In my years working as a housing organizer in New York City, I witnessed first hand the human costs of gentrification. Despite organized efforts to stem the tide of evictions and rising housing costs, however, things are getting much worse all around us: the explosion in housing prices barely abated after the 2008 meltdown, and continues setting record breaking highs in the face of a deepening homelessness crisis. Luxury towers mushroom throughout the city in a time when most working-class people were barely making ends meet. Where is this deluge of money coming from? When did all this madness begin, and how can we end it?

As traditional organizing tactics and policy tools continue to fall short, the housing movement, and the left at large, is in dire need of new strategies and paths forward. The purpose of this article is to identify money creation through the banking system as the root cause of gentrification, and propose that Bitcoin, a decentralized monetary system capable of transferring monetary authority back to the people, is a weapon that can help tenants and workers level the playing field.

The Big Game in Town: Vacancy Decontrol

It was a bitterly cold winter evening when I headed to Hazel’s apartment in Flushing. A single mother and sole breadwinner for her family, she lived in one of the few rent-regulated units available in the city, and was increasingly facing illegal tactics meant to evict her from her unit.

Vacancy Decontrol, passed by Democrats and signed into law in 1994, gave landlords gigantic legal loopholes to jack up rents on vacant rent-regulated units, and to deregulate the unit completely after reaching a rental threshold of \(2000 (later raised to \)2774). This meant that a high tenant turnover would not only help deregulate apartments; the ability to suddenly charge market rates also meant that the value of the entire apartment complex would increase accordingly.

To no one’s surprise, an entire business model of incredible depravity sprang up around Vacancy Decontrol. Investment groups with access to virtually free money in Capital markets snatched up residential buildings across the City, deregulated as many units as possible, and sold the properties at enormous profit a few years down the line. It was a highly lucrative, risk-free investment that had the tacit approval of government officials. And they love it.

But the reality on the ground betrayed the true costs of this rental racket. As I entered the apartment where Hazel lived, the lobby was littered with construction material; one of the walls had been torn down as part of a relentless “construction” push. The noise, dust and hazard of it all was constant, part of the playbook to drive as many tenants out as possible. I made my way to Hazel’s apartment, where we were supposed to conduct a building-wide tenant meeting, and knocked on the door. Her mother, grandson in tow, greeted me in Dominican Spanish. As she told me Hazel wasn’t home from work yet, I sat down on their living room couch and noticed how cold the surface felt to the touch. As it turned out, the heat had been deliberately turned off, yet again, on one of the coldest days of the year.

Fighting on a Tilted Field: A Survey of Policy Based Solutions.

The abuses had been well-documented, but the odds were against us. From bogus eviction notices to outright intimidation and threats, landlords used every trick in the book to dissuade tenants from organizing. The setbacks and heartbreaks, however, only made us more determined. Tenants packed RGB (rent guideline board) meetings, marched on landlords and took some to court, formed coalitions, courted politicians and harnessed the power of investigative journalism to shed light on the horrific living conditions. After decades of organized resistance, Vacancy Decontrol was finally outlawed in 2020.

Tenants at the New York State Capitol in Albany. Vacancy Decontrol was outlawed in 2020.

The celebrations, however, did not last. Instead of a momentum building victory, all around us things were getting much, much worse. The eviction machine churning through the City has, with the help of the pandemic, become a national trend with no end in sight. Meanwhile, gentrification found a way to turbocharge itself: no longer an issue affecting inner city dwellers exclusively, financiers and real estate developers are now even trampling over the relatively well-off residents of neighborhoods like the Upper East Side. And all across the nation, tactics perfected during the many land grabs in the global south, are now being used to conduct The Great Housing Grab in the very heart of the empire.

Traditionally, organizers have sought to mobilize people as the main tool to influence public policy. Unfortunately, new financial weapons designed and deployed after 1971 have tilted the playing field so radically that public policy challenges to the FIRE (Finance, Insurance and Real Estate) sector have been all but neutralized and rendered ineffective. As the struggle against Vacancy Decontrol in NYC painfully demonstrates, policy solutions tend to fall short: even though we closed the main legal loophole through which financial interests bled New York City’s affordable housing stock, there were broader trends that remained untouched by the new laws: the avalanche of money that spurred the explosion in housing prices, as well as an unprecedented epoch of luxury development.

As eye-popping real estate deals continue to inundate the headlines and benumb the masses, it is clear that the entire planet is becoming the plaything of rogue financial interests. How can we stop this madness?

Community coalitions like the Chinatown Working Group have championed community led rezoning plans as a way to mitigate the impacts of these trends. While this is a solid plan, and I hope it manages to overcome the conflict of interests from elected officials who are bankrolled by the real estate industry, there are fundamental issues with this approach: rezoning creates singular exclusion zones that do not scale, and thus fails to adequately address the need for affordable housing for all. In other words, rezoning is merely a defensive tool, akin to erecting a protective wall in the midst of an ocean of rising housing prices.

A more comprehensive policy solution is Biden’s Build Back Better Act, which frames the issue as a lack of supply, and proposes resolving the shortage of affordable housing by building more homes. The problem, however, is that this plan completely ignores the issue of demand: without putting a stop to the endless deluge of money pouring into real estate, there is no amount of homes one can build that will be enough to lower housing prices.

The People’s Housing Platform, on the other hand, does attempt to tackle demand by treating housing as a public good, rather than a market commodity. In policy terms, this involves expanding rental and housing assistance, massive investments into public housing units, among other proposals that would effectively shield a large portion of the housing stock from the market. Regardless of one’s opinion on state intervention in the market, however, even The People’s Housing Platform is merely a defensive tool: short of resorting to abolishing the market by declaring all real estate as the government’s property—something that not even the Communist Party of China does anymore—, gentrification is not a problem we can root out by erecting protective policy walls alone.

In the fight against climate change, coastal barriers can help mitigate rising ocean waters. But if we want to save coastal cities around the world, reducing carbon emissions is the only true solution to the problem. When it comes to gentrification, the parallels are similar: none of these housing policies attempt to change anything about the way capital markets work around the globe. Thus, from a strategy standpoint, these policy tools can scarcely make a dent on global real estate markets, and will not be able to root out gentrification.

In order to demystify why gentrification is a core feature that remains so deeply ingrained in our global economy, we need to understand the role that housing plays in a context where money printing is rampant, and inflation is perpetually maintained as a matter of Central Bank policy. As the old adage goes, we need to follow the money.

The Fed and The New Monetary World Order

What is money, and where does it come from? The value of most commodities comes from the labor it requires to create it. That’s why historically, only commodities that were labor intensive to produce, and/or in scarce supply would be used as money: if the commodity being used as money was cheap and easy to produce or procure, those with the means of production would make more of it, benefiting themselves at the expense of others in the short term, even as their inflationary actions would eventually lead to the destruction of the value of such a commodity.

Nowhere was this more painfully demonstrated than in Europe’s colonization of the African continent, where aggry beads—small, decorative glass beads—were the money of the land: since glass production was cheap to Europeans, they mass produced counterfeit African money. This then allowed them to plunder the continent through commerce, buying labor intensive goods with beads that cost very little to produce. This massive theft of wealth, or what is the same, labor-time, directly contributed to the impoverishment and ensuing enslavement and colonization of the African continent. Its long term repercussions continue to this very day in the form of the CFA monetary system, which replaced the now worthless pre-colonization currencies.

These beads were known as ‘trade’, ‘aggry’ or even ‘slave’ beads.

This is the reason why Gold reigned supreme as the commodity-money of choice for so long. No matter how much technology advanced, there has always been only so much of the metal available, and the extraction process still requires a tremendous amount of labor and energy. There are no shortcuts, and thus no ways for gold-producers to cheat.

The Gold Standard, however, officially ended with Nixon in 1971, when he reneged on the promise of convertibility with Gold. Overnight, the dollar, now a mere promise of repayment that cost as much labor to produce as a pen stroke, replaced Gold as the de facto reserve currency of the world. While the origins and precise mechanics of this new global Fiat system—where creditor nations are just as beholden to the United States as debtor nations—are beyond the scope of this article, the practical implication is devastatingly simple: just like when European powers found a way to counterfeit African aggry beads, the United States could now simply conjure dollars out of thin air, while the rest of the world had to exchange its labor and time for every penny earned. In other words, there were no longer limits to how much money the United States could print, and as a result, for the first time in human history, an empire had found a way to effectively plunder the entire planet, forcing everyone to finance its own domestic and foreign expenditures in perpetuity (or so they thought).

At the center of it all, sits the Federal Reserve. Neither federal, nor possessing in its vaults any reserves, the Fed is less a bank in the traditional sense, and more so the very embodiment of the authority to create and control the cost and supply of money. In other words, as a “private corporation in which the government has an interest,” the Fed has sole discretionary power to dictate global monetary policy, and is free from the checks and balances that other democratic institutions are subjected to; neither are its board of governors elected, nor are the inner workings of the Fed known to the public. For all intents and purposes, it is an unacknowledged fourth branch of government that is under the control of private bankers and their financial interests.

While some may claim the Fed’s independent status helps avoid government abuses of monetary powers, the question remains: who makes sure that the Fed does not abuse these same powers, and acts in the public interest instead? In the wake of the 2008 financial crisis, where the Fed simply printed money as a free hand-out to “recapitalize the banking system’s reserves,” and the 2020 pandemic response, where the Fed continued to exacerbate income inequality by disproportionately handing out money to the wealthy, it has become clear that, in fact, nobody can hold them accountable: bankers simply wanted the staggering power of money creation for themselves.

Besides gloating about doing “God’s work,” what have our new overlords done with this power over the last 50 years since the end of the Gold Standard? Among other “achievements,” they have maintained a relentless inflationary environment as a matter of policy, driving prices up while wages stagnated. It is precisely this macroeconomic environment that has fueled the relentless market forces behind gentrification.

Real Estate as a Safe Haven from Systemic Inflation

Though it can, these days the Fed seldom creates the money itself. Instead, it simply let’s its children in the commercial banking sector enjoy the party: in the UK, commercial banks are the creators and allocators of about 97% of the money supply, and the numbers are similar for Wall Street. With the outright abolition of all reserve requirements in 2020, every penny of credit that any commercial bank extends to anyone, is in fact new money that is being conjured out of thin air. Mortgages, car loans, student loans, credit cards, are all vehicles of money printing for the banks.

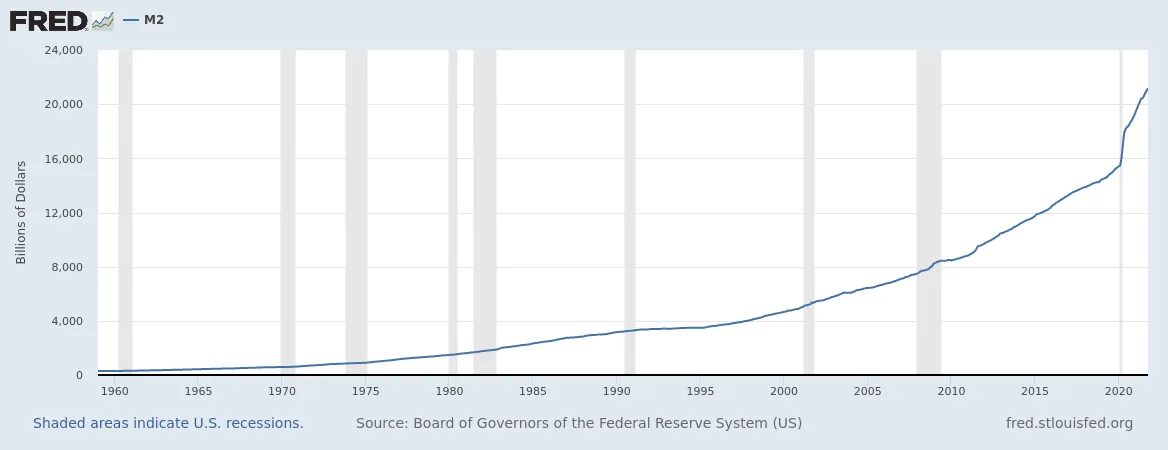

The supply of money has increased by 37% since February 2020.

When we take out a loan for a house worth \(1 million, for example, the bank simply edits a spreadsheet on its records (a ledger), and the money magically appears in our account. We use that \)1 million to pay for the house, but we then also have to pay another \(1 million to the bank, plus interest. If we keep count, that’s \)2+ million. In other words, the money supply doubled, increasing by \(1+ million dollars. The bank did not have that \)1 million they lent us prior to our exchange, they created it. But we have to spend time and energy doing work, earning a wage to pay back that loan. If this sounds familiar, it’s because it is exactly the same racket Europeans used to counterfeit aggry beads in Africa. They can mass-produce the money for almost nothing, while we have to work for it.

The Fed, however, is the one who sets the macroeconomic tone by dictating the Federal Fund Rate—the rate at which commercial banks borrow and lend their excess reserves to each other overnight. This interest rate has been set so low for so long, that capital has become an endless and free resource for the well-connected, and constitutes the very source of the money deluge that has led to the explosion in blockbuster real estate deals and luxury developments.

And why would they not enjoy it? Unlike consumer credit, the interest rate that institutional investors pay is never higher than inflation: if it costs 1% in interest to borrow money, and they can use that money to purchase real estate in a market where asset price inflation is 6% annually, they are guaranteed to turn a profit of 5%. During that time, they can charge rent, or otherwise continue to extract wealth from the property. This becomes a vicious cycle: the more money is borrowed, the more money is created; the more is created, the higher the inflation; and the higher the inflation, the more profitable it becomes to borrow money.

But here is the kicker. For a worker with a savings account, or a board overseeing a retirement fund, the interest they can accrue with their money pales in comparison to the inflation rate. If you reverse the process from the example above, for every 1% earned in interest, they lose 6% to inflation. That means any money that is sitting as a cash deposit is relentlessly melting away in purchasing power: you end up paying the bank to hold your money. It is for this reason that these days the financially literate would not touch a savings account, and union pension funds are “invested” in fossil fuel stocks and other questionable “high-yield” ventures. In other words, interest rates below inflation don’t just allow the rich to profit from the creation of new money, it also forces everybody in the economy to “chase yield,” becoming unwitting investors and market speculators.

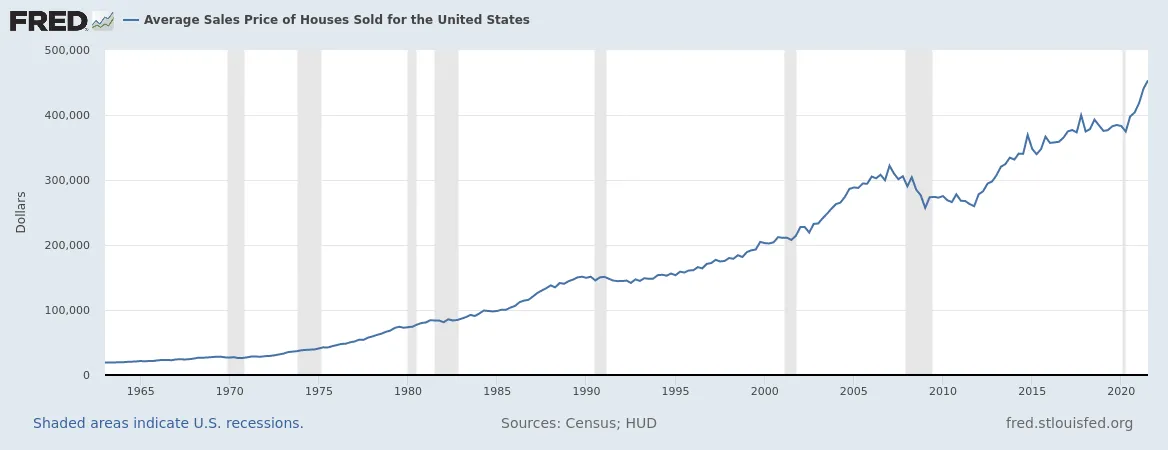

Average Sales Price of Houses Sold in the US has skyrocketed.

Real estate has been one of the main destinations for all this yield-chasing money. With a supply that is as limited by geographical constraints as the labor and materials required to build each new unit, the number of buildings and houses would never be able to inflate as fast as the money supply. Thus, housing has turned into one of the de-facto saving accounts for the entire planet—the other ones being stocks. The skyrocketing prices around the globe are a testament to this fact: for example, Canadian home prices have risen 70 percent or by $300,000 Canadian dollars since Justin Trudeau took power in 2015.

In this macroeconomic environment, where capital circles the globe in search of a safe haven from systemic inflation and money-printing, no one can seriously hope to make housing affordable, without first putting a stop to the entire central banking edifice. The Federal Reserve’s unchecked monetary authority has wreaked havoc on everyone’s lives, and caused endless suffering. It has benefited the bankers and financiers at the expense of everyone else. It is time we put an end to it.

A New Monetary System for the Dispossessed.

Organizing on the ground is not for the faint of heart. Nothing is more sobering, or as formative as experiencing the housing crisis through people’s individual struggles. Once, an undocumented couple refused to continue talking to me after their landlord installed a camera directly above their door. In other cases, entire apartment buildings became surveillance zones overnight, sending a chilling effect to anyone who had considered opening their door to me. More than once, I sat in a kitchen with tenants resigned to evictions or code-violations simply because they could not afford the time off to attend an overwhelmed housing court system.

Through it all, the bankers and financiers who engineered this perpetual crisis were hidden behind a thick veil of paperwork and economic misconceptions, nowhere to be seen. Of course we knew that “the 1%” was behind it all, but lacking a clear understanding of the processes and institutions responsible for our collective suffering, we were resigned to play defense on a tilted field. After all, printing money is easy, but organizing people is time-consuming, full of risks and therefore extremely hard.

Ending the Fed, however, is not something that can be done through policy alone: after Citizens United, money has never exerted more control over the political process. In today’s world, the political class takes the “independence” of the Federal Reserve as if it was a founding tenet enshrined in the Constitution, even though the power to mint money was in fact explicitly granted to Congress (Article 1, section 8).

Nor can the Fed be disbanded through force: only dust remains of the nations and armies that have dared challenge the dollar’s status as the reserve currency of the world. Even if some nation was to succeed in supplanting the U.S., what would stop them from abusing the same power once their central-bank-issued money became the world’s reserve currency?

This is why in today’s world, many see Bitcoin as the only viable alternative that can allow us to finally achieve what we did with religion centuries ago: the separation of state and money. As a new monetary system that relies on cryptography to create a truly decentralized governance model, in Bitcoin the end users are the ultimate arbiters of monetary policy. And what is that policy? A supply that is capped at 21 million Bitcoin, and the requirement that all newly minted Bitcoin be done so through “Proof of Work.” Bitcoin’s consensus mechanism has survived coup attempts by corporations and attacks from governments. Through it all, it’s absolute scarcity, which millions help enforce with their home computers, has given people from around the world a way to safeguard themselves from all forms of wealth confiscation and abuses of power.

Unfortunately, nobody can be told what Bitcoin is. Consider this an invitation to not only read about this technology, but also to experience the power of using money that is outside of the purview of governments and central banks; a money that truly belongs to the people, and is safeguarded as an open-source commons that belongs to all. In our struggle to end gentrification, Bitcoin offers us a way forward, a tiny ray of hope in an otherwise dark universe.