Unlocking Knowledge: Bitcoin in Plain Language

This series continues to translate the original white paper by Satoshi Nakamoto to plain language. The goal is to have easily shared content, and send new people directly to nostr to read it. The original content will be posted, with the plain language below.

Please show support by sharing or sending sats.

2. Transactions Paragraph 1 and 2

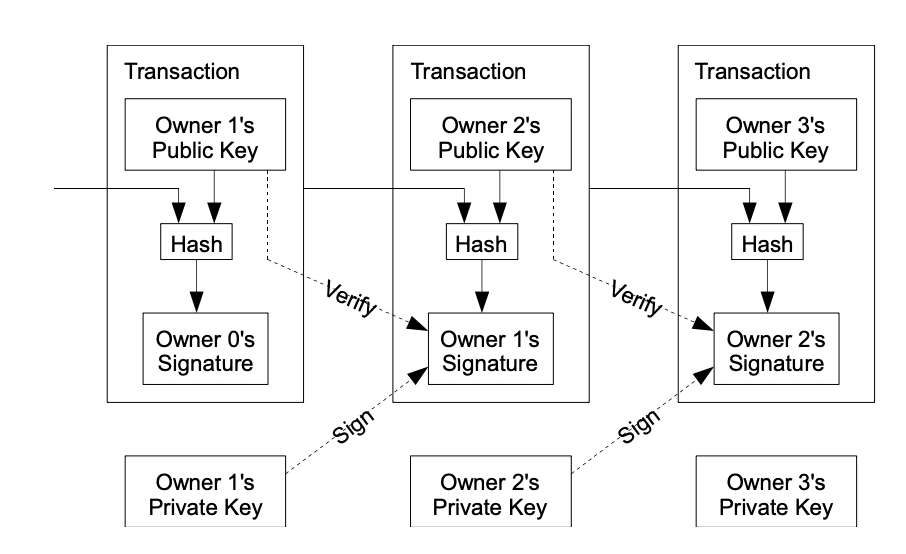

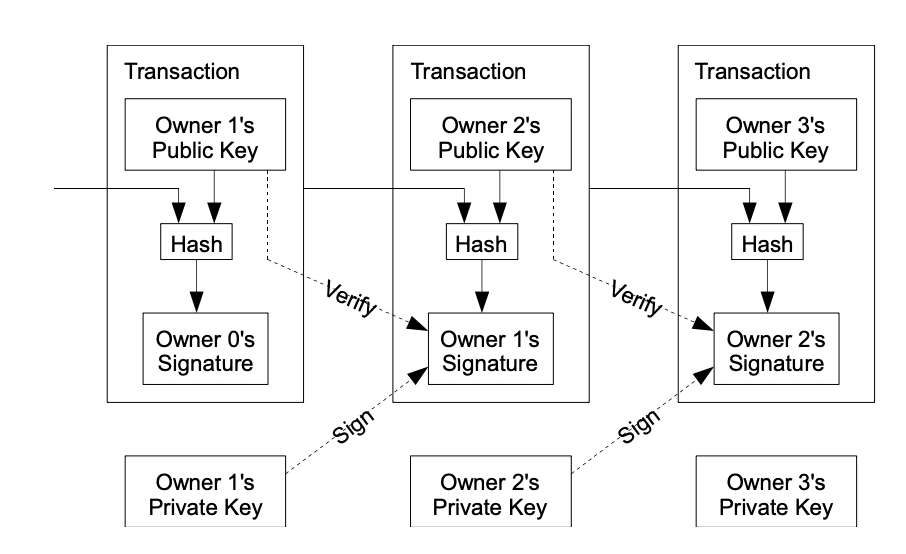

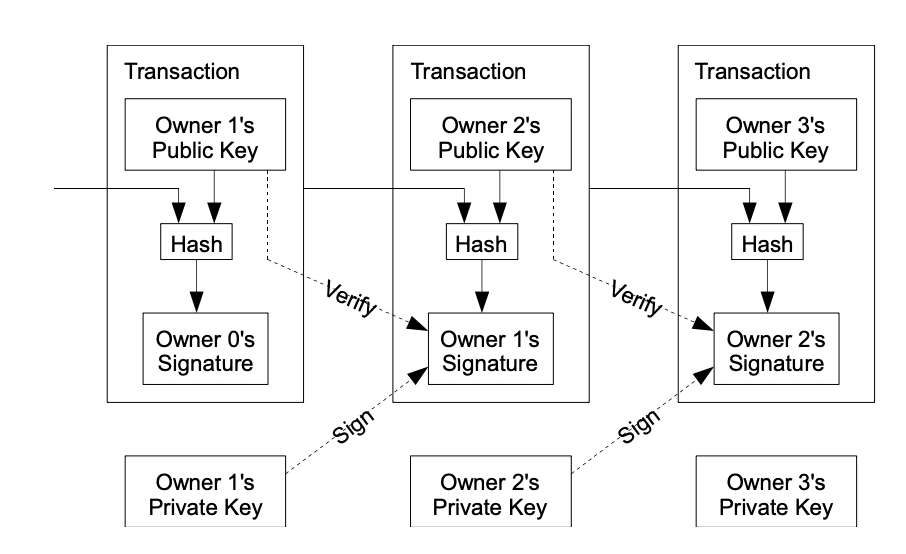

We define an electronic coin as a chain of digital signatures. Each owner transfers the coin to the next by digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin. A payee can verify the signatures to verify the chain of ownership.

The problem of course is the payee can’t verify that one of the owners did not double-spend the coin. A common solution is to introduce a trusted central authority, or mint, that checks every transaction for double spending. After each transaction, the coin must be returned to the mint to issue a new coin, and only coins issued directly from the mint are trusted not to be double-spent. The problem with this solution is that the fate of the entire money system depends on the company running the mint, with every transaction having to go through them, just like a bank.

Plain Language

These electronic coins act a like digital chain of information. When you own this digital coin and want to give it to someone else, you "sign" it digitally. This involves creating a unique code that includes information about the previous transaction and the new owner's public key. This code is then added to the end of the digital coin.

Now, if someone receives the coin, they can check these digital signatures to make sure the chain of ownership is legitimate. Like a way of making sure that the history of the coin and who owns it is secure and reliable.

The issue here is that the person receiving the digital coin can't be sure that the person who gave it to them didn't try to spend the same coin again somewhere else. To solve this problem, some suggest having a trusted central authority, like a bank, that checks every transaction to make sure no one is trying to spend the same coin twice.

The catch, though, is after each transaction, the coin has to go back to this central authority, and they issue a new coin. The idea is that only coins directly issued by this authority can be trusted not to be double-spent.

The problem is that the entire money system relies on this central authority. Every transaction has to go through them, similar to how transactions go through a bank. This can be a drawback because the whole system depends on the trustworthiness of the company, or people, running this central authority.

#bitcoin #crypto #btc #blockchain #cryptocurrency #hodl #digitalgold #decentralized #satoshi #cryptonews #satoshinakamoto #whitepaper #bitcoinwhitepaper #nostr #grownostr