SaberhagenTheNameless on Nostr: With blockchains, you have two choices to secure the chain: 1) transaction fees ...

With blockchains, you have two choices to secure the chain:

1) transaction fees (Better for SoV)

2) block subsidy (Better for MoE)

Monero is trying to be p2p digital *cash* with low transaction fees, thus chose tail emission route.

Bitcoin transaction fees will continue to grow on average making it a poor MoE to use all the time especially in the future (the more you use it, the poorer you'll get).

0.6 wasn't arbitrary in the sense that it was trying to have less inflation than gold, roughly match estimated annual lost coins, and chose a constant, instead of a percentage, meaning in relation to total supply the % inflation would constantly be shrinking.

But it was arbitrary in the same way that every number chosen for Bitcoin was arbitrary (21 million, 1MB blocksize, etc).

How would devs be abusing tail emission? There is no Dev Tax.

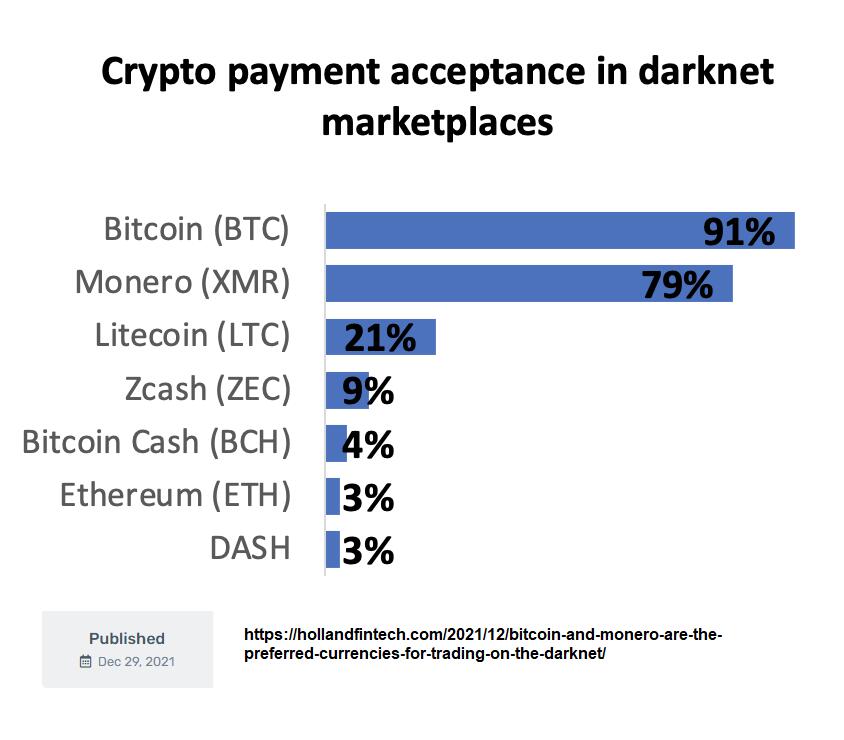

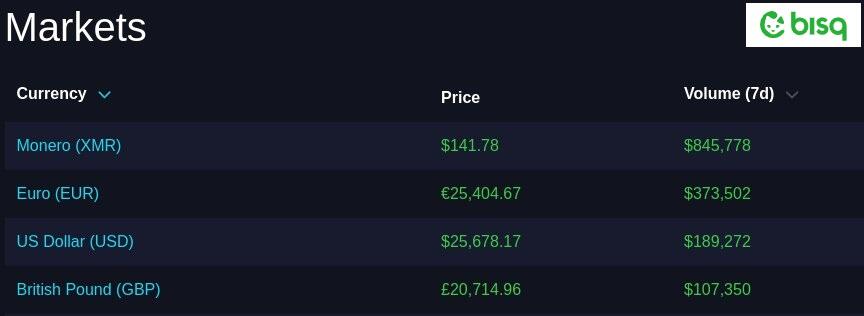

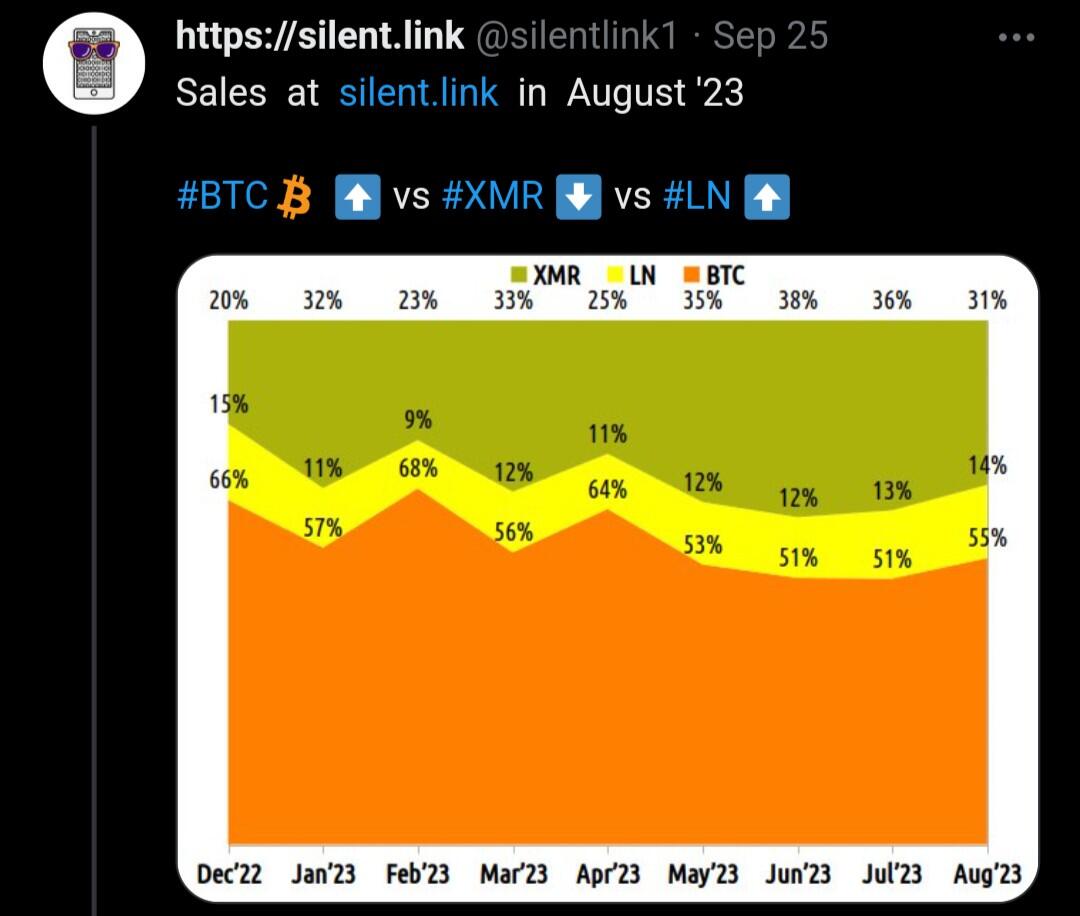

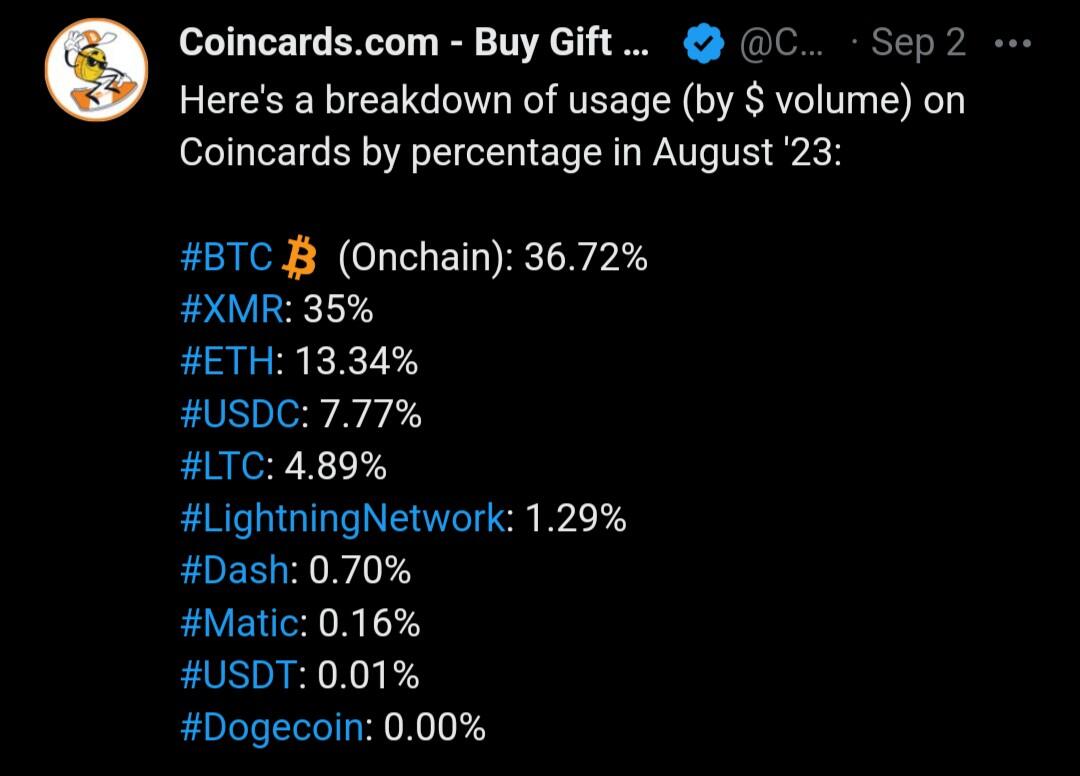

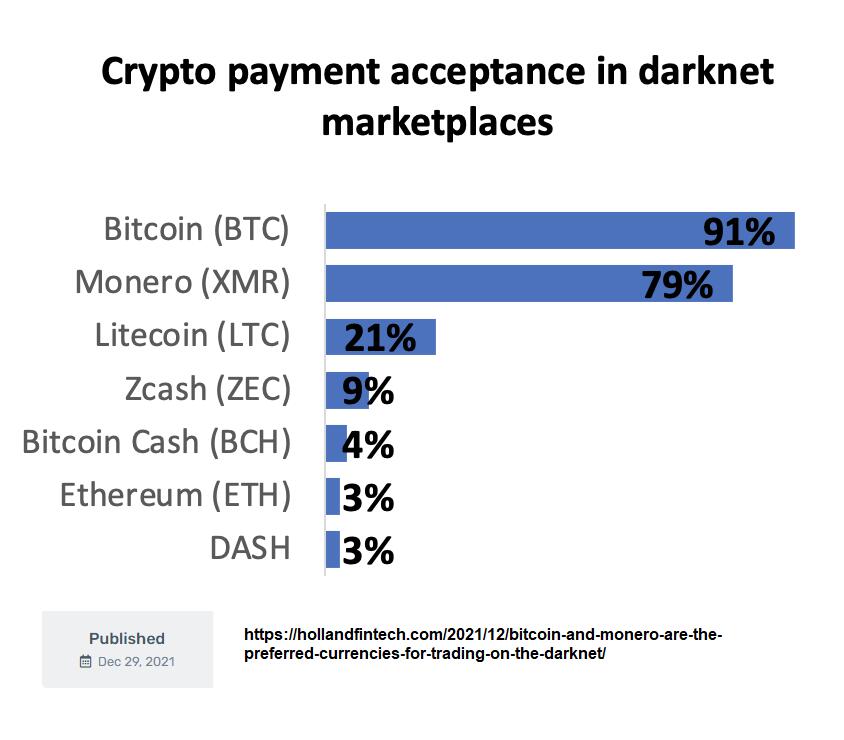

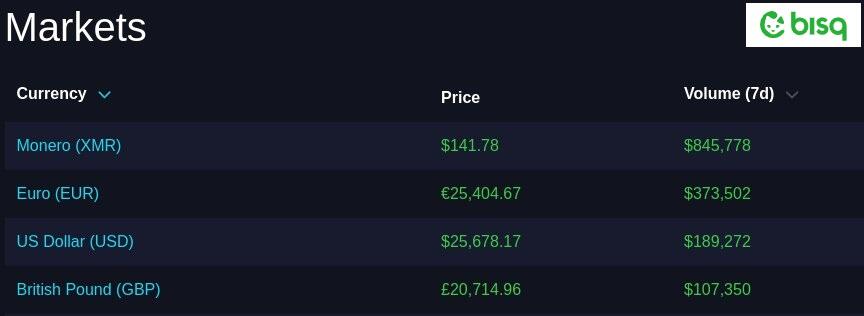

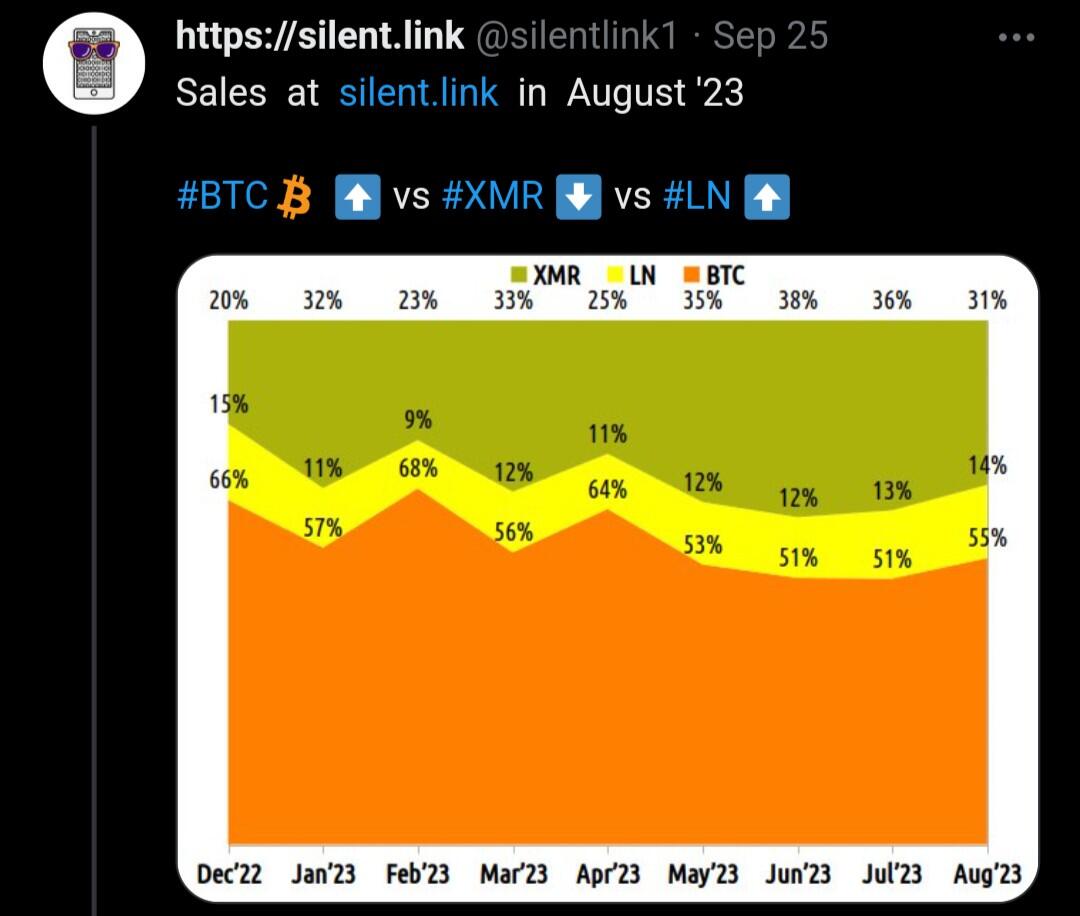

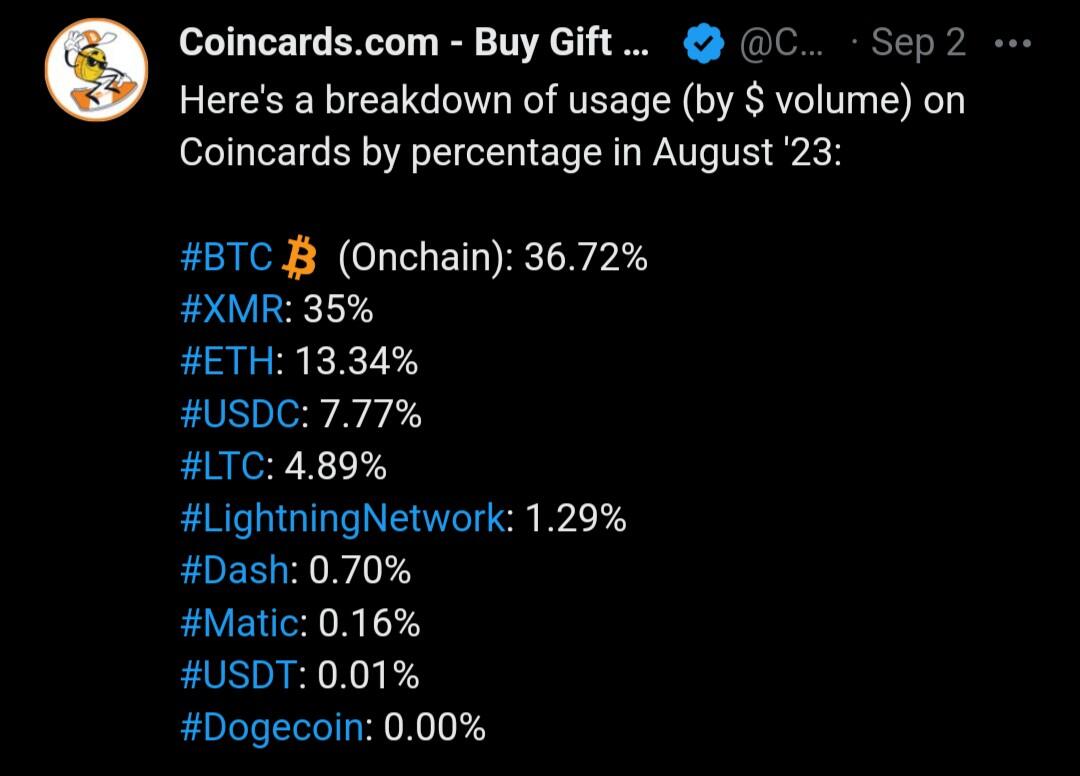

As far as "fee structure failed to sustain the system"...not sure where you get this from. Proportionally to market cap, Monero gets far more use than Bitcoin (roughly ~8x more)

Published at

2023-10-15 02:32:25Event JSON

{

"id": "fc6c3d569169096540e2dc4c80f673b176657be498e8a9b83e5886afdb404ca9",

"pubkey": "af740d198babb8c7b82d0a4718eb354bb3f6af9a98639b85d4a5cf1371caba85",

"created_at": 1697337145,

"kind": 1,

"tags": [

[

"e",

"5f76ccd62ecd4bfe641ae3ca5a7500d8ed1447e5e8bb042fa8f4ece7d8759e6d",

"",

"root"

],

[

"p",

"242e066aaf1940fb71a8eeee262c0e73985f2c17c697ad0783dba1f42c68d231"

]

],

"content": "With blockchains, you have two choices to secure the chain: \n1) transaction fees (Better for SoV)\n2) block subsidy (Better for MoE)\n\nMonero is trying to be p2p digital *cash* with low transaction fees, thus chose tail emission route. \n\nBitcoin transaction fees will continue to grow on average making it a poor MoE to use all the time especially in the future (the more you use it, the poorer you'll get).\n\n0.6 wasn't arbitrary in the sense that it was trying to have less inflation than gold, roughly match estimated annual lost coins, and chose a constant, instead of a percentage, meaning in relation to total supply the % inflation would constantly be shrinking.\n\nBut it was arbitrary in the same way that every number chosen for Bitcoin was arbitrary (21 million, 1MB blocksize, etc).\n\nHow would devs be abusing tail emission? There is no Dev Tax.\n\nAs far as \"fee structure failed to sustain the system\"...not sure where you get this from. Proportionally to market cap, Monero gets far more use than Bitcoin (roughly ~8x more)\n\nhttps://image.nostr.build/06cc8e656fc2781f9323aec3bbde678ebde86eb0631414ca1db05b736c0445e0.jpg\n\nhttps://image.nostr.build/8599b34eccd2f28fc56ee3a749ab7ac044d23a8dcff609020a9ded10f9677c43.jpg\n\nhttps://image.nostr.build/ce5fbe19fd498ed948ec66e2f91efb9dc8fcfd388f56a23c97735d9bb86d3460.jpg\n\nhttps://image.nostr.build/5a409dca8ccb4b10f8879a4e7bc99137fc104cef5ce01fbdd8e3aad3724ebba0.jpg",

"sig": "4a65bc1d8b2276d98e1512fe8ec33701c366ffb09c4707545c8b24e91e98aeb99d6777ccd4dd2ec55917ebbbd856299ad16d3bd49fb74b669491380ddc2861cb"

}