IN BRIEF: The Cliff’s Notes Version

- Bitcoiners are arguing about the wrong enemy

- Images aren’t causing the high fees; BRC-20 shitcoins are.

- This is fueled by VC money, and the BRC-20 payday breaks normal fee-market incentives.

- The problem is getting worse, not better.

- We have ways to dig deeper; let’s work together.

- There are possible “solutions” that don’t break Bitcoin.

“The whole secret lies in confusing the enemy so that he cannot fathom our real intent.” - Sun Tzu

The Ordinal-Scam Theory

Griftfluencers want you to think this is about jpegs and fees. Hint: it’s not. They’re actually running a much bigger scam that exploits everyone for their personal gain. Cooler heads must prevail, and we must look to the correct problems. Let’s dig in.

What’s fueling the fees isn’t jpegs. That’s just the marketing. If it were simply jpegs, the fee markets would correct the stupidity all on their own. Very few images have been minted in relation to the number of shitcoins.

So, the influencers that were “building?” They’ve been building this scam. As part of the scam, they’ve convinced VCs to fund the idiocy.

So, the influencers that were “building?” They’ve been building this scam. As part of the scam, they’ve convinced VCs to fund the idiocy.

How does it work? From what I can tell, the VCs fund inscriptions, which mostly aren’t jpegs; they’re BRC-20 shitcoin tokens. The VCs can turn millions virtually into billions and griftfluencers likely take a healthy cut.

Twisted Incentives: Exposing Inscription Fee Indifference

As many Bitcoiners know, the fee market will generally charge a stupid tax, and the moronic behavior eventually ends. Shitcoin incentives are a little different. When millions turn to billions, high Mempool fees are just the cost of doing scammy business.

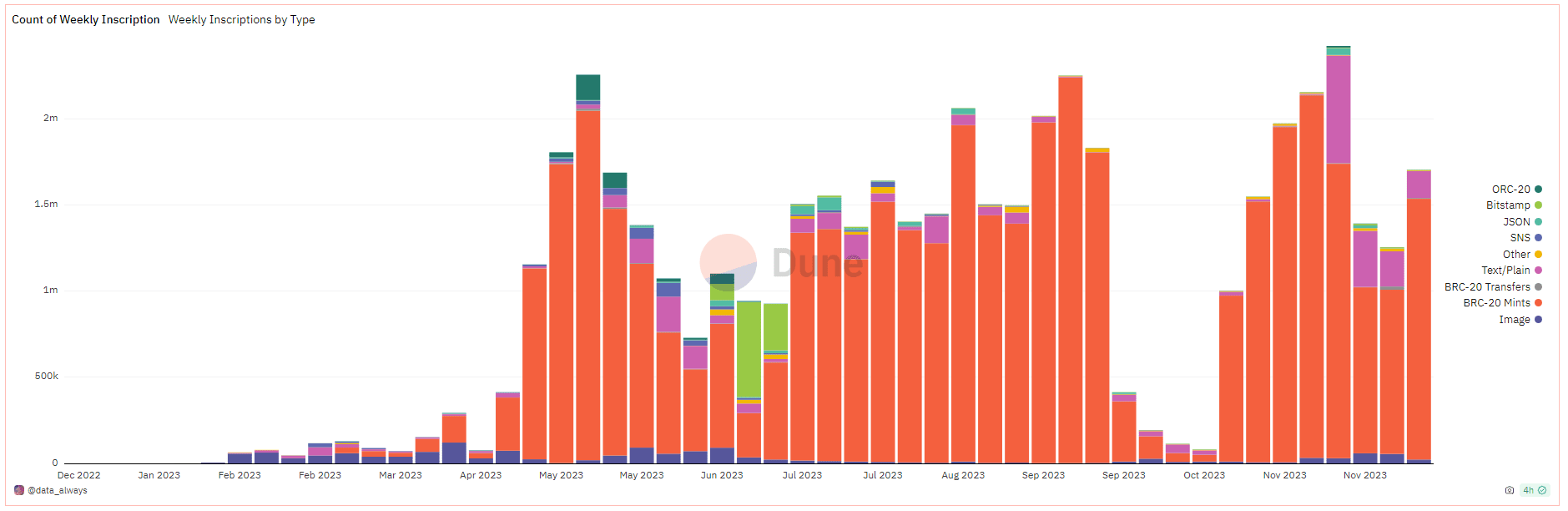

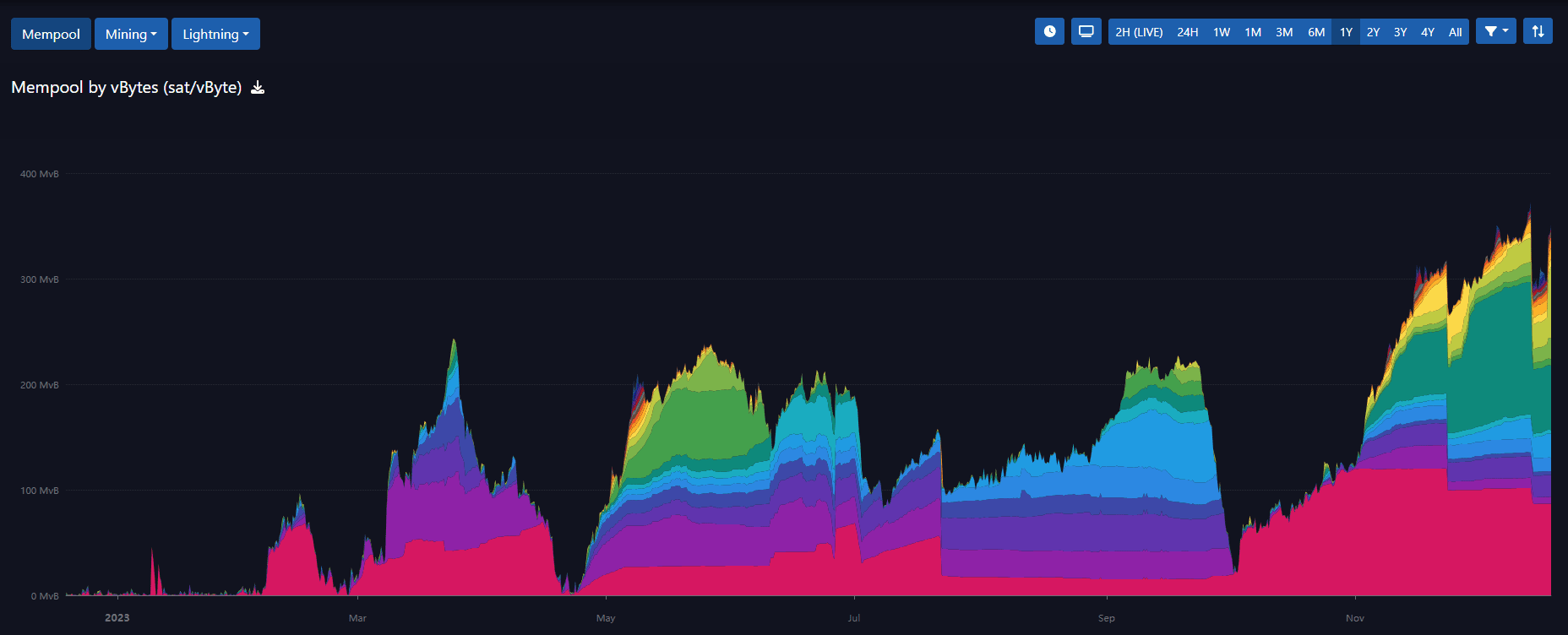

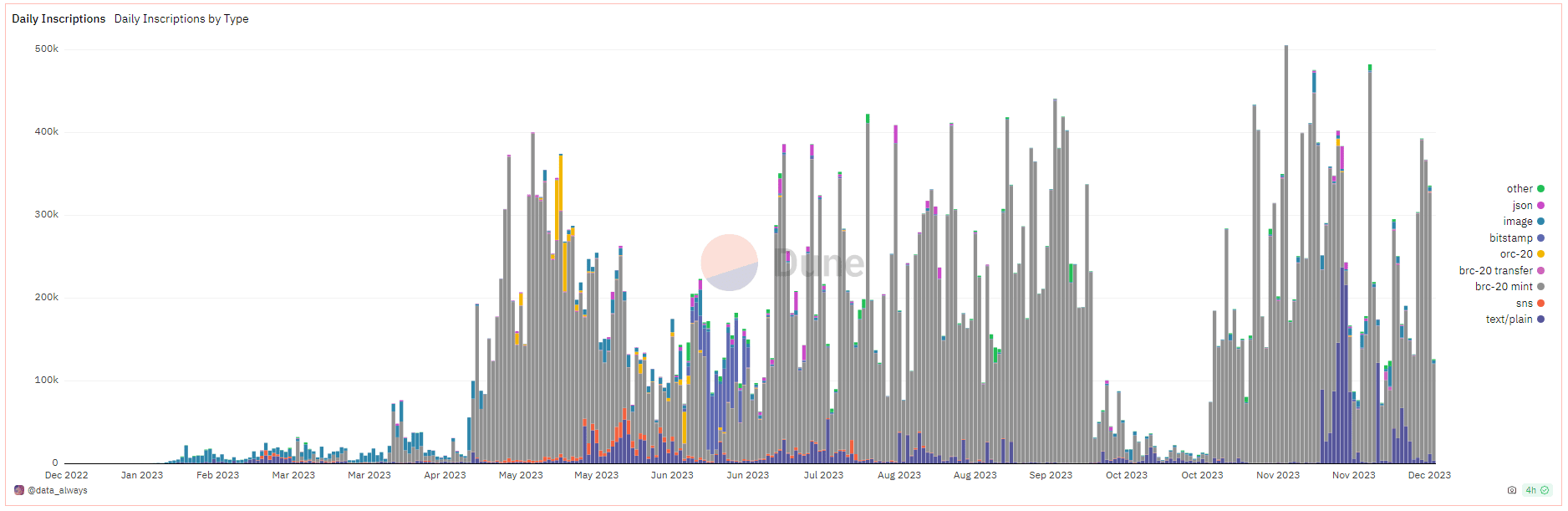

The problem isn’t getting better; it’s getting worse as the number of BRC-20s explodes. Let’s compare the last 12 months’ data from Mempool (above) with the daily inscriptions by type (below). You’ll see that it started out slow, mostly images, and has come to be just a shitcoin factory in roughly corresponding waves.

The problem isn’t getting better; it’s getting worse as the number of BRC-20s explodes. Let’s compare the last 12 months’ data from Mempool (above) with the daily inscriptions by type (below). You’ll see that it started out slow, mostly images, and has come to be just a shitcoin factory in roughly corresponding waves.

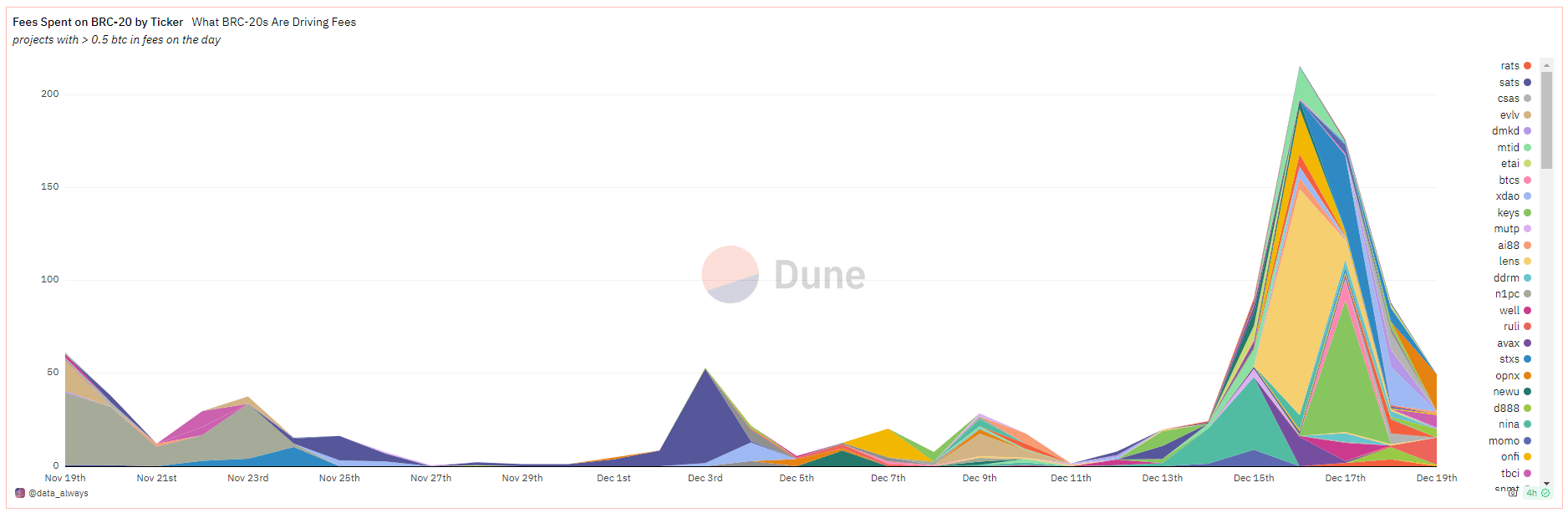

As I said, the problem is getting worse. Now that they’ve got their model down, they’ve entered the rinse-and-repeat mode. Let’s look at the drastic increase in the number of BRC-20s pulling significant daily fees. The legend is getting so big it needs a slider.

As I said, the problem is getting worse. Now that they’ve got their model down, they’ve entered the rinse-and-repeat mode. Let’s look at the drastic increase in the number of BRC-20s pulling significant daily fees. The legend is getting so big it needs a slider.

Who benefits? Indeed not the few actual artists and retail buyers. VCs and griftfluencers for sure, maybe the griftfluencers more. Miners benefit from increased fees, which pay for the increased hash rate in the face of the incoming HalFinning.

Who benefits? Indeed not the few actual artists and retail buyers. VCs and griftfluencers for sure, maybe the griftfluencers more. Miners benefit from increased fees, which pay for the increased hash rate in the face of the incoming HalFinning.

A Little Tin Foil

There seem to be second-order effects and possible shadow players. This is more questions and speculation. Who gets the fees? Who’s incentivized to perpetuate the scam?

- Miners, obviously.

- Institutional investors that are facing extremely low liquidity at the time ETFs might be approved. They can buy these increased fees as bitcoin directly from miners or indirectly from OTC desks.

- Shitcoins and other people that benefit from a fork war have incentives to keep this going.

- Governments that want to stall adoption have incentives.

- Ironically, L2 solutions and sidechains can benefit, even though they also get extra scrutiny and a lack of support from rightfully suspicious and jaded plebs.

Feel free to put my tinfoil on a shelf. It’s mostly just rhetorical, anyway.- But if you’re tracking with me generally, how do we uncover more truth?

Let’s Dig Deeper

Let’s learn more by getting more eyes on the data. Dune Dashboards, specifically those by @data_always have proved helpful in some initial research. Special thanks to them and Alex Thorn for pointing out an initial chart. Data_always has lots of relevant charts and even a dashboard.

Someone could dig into GitHub. We might discover when BRC-20s got added to ordinal inscriptions and by whom. Answers to these questions might point us at “who to blame.” It’s not the most crucial question, but it could lead bread crumbs to “follow-the-money” type answers.

Chain analysis or Mempool sleuthing might be helpful to see if there is a paper or Bitcoin trail to where the funds are coming from. Bottom line, it could be enlightening to see who’s investing, even as a front for someone else with deeper pockets, like institutions. I’d love to see the grifters cashing in or taking their cut, too.

What’s the premine situation? Can anyone even validate the supply? Initial research suggests that they’re entirely issued already. If that’s fact or crap is unclear.

As we learn more about what’s going on, possible solutions may start to illuminate themselves. If we find a way to stop or disincentivize one BRC, it may cast light on how we discourage further ones.

It’s just a theory so far; data will help validate, or it won’t. If we discover theory is the truth, and we’ve been arguing about the wrong things, let’s switch to fighting the correct battle.

Possible REAL solutions that don’t damage Bitcoin.

The first, and I mean the absolute first step, is to change the conversation to the correct problem. If we’re arguing about jpegs and Bitcoin’s intended use versus filtering, we’ve missed the point. If, as I suspect, BRC-20s are the real villains, we need to discuss that.

Here are a few more possible solutions to get your creative juices flowing:

- Social. Expose the scam and the scammers to destroy their credibility to everyone.

- Social: Coordinated meme warfare.

- Social: Expose the fact that inscriptions are on transactions, not UTXOs. (This is a hard sell. They don’t want to believe they’ve been fooled) Southern Hands, also read by Guy Swann, is a great starting point.

- Gray hat: Rijndael) created a Sophon to front-run the BRCs and intercept the deployment of tokens. Can we turn that into a perpetual motion device that funds itself with intercepted tokens? (Thanks, Gary))

- Black hat: An Exploit that shakes the confidence in the BRC scam itself, possibly starting with an individual shitcoin. I posit that “bridge” is synonymous with “exploit.”

- Technical: not against the time-chain, but against the arbitrary bullshit BRCs use as part of their affinity scam.

- Open interest: Can we short the BRC-20s into tanking? Some other financial manipulation to get them to panic-sell or get left holding a worthless bag? Maybe there’s a “whale” we can get to crash-fake like CZ did to FTX.

- Perhaps we can convince major shitcoin NFT outfits that ordinal ownership is less than they had on their own chains.

DYOR: Do Your Own Research.

This has been my attempt to shine a light on the griftfluencers and ordinal scam theory. But I’m literally a nobody. Not an expert. I could be wrong on points. My ignorance shows in others. Don’t trust - verify. Dig in yourself. Contribute to the fix. Fight the correct battle.