🧠Quote(s) of the week:

‘The world is a large theater with a small exit door. The definition of the sucker is someone who focuses on the size of the theater, not the size of the door.’ -Nassim Taleb

🧡Bitcoin news🧡

Now before I start with the Weekly Recap I want to share the following message:

- It’s my Birthday 24.07!🧡

- ‘If your Hardware wallet is:

👉🏽Closed source

👉🏽Has no screen

👉🏽Can’t buy it with Bitcoin

👉🏽Has the word LEDGER on it or connects to a computer

👉🏽Parent company supports censorship and/or Chainanalysis

It’s time to level up your self-custody game.’

Open or verifiable source Bitcoin only!

For example:

Blockstream Jade

Passport Foundation

BitBox02 - Bitcoin Only edition

15th of July:

➡️While Germany sold, the U.S. Bitcoin ETFs bought 19.138 Bitcoin last week alone. Bear in my 3.150 Bitcoin is mined weekly. Supply & demand people, supply & demand. Fun stat, since Germany has finished selling their Bitcoin, the price has increased by ~15%.

Germany sold all of their Bitcoin for \(54,000 They could have made an extra \)500 million if they had waited two days. Classic!

Official statement/press release:

It states, “The sale of assets even before the conclusion of ongoing criminal proceedings is always legally required if there is a threat of a significant loss in value of about ten percent or more. These conditions were always met with the volatile Bitcoins due to the enormous and extremely fast price fluctuations.”

“From the beginning, less than one percent of the market volume of Bitcoins was regularly traded over 90 percent over the counter in a market-friendly manner. On this scale, there is no direct influence on the Bitcoin price.”

’…there is no direct influence on the Bitcoin price’. Except for the price going significantly up after they have sold their last Bitcoin.

Anyway, thank you for the Bitcoin Germany!

16th of July:

➡️’Senator Menendez who said “Bitcoin is the ideal choice for criminals,” was just convicted for taking bribes in Gold and Cash!’ -Bitcoin Archive

➡️Someone or an entity moved \(3 billion around the globe for \)2.61. Bitcoin is a game changer, yet some people can’t grasp it. It is insane you can move that much money that cheap.

➡️’13F filings show how Bitcoin ETF holder positions changed in Q2.*

So far, with 154 entities filed (& many more to come):

- 79% have increased their holdings

- 12.5% have decreased

- Buyers added $83.5m

- Sellers lost only 5.4m

TL;DR: ETF buyers stacked the Q2 dip.’ -Julian Fahrer

- This is a provisional analysis based on 13F filings so far. The filing deadline is a month away, and most of the largest & influential entities will probably file toward the end.

➡️’Long-term Bitcoin holders are accumulating at a record pace. You gotta love the diamond-handed Bitcoin-sucking nerds. Once a legend, always a legend.’ - CarlBMenger

17th of July:

➡️ Mt. Gox was supposed to pay out $9 billion worth of Bitcoin, which could impact the price. It seems like this isn’t happening anytime soon. Most creditors have been paid and it’s then up to the creditors to distribute those repayments over agreed schedules to avoid impact on the market. Only a small batch of ~150m BTC from ca. 2 weeks ago has made it to the actual creditors.

56% of surveyed Mt. Gox creditors intend to keep all of their recouped Bitcoin, according to a recent Reddit poll that asked users whether they would sell immediately after being credited in the ongoing repayment process, and if so, what percentage.

➡️German Bitcoin miner Northern Data is raising €214M ($234.2M) to expand its high-performance computing facilities and AI operations in the EU and the US.

➡️Mark Cuban & Bitcoin. Part 1: click here

Part 2: ‘How high can the price go? Way higher than you think. Remember, the market for BTC is global. And the supply has a final limit of 21m BTC, with unlimited fractionalization.

Keep that in mind as you consider what happens if because of geopolitical uncertainty and the decline of the dollar as the reserve currency, BTC becomes a “safe haven” globally. This means that BTC could be what countries and all of us look to buy as a means to protect our savings. Crazy? It already happens in countries facing hyperinflation. And if things really go further than we can imagine today (and I’m not saying they will. Just that this has a possibility somewhere above zero), then BTC becomes exactly what the Maxis envision. A global currency.’ -Mark Cuban

The maxis were right all along, again!

Only took 4 years to go from “I would rather have bananas” to “Global Currency”. Bitcoin will become the global currency. A neutral, open, censorship-resistant, corruption-proof monetary base layer for all

“First they ignore you, then they laugh at you, then they fight you, then you win.”

➡️Trump says he doesn’t want to let “another country take over” Bitcoin and crypto industries - Bloomberg. Normally I would say, ‘Hello game theory.’ But my god no country can take over Bitcoin… Tell me you don’t understand Bitcoin without telling me. This is just him trying to get votes. That’s it.

➡️Bitcoin ETFs to be approved at major wirehouses and large bank platforms in Q3/Q4 THIS YEAR - Bernstein

18th of July:

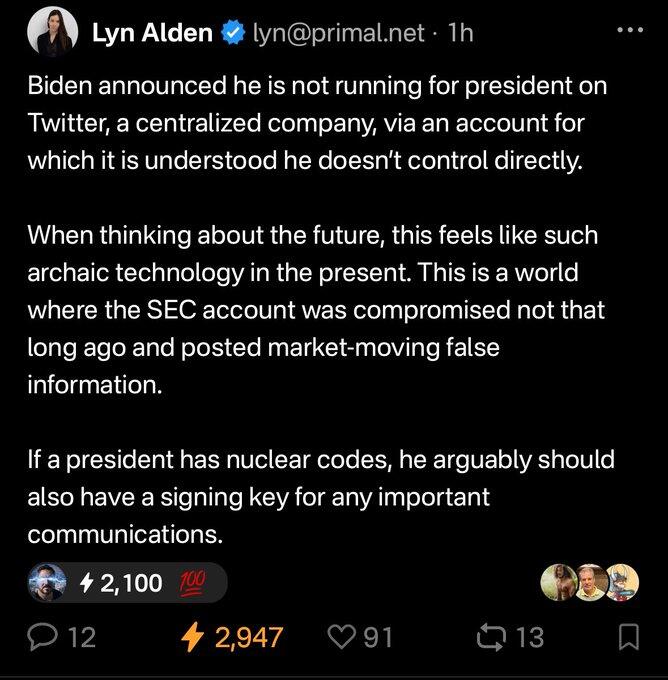

➡️Forbes: “Nostr is not just social media and communications. It’s a different way of structuring the Internet towards one where an anonymous key-pair can help give you new abilities - from transmitting value around the world to accessing and sharing new web services.”

People don’t realize how this will take over the web. No spam emails, no passwords, no personal info being exposed, no algos, no entity can stop it!

19th of July:

➡️’Blackrock has purchased over \(1B worth of Bitcoin this month - Including \)107M Today.

That’s 18,600 Bitcoin. This is a total acceleration of inflows.’ - Thomas Fahrer

That’s almost half a Germany…in one month. Gnarly!

➡️New paper proves that “Bitcoin mining can play a key role in the transition to a sustainable energy future by enhancing grid stability, promoting renewable energy use, and supporting economic viability.”

Source: click here

➡️On the day of the biggest global IT outage, Bitcoin is still running uninterrupted. Banks are down, airlines are down, Microsoft is down, all having outages because of a cybersecurity outage at CrowdStrike.

Single point of failure (!) yet Bitcoin runs smoothly, producing blocks exactly every 10 minutes as intended.

The Bitcoin network has been functional for 99.99% of the time since its inception on January 3, 2009.

Vires in Numeris

➡️’Everyone who’s been daily dollar cost averaging Bitcoin is once again in profit…even those who started DCAing at the all-time high 4 months ago.’ - Wicked

➡️Metaplanet is up over 700% since adopting a Bitcoin treasury in April 2024. Metaplanet has increased its market cap from under \(20M, to over \)160M, by simply adopting Bitcoin.

➡️’Fidelity’s Bitcoin saw \(142 million in inflows today, marking its second-best day in three months and nearing \)10 billion in total inflows.’ - Bitcoin News

22nd of July:

➡️Japanese public company Metaplanet has purchased an additional ~20.38 Bitcoin for ¥200 million at an average price of ¥9,813,061 per BTC. As of July 22, Metaplanet holds ~245.99 Bitcoins acquired for ¥2.45 billion at an average price of ¥9,959,687 per Bitcoin.

➡️Bitcoin miners are heavily selling into the recent rally, offloading 170% of the 30-day mined supply.

➡️Bitcoin miners are fleeing Paraguay for Brazil after the National Power Administration of Paraguay raised tariffs by 14%.

Miner Penguin Group is leading the exodus, securing 400MW of power in Brazil and threatening to relocate 150 jobs from Paraguay.

➡️The next difficulty adjustment is coming in at an estimated +9% as Bitcoin hashrate rebounds sharply off the lows seen earlier this month. -Bitcoin News

💸Traditional Finance / Macro:

👉🏽Billionaire Warren Buffet says he could end the United States deficit problem in five minutes. “You just pass a law that says any time there’s a deficit of more than 3% of GDP, all sitting members of Congress are ineligible for re-election.”

I agree with this! It could end the deficit problem, corruption, and other problems. But we all know this won’t happen. And because of that, we have Bitcoin.

🏦Banks:

👉🏽 U.S. Banks Report from the Office of the Comptroller of the Currency finds that half of large U.S. Banks are failing on operational risk.

🌎Macro/Geopolitics:

Let’s start with some stats of our world leader, the U.S.:

- 39 MONTHS OF CPI INFLATION AT 3% OR ABOVE

- Jobs OVERSTATED in 2023 by 730K

- 346 BIG bankruptcies in 2024, most in 14 years

- $2.1tn excess savings gone in 3 years

- 1.5M jobs lost in 6 months

- $34.8 tn NATIONAL DEBT - record

Keep that in mind while you read the following segment.

On the 15th of July:

👉🏽 1 out of 3 Americans with salaries of less than $40,000 a year have trouble paying their bills.

More than 33% of US consumers are now worried about making ends meet over the next 6 months.

This includes 30% of Americans earning $150,000 or more annually, according to the Fed survey of 5,000 respondents.

Over the last 12 months, 43% of all surveyed consumers and 37% of high-income individuals cut their discretionary spending.

Looking at stats like this, you can really feel how difficult things are currently.’ -TKL

👉🏽’While politics takes center stage, the cost of U.S. debt nears $1.15 trillion, an all-time high.’ - Bitcoin News

Now you think a trillie here or there amongst friends who care, right?

The national debt of the U.S. increases by the size of the Bitcoin market cap EVERY 100 DAYS, $ 1 trillion! More on the U.S. debt below (20th of July)

On the 16th of June:

👉🏽’The Euro is dying. Since its inception in 1999, the Euro has lost 40% of its value. To put this into perspective: 1 Euro today can only purchase about 60% of what it could back in 1999. Bitcoin fixes this.’ - Relai

👉🏽’An All-Time High of $9.3 trillion in U.S. Debt is set to mature within the next 12 months.’ -CarlBMenger

👉🏽European Court of Justice rules that EU Commission chief Ursula von der Leyen has violated European law by keeping the mRNA injection contracts excessively secret. source

You might think there will be any consequences, right? Her husband is a director of the company Orgenesis, cooperating with Pfizer,…Orgenesis is the same company that Ursula signed a 71 billion euro contract with to buy an astronomical 4.6 billion doses (10 per citizen)… and she has been an employee of Big Pharma for years…conflict of interest you might say, right?

Nope(!), a day later she was re-elected by the EU Parliament and gets to keep her job. EU ‘democracy/corruption’ in action. Why? Follow the money.

To make it even worse:

Ursula: ‘People are struggling to find affordable homes. This is why – for the first time – I will appoint a Commissioner with direct responsibility for Housing. And we will develop a European Affordable Housing Plan.’

Housing regulation pertains to the member states, not the commission. This is completely against the EU subsidiary principle.

Ursula: ‘It is time for Europe to build a true European Defence Union.’ ‘We need to create a single market for defense. Invest more in high-end defense capabilities and invest together and create common European projects, such as a European Air Shield.’

Strange words coming from a failed German Defense official, Source

Now don’t get me wrong. We (the EU) can’t rely on the US, but the reason for not wanting an EU army is entirely different: the lack of democratic oversight over the EU. Giving leaders who are not democratically controlled a military is the ultimate recipe for dictatorship.

The EU is increasingly moving towards a centrally planned economy. Historically, that has always worked so well…

👉🏽Italy bans ground-mounted solar panels on agricultural land. When we return to common sense and logic. Now don’t get me wrong. Solar panels mounted above farmland can be useful, but using farmland for anything other than growing food isn’t. The nations that keep their food will have power over those who destroy theirs. More info: https://www.agritecture.com/blog/2022/2/3/largest-farm-to-grow-crops-under-solar-panels-proves-to-be-a-bumper-crop-for-agrivoltaic-land-use

On the 18th of July:

👉🏽More on the EU and this time in particular the ECB.

ECB President Christine Lagarde: “The risks to economic growth are tilted toward the downside… extreme weather events, and the unfolding climate crisis more broadly, could drive up food prices.”

‘The logic is impeccable! It’s not the money printing, the debt, or the managed deconstruction of reliable energy infrastructure that are driving up food costs. It’s the weather, stupid.’ -Marty Bent

Remember how Lagarde said in 2021⁄2022 that inflation was just a hump and we will be back to 2% inflation in no time and 2023 ‘that inflation has…pretty much come from nowhere’.

They printed trillions of Euros and had negative interest rates for years, but yeah inflation came from nowhere!

On the 20th of July:

👉🏽The US debt crisis is terrible:

‘Currently, every new dollar of US public debt generates just $0.58 of GDP, near the lowest on record.

By comparison, in the 1960s this metric was as high as \(9.80, and in 2000 it was \)4.00, or 7 times above current levels. Over the last 4 years, the US national debt has skyrocketed by \(11.6 trillion while the US added \)6.6 trillion in GDP.

In other words, the US economy’s productivity has declined near the worst levels in modern history.’ -TKL

On the 21st of July:

👉🏽Interest Payments on U.S. National Debt Will Shatter $1,140,000,000,000 This Year – Eating 76% of All Income Taxes Collected.’ -CarlBMenger

On the 22nd of July:

👉🏽China just made a surprise interest rate cut by 0.25% to stimulate economic growth. Is global liquidity about to happen?

🎁If you have made it this far I would like to give you a little gift:

Nostr is the SIGNAL:

Well-written piece by Lyn Alden.

My advice: Try Nostr before you need Nostr

Credit: I have used multiple sources! My savings account: Bitcoin The tool I recommend for setting up a Bitcoin savings plan: @Relai especially suited for beginners or people who want to invest in Bitcoin with an automated investment plan once a week or monthly. (Please only use it till the 31st of October - after that full KYC)

Hence a DCA, Dollar cost Average Strategy. Check out my tutorial post (Instagram) & video (YouTube) for more info.⠀⠀⠀⠀

Get your Bitcoin out of exchanges. Save them on a hardware wallet, run your own node…be your own bank. Not your keys, not your coins. It’s that simple.⠀⠀⠀⠀⠀⠀⠀⠀

Do you think this post is helpful to you? If so, please share it and support my work with sats.