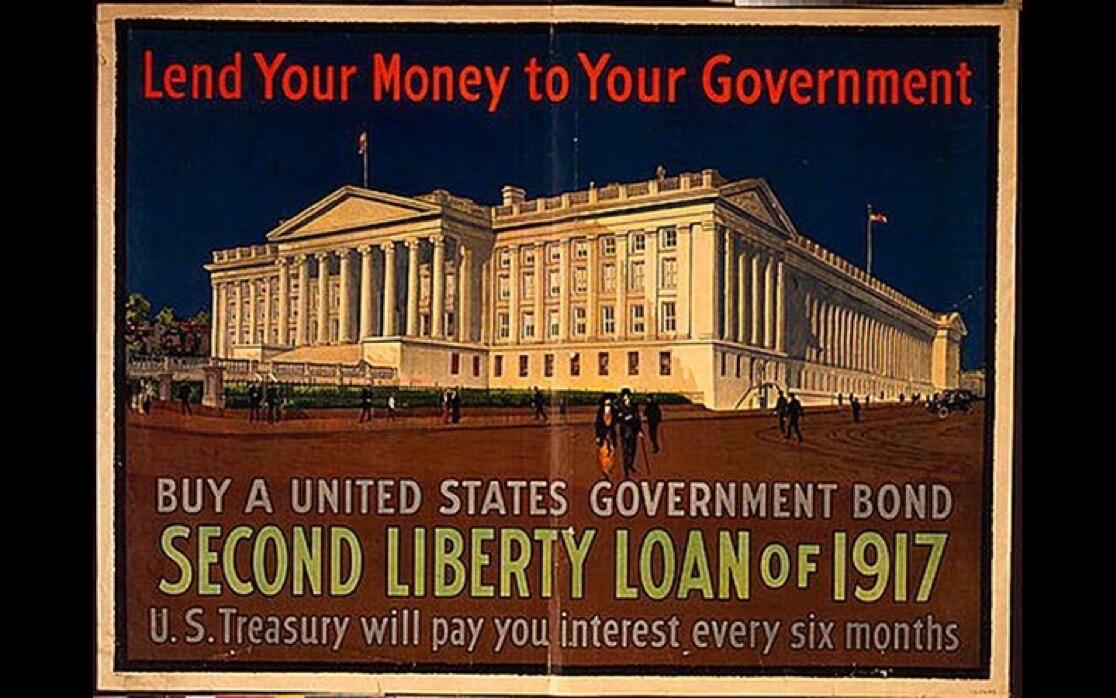

The Treasury introduced “war bonds”, the Federal Reserve took an active role in marketing war debt to the public.

By the end of World War II, the US had 75% of the world’s monetary gold supply, and the USD was the only currency still backed by gold.

In the decades following WWII as the world rebuilt itself, the US spent its gold on war torn nations, hunger for imports, and the Vietnam War.

What was the result? Belgium, Netherlands, Germany, France showed interested in redeeming their US dollars for the gold that “backed” it. Britain, in August 1971, did officially request to be paid in gold for their dollars.

But Nixon slammed the door shut on the redeemability of US dollars for gold, refusing to repay them. And thus, the gold standard came to an end.

A true international gold standard existed for less than 50 years - from 1871 to 1914.

Though a lesser form of the gold standard continued until 1971, its death had started centuries before with the introduction of paper money.